Overall, HFM can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive in terms of its trading fees. HFM offers an easy-to-use social copy trading platform with excellent customer support. In addition, HFM offers Ivory Coast traders four different retail trading accounts, namely a Cent, Account, Account, and Pro Account HFM has a trust score of 85 out of 99.

| 🧑⚖️ Order Execution | 4/5 |

| 💵 Commissions and Fees | 4/5 |

| 📈 Range of Markets | 4/5 |

| 📉 Variety of Markets | 4/5 |

| ⏱️ Withdrawal Speed | 4/5 |

| ☎️ Customer Support | 4/5 |

| 📊 Trading Platform | 4/5 |

| 🎓 Education | 3/5 |

| 🗂️ Research | 4/5 |

| 📝 Regulation | 5/5 |

| 📱 Mobile Trading | 5/5 |

| 💯 Trust Score | 85% |

HFM Review – Analysis of Brokers’s Main Features

- ☑️ HFM Overview

- ☑️ HFM Detailed Summary

- ☑️ HFM – Advantages over Competitors

- ☑️ Who will Benefit from Trading with HFM?

- ☑️ HFM Safety and Security

- ☑️ HFM Bonuses and Promotions

- ☑️ HFM Affiliate Program Features

- ☑️ HFM Account Types and Features

- ☑️ HFM Base Account Currencies and Basic Order Types

- ☑️ HFM – Slippage and Requote Policy

- ☑️ How to Open and Close an HFM Account

- ☑️ HFM Trading Platforms

- ☑️ Which Markets Can You Trade with HFM?

- ☑️ HFM Fees, Spreads, and Commissions

- ☑️ HFM Deposits and Withdrawals

- ☑️ HFM Education and Research

- ☑️ HFM Customer Support

- ☑️ HFM VPS Review

- ☑️ HFM Corporate Social Responsibility

- ☑️ HFM Cashback Rebates Features and Conditions

- ☑️ HFM Web Traffic Report

- ☑️ HFM Geographic Reach and Limitations

- ☑️ HFM vs NinjaTrader vs FP Markets – A Comparison

- ☑️ HFM Alternatives

- ☑️ HFM Awards and Recognition

- ☑️ Recommendations according to our in-depth review of HFM

- ☑️ HFM Customer Reviews

- ☑️ Pros and Cons of Trading with HFM

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

HFM Overview

HF Markets (HFM) is a well-established Forex Broker that offers access to Ultra-Fast Execution and Zero Commissions. Traders will be able to trade CFDs on Forex, Commodities, Bonds, Metals, Energies, Shares, Indices across a multitude of account types and trading platforms.

HFM is highly regulated by top tier providers, including the FSCA, CySEC, DFSA and FSA, and take the security of client funds very seriously. Traders funds are kept in Segrgated accounts and Negative Balance Protection is on offer.

HFM Detailed Summary

| Broker | HFM |

| 📌Headquartered | Cyprus |

| 🌎Global Offices | Seychelles, South Africa, Dubai, UK, Kenya |

| 🔍Local Market Regulator in Ivory Coast | Banking Commission of the West African Economic Monetary Union (WAEMU) |

| ⚠️Foreign Direct Investment in Ivory Coast | 1.4 billion USD (2021) |

| 💵Foreign Exchange Reserves in Ivory Coast | 2.5 million USD (April 2024) |

| 🏦Local office in Yamoussoukro | None |

| 👤Governor of SEC in Ivory Coast | None |

| ✔️Accepts Ivory Coast Traders? | ✅ Yes |

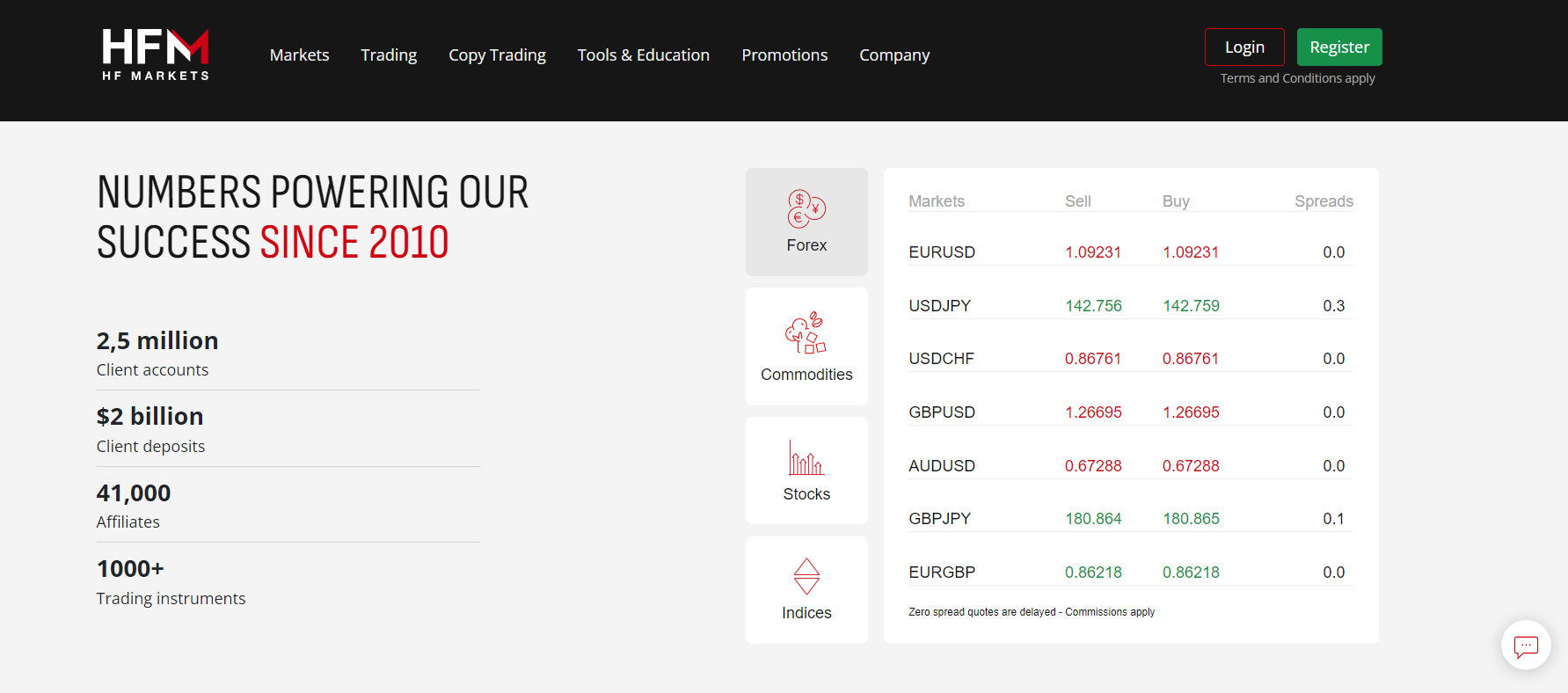

| 🔢Year Founded | 2010 |

| ☎️Ivory Coast Office Contact Number | None |

| 💻Social Media Platforms | Facebook Telegram YouTube |

| ℹ️Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📈Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 📉Tier-2 Licenses | Financial Sector Conduct Authority (FSCA) Cyprus Securities and Exchange Commission (CySEC) Capital Markets Authority (CMA) Dubai Financial Services Authority (DFSA) |

| 📊Tier-3 Licenses | Financial Services Authority (FSA) Financial Services Commission (FSC) |

| 🔢License Number | France ACPR – 53684 Germany BaFin – 132342 Hungary MNB – K8761153 Italy CONSOB– 3673 Norway – FT00080085 Spain CNMV – 3427 Sweden FI – 31987 Austria FMA Bulgaria FSC Croatia HANFA Czech Republic CNB Denmark Finanstilsynet Estonia FSA Finland FSA Greece HCMC Iceland FME Central Bank of Ireland Latvia FKTK Liechtenstein FMA Lithuania Lietuvos Bankas Luxembourg CSSF Malta MFSA Netherlands AFM Poland KNF Portugal CMVM Romania ASF Slovakia NBS Slovenia ATVP |

| 🏦Banking Commission of WAEMU Regulation | None |

| 👉Regional Restrictions | The United States, Canada, Sudan, North Korea, and Syria |

| 🤝Islamic Account | ✅ Yes |

| 🛎️Demo Account | ✅ Yes |

| ✅Non-expiring Demo | ✅ Yes |

| ⌛Demo Duration | Unlimited |

| 🏪Retail Investor Accounts | 4 |

| 💡PAMM Accounts | ✅ Yes |

| ✔️Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 👥Affiliate Program | ✅ Yes |

| 🧑⚖️Order Execution | Market |

| 📝OCO Orders | None |

| 🖥️One-Click Trading | ✅ Yes |

| ✴️Scalping | ✅ Yes |

| 🚨Hedging | ✅ Yes |

| 🗣️Expert Advisors | ✅ Yes |

| 📰News Trading | ✅ Yes |

| 🔖Trading API | ✅ Yes |

| ⏱️Starting spread | 0.0 pips |

| 💵Minimum Commission per Trade | From $6 per round turn on Forex |

| 💷Decimal Pricing | 5th decimal pricing after the comma |

| 📝Margin Call | Between 40% to 50% |

| 🛑Stop-Out | Between 10% and 20% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 💰Crypto trading offered? | ✅ Yes |

| ☑️Offers a XAF Account? | None |

| 👤Dedicated Ivory Coast Account Manager? | None |

| ⬆️Maximum Leverage | 1:2000 |

| ❌Leverage Restrictions? | None |

| 💴Minimum Deposit (XAF) | 3,050 ($5) |

| 💸Deposit Currencies | USD, AED, EUR, GBP, CHF, JPY, NZD, CAD, ZAR, and more. |

| ℹ️Are XAF Deposits Allowed? | ✅ Yes |

| 💷Account Base Currency | EUR, USD, NGN, ZAR |

| ✔️Active Ivory Coast Trader Stats | Unknown |

| 👩👧👧Active HFM customers | 3.5 million+ |

| 👤Active HFM customers in Ivory Coast | Unknown |

| 🏷️Ivory Coast Daily Forex Turnover | $5 trillion+ (Overall Forex Globally) |

| 💳Deposit and Withdrawal Options | Bank Wire Transfer Electronic Transfer Credit Card Debit Card Skrill |

| ⏰Minimum Withdrawal Time | 10 Minutes |

| ⏱️Maximum Estimated Withdrawal Time | 10 business days |

| 💸Instant Deposits and Instant Withdrawals? | None |

| 🗂️Segregated Accounts? | ✅ Yes |

| 📝Segregated Accounts in Ivory Coast? | None |

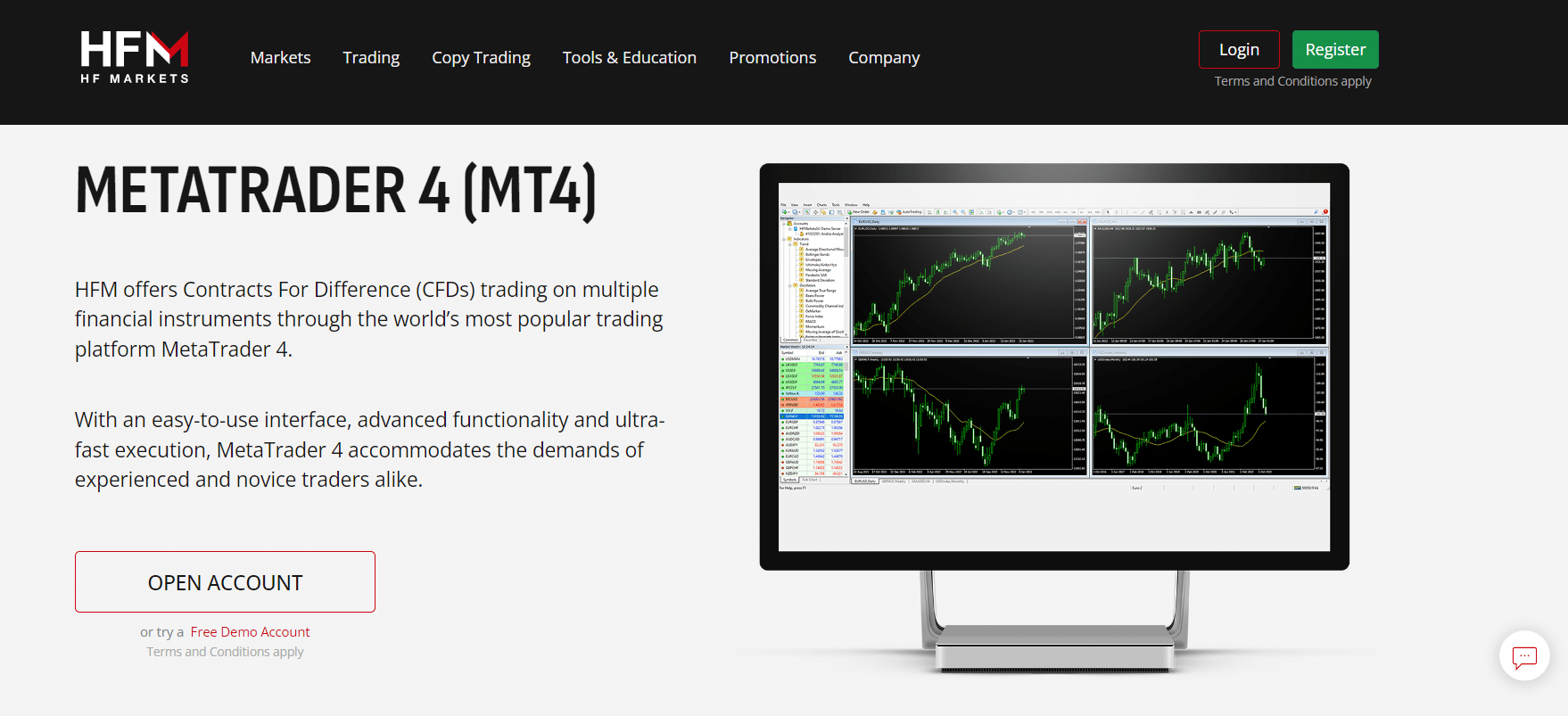

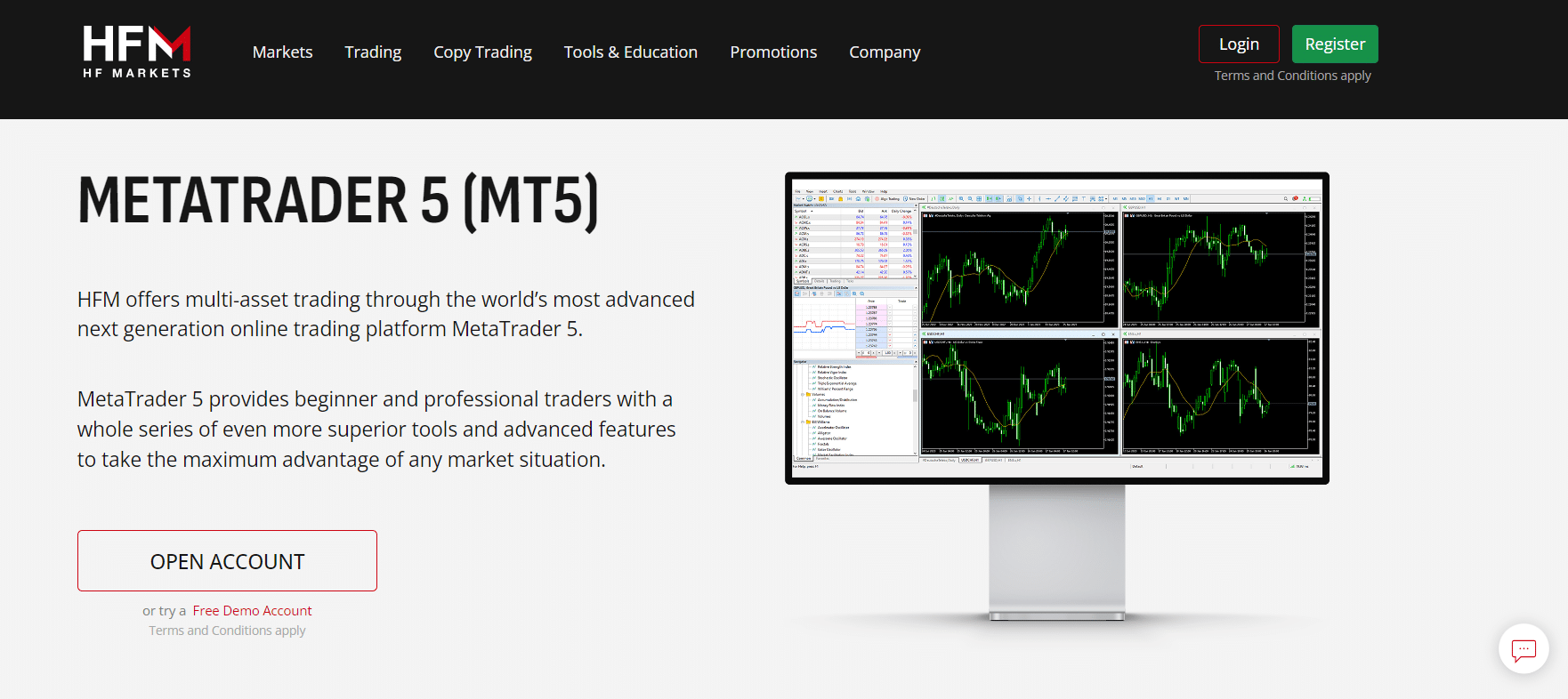

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 HF App |

| ⌚Trading Platform Time | UTC +02h00 |

| 👁️🗨️Observe DST Change | ✅ Yes |

| 🕰️DST Change Time zone | Eastern European Time (EET) |

| 📈Tradable Assets | Forex Precious Metals Energies Indices Shares Commodities Cryptocurrencies Bonds Stocks DMA ETFs |

| 💡HFM USD/XAF Forex Pair? | None |

| ☑️Are local Stocks and CFDs offered? | None |

| 🗣️Languages supported on the Website | English, Portuguese, Spanish |

| 👩👧👧Customer Support Languages | Multilingual |

| 📝Copy Trading Support | ✅ Yes |

| ⏲️Customer Service Hours | 24/5 |

| ☎️Customer Support in Ivory Coast? | None |

| 💸Bonuses and Promotions for Traders? | ✅ Yes |

| 🎓Education for beginners | ✅ Yes |

| ✅Proprietary trading software | ✅ Yes |

| 🏆Most Successful Ivory Coast Trader | Unknown |

| 🎖️Is HFM a safe broker for traders? | ✅ Yes |

| 🔢Rating for HFM in Ivory Coast | 9/10 |

| 💯Trust score for HFM in Ivory Coast | 85% |

HFM – Advantages over Competitors

HFM has the following notable advantages over competitors:

- ✅ Exceptional Trading Environment: HFM extends an exceptional trading environment, resulting in more lucrative trades and a superior trading experience.

- ✅ High-End Trading Instruments: Traders are equipped with top-notch trading instruments by HFM, bolstering their market analysis and trading success.

- ✅ Assortment of Account Options: By offering various account options, including zero minimum deposit accounts, HFM accommodates the diverse needs of traders, including beginners or those on a budget.

- ✅ Various Platform Alternatives: HFM provides a range of platform alternatives, ensuring traders can select one that aligns with their trading style and requirements.

- ✅ Extensive Selection of Trading Assets: HFM offers a broad array of trading assets, enabling traders to expand their portfolios and tap into various opportunities.

- ✅ Accolades and Acknowledgements: HFM, with over a decade of industry experience and more than 60 industry accolades, including Best Forex Mobile Application and Most Transparent Broker, has made its mark.

- ✅ Regulation by Esteemed Bodies: HFM is regulated by prestigious financial bodies like the UK’s FCA and Cyprus’s CySEC, offering clients important protections such as compensation schemes and fund segregation.

- ✅ Global Operations: HFM has a footprint in various regulated regions, including the UAE, EU, Kenya, UK, and South Africa, as well as offshore branches in Seychelles and Saint Vincent, Grenadines (SVG).

- ✅ Accessible Entry Point: HFM offers a reasonably accessible entry point with minimum deposits as low as 0 units of local currency for basic account types in Europe, Africa, and the UAE and $5 for other regions.

- ✅ Amplified Leverage: In regions without regulatory constraints, HFM provides amplified leverage, up to 1:2000, potentially magnifying profits and risk.

Finally, HFM offers attractive spreads, reducing trading costs, with spreads as low as 0 pips available on certain account types.

Who will Benefit from Trading with HFM?

According to our research, the following trading groups will benefit the most from HFM’s trading solutions:

- ✅ Veteran Traders: Experienced traders can use HFM’s sophisticated trading tools, diverse instruments, attractive spreads, and high-leverage options.

- ✅ Beginner Traders: HFM’s user-friendly platforms, assorted account types (including those with low minimum deposits), and educational resources make it a good choice for beginners. New traders can acquire valuable experience and hone their skills with HFM.

- ✅ Diversification Enthusiasts: Traders aiming to diversify their investment portfolios will find HFM’s broad range of trading instruments and global operations beneficial. Different markets and asset classes allow for enhanced diversification opportunities.

- ✅ Tech-Savvy Traders: HFM’s versatile platform options, including mobile applications, appeal to traders who prefer to trade on the move or utilise advanced trading technologies.

- ✅ Risk-Conscious Traders: HFM’s regulatory compliance and adherence to respected financial authorities’ guidelines provide comfort and protection for traders mindful of their fund’s safety. Those prioritising risk management will appreciate HFM’s commitment to regulatory adherence.

HFM Safety and Security

HFM Regulations in Ivory Coast

HFM is not currently regulated by the Banking Commission of the West African Economic Monetary Union (WAEMU). However, as per the table in the following section, HFM is well-regulated by several reputable market regulators in other countries.

| 📌 Registered Entity | 🌎 Country of Registration | 🔢 Registration Number | 💡 Regulatory Entity | 📈 Tier | ℹ️ License Number/Ref |

| 🔍HF Markets SA (PTY) Ltd | South Africa | 2015/341406/07 | FSCA | 2 | FSP 46632 |

| 🛎️HF Markets (Europe) Ltd | Cyprus | HE 277582 | CySEC | 2 | 183/12 |

| 🔖HF Markets (Seychelles) Ltd | Seychelles | 8419176-1 | FSA | 3 | SD015 |

| 🏷️HF Markets Ltd | Mauritius | 094286/GBL | FSC | 3 | 094286/GBL |

| ⌛HF Markets (DICF) Ltd | Dubai | N/A | DFSA | 2 | F004885 |

| 🚩HF Markets (UK) Ltd | United Kingdom | 11118651 | FCA | 1 | 801701 |

| ⚠️HFM Investments Limited | Kenya | N/A | CMA | 2 | 155 |

How HFM Protects Ivory Coast Traders and Client Funds

| 📌 Security Measure | ℹ️ Information |

| 🔍Segregated Accounts | ✅ Yes |

| 💵Compensation Fund Member | ✅ Yes |

| 💷Compensation Amount | 5 million EUR |

| 📝SSL Certificate | ✅ Yes |

| ✏️2FA (Where Applicable) | ✅ Yes |

| 🛑Privacy Policy in Place | ✅ Yes |

| ✔️Risk Warning Provided | ✅ Yes |

| ❌Negative Balance Protection | ✅ Yes |

| ⛔Guaranteed Stop-Loss Orders | None |

Security while Trading

HFM offers a variety of protective measures for its traders, with the specifics largely hinging on the trader’s jurisdiction due to varying regulations.

For traders in Europe and the UK, HFM ensures a robust level of security. Their capital is stored in separate accounts, signifying that the trader’s assets are distinct from the firm’s working capital. This is a standard procedure in regulated markets to safeguard trader funds in the event of the broker’s insolvency.

Moreover, these traders are shielded by a policy that protects against negative balance, ensuring they will not lose more than their initial deposit. This is a vital precaution against the unpredictability of the market and the risks associated with leveraged trading.

Regulatory bodies such as the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC) necessitate these protections.

HFM must also provide these premier regulators with daily updates on open and closed trades. This mandate aids in ensuring that brokers do not engage in price manipulation.

In the rare scenario that HFM becomes insolvent and cannot repay its clients, customers of the broker’s Cypriot branch are insured up to 20,000 EUR, while the UK branch may offer up to GBP 85,000 in compensation.

For traders in the UAE, HFM’s Dubai branch is licensed by the Dubai Financial Services Authority (DFSA), which adheres to regulations related to Sharia laws, including the provision of only swap-free accounts.

In Africa, HFM is regulated in South Africa and Kenya. Although traders in these countries do not receive the same protections as their European counterparts, they are still assured of transparency and the segregation of their funds from the company’s operational capital.

Similar standards of transparency and fund segregation can be expected for traders in Ivory Coast, providing them with a secure trading environment.

Pros and Cons Regulation and Safety of Funds

| ✅ Pros | ❎ Cons |

| HFM is regulated by reputable entities worldwide | HFM is not locally regulated in the Ivory Coast |

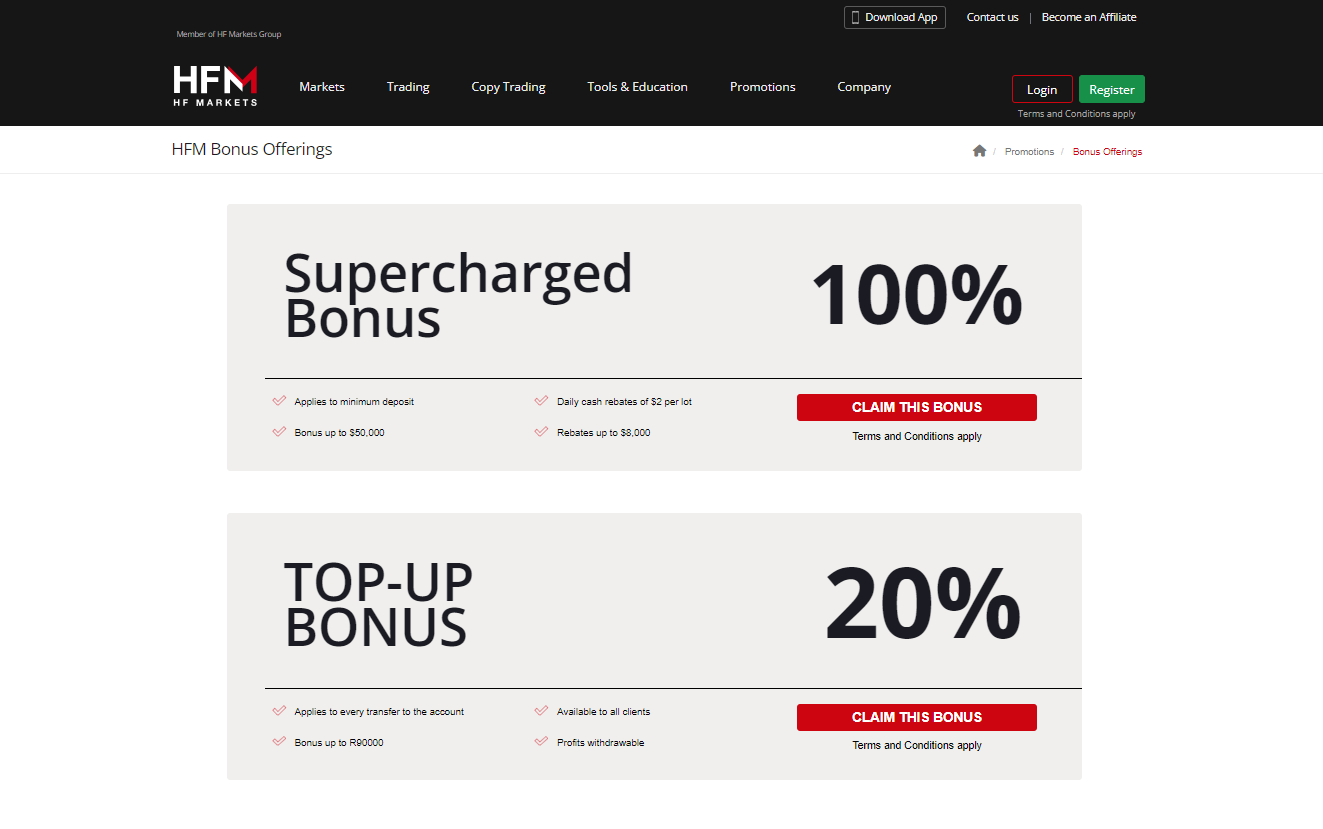

HFM Bonuses and Promotions

HFM presents various bonuses and promotions to enhance the trading experience:

- ✅ HFM Gadget Giveaway: Follow HFM on social media platforms to win exciting gadgets like the PlayStation 5, iPhone 14 Pro Max, GoPro Hero 11, and more. Stay updated for upcoming giveaways and grab the opportunity to win these fantastic prizes.

- ✅ $1,000 Monthly Cash Prize: The trader with the highest gain will be awarded a cash prize of $1,000, an obelisk award, and an esteemed position in the HFM Hall of Fame. The top 10 traders will also receive recognition on the HFM Traders Awards page.

- ✅ Deposit Top-Up Bonus: Enjoy a 20% bonus on every transfer to your account up to R90,000. This enticing bonus is available to all clients, and the profits earned can be withdrawn.

- ✅ Virtual to Real Demo Contest: Participate in the thrilling ‘Virtual to Real’ Demo Contest, where you can compete for cash prizes on demo accounts. Sharpen your trading skills without risk and stand a chance to win real money prizes.

- ✅ HFM Merchandise: As a token of appreciation, valued traders and partners receive exclusive branded merchandise, including a black cap, notepad, t-shirt, pen, keyring, and stress ball. These items are provided free of charge to express gratitude for their loyalty and support.

- ✅ HFM Trading Rewards Loyalty Program: Earn HFM Bars based on your trading activity and climb through reward levels: Red, Silver, Gold, and Platinum. Accumulated Bars can be exchanged for cash or trading services, providing added value and benefits.

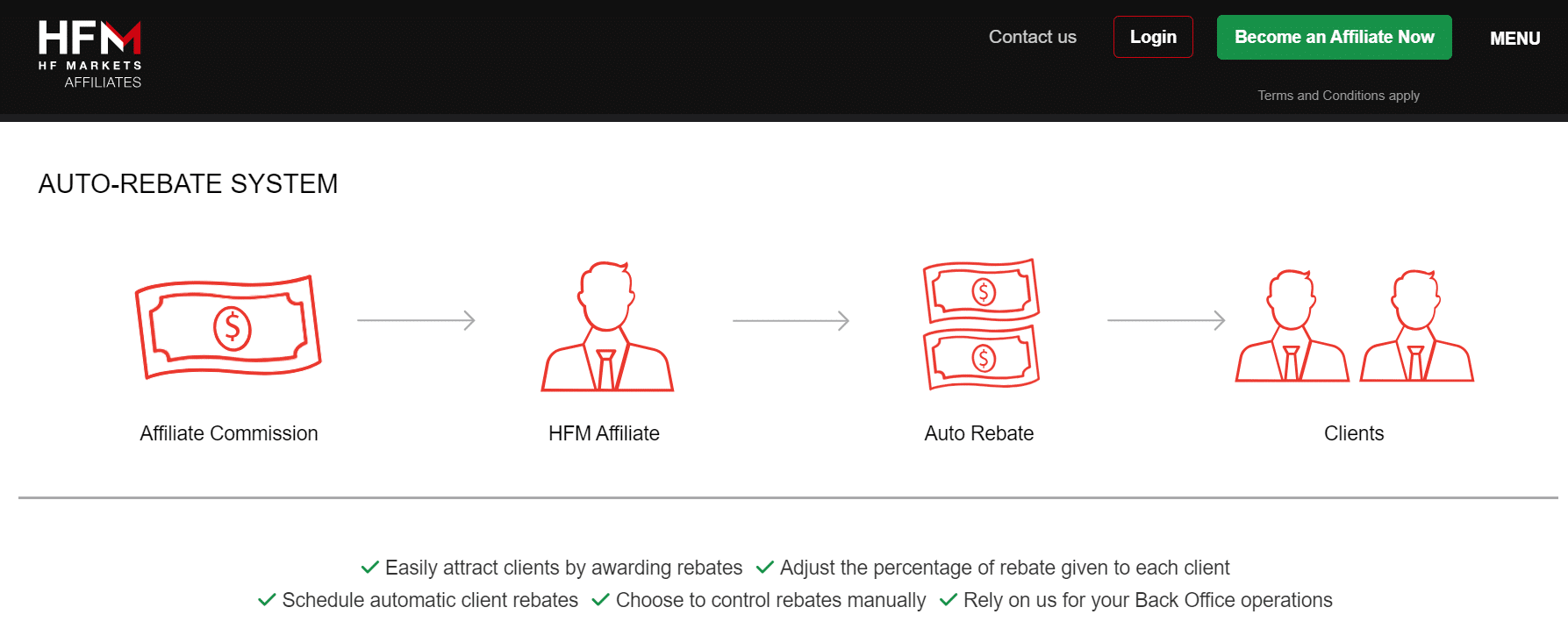

HFM Affiliate Program Features

HFM provides a comprehensive Affiliate Program tailored to online and offline affiliates in the Forex market. With a superior commission structure and customised products, HFM can aid affiliates in meeting revenue targets without necessitating extensive programming or administrative expertise.

Types of Partnerships

Affiliates: Traders can easily in HFM’s premier Affiliate Program and earn superior commissions by referring clients to HFM. Furthermore, they can enjoy the finest commission structure and customised products to meet your revenue expectations.

Sub-Affiliates: Individuals possessing online marketing proficiency or successful websites can earn commissions by introducing new clients to HFM. Furthermore, this partnership allows you to earn from your clients’ trading and the trading of your sub-affiliates’ clients.

Advantages of the HFM Affiliate Program

- ✅ Competitive Terms: Draw more clients with our competitive trading terms, including the best possible spreads. Your clients will enjoy favourable trading conditions.

- ✅ Unlimited Commissions: As an HFM Affiliate, there are no restrictions on the number of clients you can attract. Set your objectives, expand your business, and boost your earnings without any limits.

- ✅ Earnings per Standard Lot: Earn a commission of 6 USD per standard lot for clients using the HFCopy account. Leverage this profitable opportunity to generate income based on your clients’ trading activity.

- ✅ Opportunities for Business Growth: With the HFM Affiliate Program, you can grow your business and achieve your growth targets. Utilise our resources and support to optimise your earning potential.

How to open an Affiliate Account with HFM

To register an Affiliate Account, Ivory Coasts can follow these steps:

- ✅ Access the Official HFM Website.

- ✅ Head to the “Affiliates” section on the main toolbar to get acquainted with the HFM Affiliate Program.

- ✅Press the “About HF Affiliates” link to explore more details.

- ✅ Study the variety of affiliates that HFM is open to collaborating with. After understanding the options, hit the green banner stating “Become an Affiliate” to initiate the process.

- ✅ Choose the kind of affiliate you aspire to be, either a corporation or an individual. This selection should align with your specific affiliation needs and objectives.

- ✅ Complete the necessary fields with your data. Input precise details to wrap up this portion of the registration process.

- ✅ Move on to complete the “Business Information” section. Disclose details about your affiliate experience, estimated count of existing clients, anticipated deposits from current clients, and your client acquisition methods.

- ✅ Conclude the Program Information section. Under the HFM Revenue Share title, opt for “Yes” or “No” based on your preference and agreement with HFM’s revenue share conditions.

- ✅ Before registering for the affiliate program, ensure you have thoroughly acquainted yourself with the HFM Affiliates Agreement, Terms and Conditions, and Privacy Policy.

HFM Account Types and Features

HFM’s dedication to providing a variety of account types and features reflects its commitment to meeting the specific requirements of different traders.

Whether it is the Cent account for novice traders, the Premium account for retail traders, the Zero account with its cost-effective features, the Pro account for experienced traders, the Demo account for practice and seamless transition, or the Islamic account for Muslim traders, HFM strives to offer tailored solutions that enhance the trading experience for all individuals.

| 🔍 Live Account | 💵 Minimum Dep. | ⏱️ Average Spread | 💷 Commissions | 💶 Average Trading Cost |

| 🥇Cent | 0 XAF / $0 | 1.2 pips | None | 12 USD (Cents) |

| 🥈Premium | 3,050 XAF / $5 | 1.2 pips | None | 12 USD |

| 🥉Zero | 3,050 XAF / $5 | 0.0 pips | 6 USD | 6 USD |

| 🏅Pro | 61,000 XAF / $100 | 0.5 pips | None | 5 USD |

HFM Live Trading Account Details

HFM Cent Account

The Cent account provided by HFM represents a unique trading option incorporating swap-free trading and cent lots. A cent lot, equivalent to 0.01 of a Standard lot or 1,000 units, enables precise position sizing.

Notably, the Cent account has remarkably low margin requirements, starting from as little as 10 US cents. This feature makes it ideal for novice traders who want to transition from demo to live trading while minimising financial risk.

Novice traders benefit from Cent accounts as they can test their trading skills in a real market environment without committing significant amounts of trading capital.

Moreover, experienced traders can utilise Cent accounts to explore new trading instruments, refine strategies, and reduce exposure by allocating less capital to such endeavours.

| 🔍 Account Feature | 💰 Value |

| 💵Minimum Deposit | 0 XAF ($5) |

| 📝Spreads | 1.2 pips EUR/USD |

| 📈Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| ⌛Trading Instruments | 50+ Forex Pairs and Gold |

| 🧑⚖️Execution | Market Execution |

| ⬆️Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lot |

| ⬆️Maximum Trade Size | 7 Standard Lots (100,000 base currency) |

| 📖Maximum Open Orders | 150 lots (Simultaneous) |

| ↘️Margin Call (%) | 40% |

| 🛑Stop-Out (%) | 10% |

| 💵Account Base Currency | USD, ZAR, NGN |

| 👤Personal Account Manager | ✅ Yes |

| 💶Commission Charges | None |

| 💎Bonuses Offered | Flexible bonus offering |

HFM Premium Account

The Premium account offered by HFM is specifically tailored to meet the needs of retail traders seeking swap-free trading options, reduced spreads, no minimum deposit requirements, and commission-free transactions.

By opening a Premium account, traders gain convenient market access through popular platforms like MT4, MT5, WebTrader, or the HFM App.

This account type ensures a seamless trading experience, enabling retail traders to participate in the financial markets while enjoying favourable trading conditions and the flexibility to choose their preferred trading platform.

| 🔍 Account Feature | 💰 Value |

| 💵Minimum Deposit | 3,050 XAF ($5) |

| 📝Spreads | From 1.2 pips EUR/USD |

| 📈Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| ⌛Trading Instruments | All |

| 🧑⚖️Execution | Market |

| ⬆️Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 📖Maximum Open Orders | 500 |

| ↘️Margin Call (%) | 50% |

| 🛑Stop-Out (%) | 20% |

| 💵Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅ Yes |

| 💶Commission Charges | None |

| 💎Bonuses Offered | None |

| 🤝Personalised Services | None |

| ✔️Swap Free Available? | ✅ Yes |

HFM Zero Account

The HFM Zero Account introduces a remarkable trading solution that ushers in a new era in the foreign exchange market.

With an impressive feature set that includes no minimum opening deposit requirement and leverage options of up to 1:2000, the Zero Account offers accessibility, cost-effectiveness, and swap-free trading capabilities to cater to the diverse needs of all traders.

A standout feature of the Zero Account is the provision of RAW, Super-Tight Spreads sourced from leading liquidity providers. These spreads are transparent and devoid of hidden markups, ensuring a fair and competitive trading environment.

Additionally, traders can benefit from commissions as low as $0.03 per 1k lot, further contributing to the account’s cost-effectiveness.

| 🔍 Account Feature | 💰 Value |

| 💵Minimum Deposit | 3,050 XAF ($5) |

| 📝Spreads | From 0.0 pips EUR/USD |

| 📈Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| ⌛Trading Instruments | All |

| 🧑⚖️Execution | Market |

| ⬆️Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 📖Maximum Open Orders | 500 |

| ↘️Margin Call (%) | 50% |

| 🛑Stop-Out (%) | 20% |

| 💵Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅ Yes |

| 💶Commission Charges | From $6 per round turn on Forex |

| 💎Bonuses Offered | None |

| 🤝Personalised Services | ✅ Yes |

| ✔️Swap Free Available? | ✅ Yes |

HFM Pro Account

The HFM Pro Account is exclusively designed to meet the demands of experienced traders who aspire to elevate their trading endeavours to new heights. This account encompasses distinctive features, including ultra-low spreads, leverage of up to 1:2000, and the absence of commissions.

These advantageous elements collectively enhance the trading experience, empowering seasoned traders to explore their full potential and optimise their strategies.

The swap-free nature of the Pro Account adds further flexibility and convenience, enabling traders to focus on maximising their trading outcomes without the burden of swap fees.

| 🔍 Account Feature | 💰 Value |

| 💵Minimum Deposit | 61,000 XAF ($100) |

| 📝Spreads | From 0.05 pips EUR/USD |

| 📈Trading Platform | MetaTrader 4, MetaTrader 5, HF App |

| ⌛Trading Instruments | All |

| 🧑⚖️Execution | Market |

| ⬆️Maximum Leverage Ratio | 1:2000 |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 60 lots |

| 📖Maximum Open Orders | 500 |

| ↘️Margin Call (%) | 50% |

| 🛑Stop-Out (%) | 20% |

| 💵Account Base Currency | Depends on the region |

| 👤Personal Account Manager | ✅ Yes |

| 💶Commission Charges | None |

| 💎Bonuses Offered | None |

| 🤝Personalised Services | ✅ Yes |

| ✔️Swap Free Available? | ✅ Yes |

HFM Demo Account

The HFM Demo Account provides a comprehensive simulation of real trading environments, meticulously crafted to replicate market conditions accurately.

HFM’s commitment to aligning the Demo trading environment with the Live trading experience reflects the broker’s core values of Honesty, Openness, and Transparency. This approach ensures a seamless transition when traders open a Live Account and engage in real-market trading.

With the HFM Demo Account, traders can gain valuable trading experience and confidently enter the market. Enjoy the following benefits:

- ✅ Up to $100,000 Virtual Opening Balance: Begin your Demo Account journey with a substantial virtual opening balance of up to $100,000.

- ✅ Real Market Conditions: Experience trading in a simulated environment that closely mirrors the actual market dynamics.

- ✅ Test Trading Strategies: Experiment with various trading strategies and techniques without risking your real funds.

- ✅ Unlimited Usage: Take advantage of unlimited practice time on the Demo Account.

- ✅ Access to Trading Platforms: Trade on the industry-leading MT4 and MT5 Terminals and WebTrader, providing flexibility and convenience.

HFM Islamic Account

HFM’s commitment to catering to a wide range of customer needs and diversifying its product portfolio. Muslim traders can register for a regular HFM account and then contact HFM customer support to request an account conversion to the Swap-Free Islamic Account.

This ensures that Muslim traders can engage in activities that align with their religious beliefs and principles.

By offering the Islamic Account, HFM aims to create an inclusive and accommodating trading environment where traders from diverse backgrounds can participate without compromising their faith.

Furthermore, the account’s swap-free nature eliminates interest-based transactions, adhering to the principles of Sharia law.

HFM Professional Account

HFM offers a Professional Account under its retail trading accounts.

Pros and Cons HFM Account Types and Features

| ✅ Pros | ❎ Cons |

| There are four flexible account types to choose from, each designed for different types of traders | HFM does not support XAF as a currency for trading accounts |

HFM Base Account Currencies and Basic Order Types

HFM Base Account Currencies

When registering a live trading account, traders can select between several currencies as their base currency according to their country of residence.

However, XAF is not currently among those currencies, meaning that Ivory Coast traders might face currency conversion fees on deposits and withdrawals

HFM Basic Order Types

HFM’s basic order types are as follows:

- ✅ Market Orders

- ✅ Pending Orders

- ✅ Take Profit

- ✅ Stop-Loss Orders

Market Orders

A Market Order is a request to buy or sell a Contract for Difference (CFD) at the prevailing market price as promptly as possible, opening a trade position. CFDs are purchased at the ASK price and sold at the BID price.

Furthermore, with HFM, Market Orders are available for all accounts. In addition, Market Orders can be accompanied by Stop Loss and Take Profit Orders.

Pending Orders

Pending Orders are requests to buy or sell a CFD at a pre-defined price in the future once a certain price is reached. HFM offers four Pending Orders: Buy Limit, Buy Stop, Sell Limit, and Sell Stop.

These orders are executed when the price reaches the specified level. However, executing at the requested price may be impossible under certain trading conditions. HFM can execute the order at the first available price in such cases.

Stop Loss and Take Profit Orders can be attached to a Pending Order and are valid until cancelled. In addition, Pending Orders are available for all accounts with HFM.

Take Profit

Take Profit Orders are intended to secure profit when the price of a CFD reaches a specific level. The execution of this order results in the complete closure of the entire position and is always connected to an open, market, or pending order.

In addition, the HFM platform checks long positions with the BID price and short positions with the ASK price to determine if the provisions of the Take Profit Order have been met.

Stop-Loss Orders

Stop-Loss Orders are used to minimise losses if the price of a CFD begins to move in an unprofitable direction. If the price of the CFD reaches the Stop-Loss level, the entire position will be automatically closed.

Stop-Loss Orders are always connected to an open, market, or pending order. The HFM platform checks long positions with the BID price and short positions with the ASK price to determine if the provisions of the Stop-Loss Order have been met.

HFM – Slippage and Requote Policy

HFM’s Slippage and Requote Policy clarifies order execution and factors impacting it. While striving to offer the best price, HFM acknowledges that executing pending orders at declared prices may be impossible due to volatile markets or insufficient liquidity.

In such cases, orders are executed at the first available price. Market Orders execute instantly, while Pending Orders allow clients to specify future execution prices. HFM prioritises the best execution and client protection based on total consideration.

Risk management measures may be implemented during market volatility, like order restrictions, leverage adjustments, spread modifications, margin requirement changes, or volume limits.

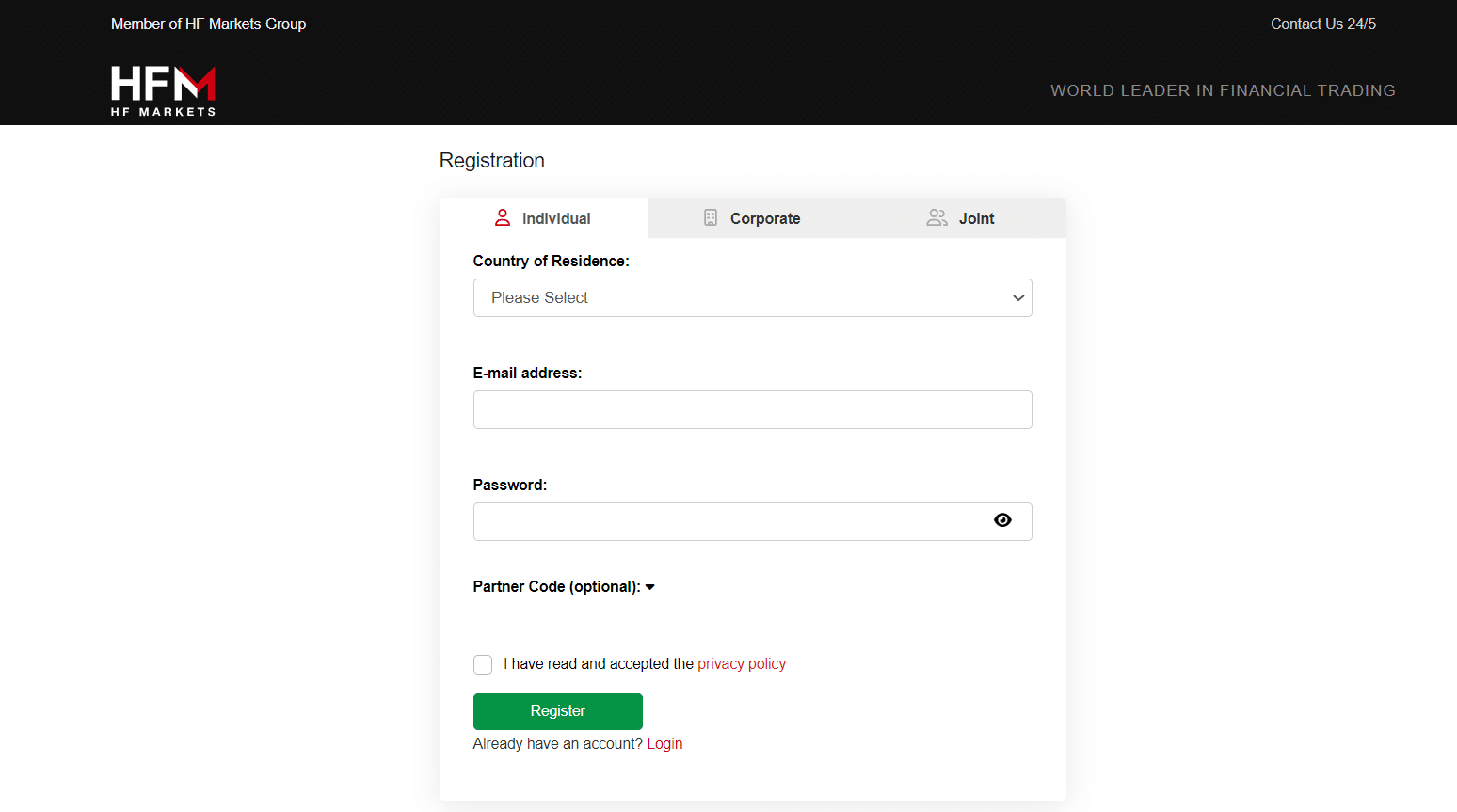

How to Open and Close an HFM Account

How to open an Account with HFM

To register an account with HFM, Ivory Coast, traders can follow these easy steps:

- ✅ Visit the HFM homepage and click the “Open Live Account” button at the top right.

- ✅ Enter your personal information as required to open the account.

- ✅ Upload the requested documentation before selecting a Forex trading platform.

- ✅ Account verification is usually completed within minutes of uploading all documents. You’ll receive an email confirmation when your account is fully verified.

How to close My Account with HFM

To close a live trading account with HFM, Ivory Coast, traders can follow these steps:

- ✅ Withdraw all funds from the account before initiating the closure, as you won’t be able to access or withdraw funds after cancellation.

- ✅ Close all open positions through MT4 or MT5.

- ✅ Keep a record of your transaction history for tax purposes.

- ✅ If the account remains inactive for an extended period, it will be archived, making trading impossible. An account maintenance fee of $5 will be charged monthly until the balance reaches zero. Archived accounts can be restored by contacting support.

- ✅ To request account cancellation, contact the support centre via live chat or email, providing your ID for verification. Note that account deletion or cancellation is handled manually by the staff.

HFM Trading Platforms

HFM MAM / PAMM Features

HFM offers PAMM (Percentage Allocation Money Management) accounts exclusively for money managers who open a live trading account with HF Markets (SV) Ltd.

PAMM accounts allow investors to allocate funds to experienced PAMM Fund Managers who trade on their behalf. Managers receive a predetermined “Success Fee” based on investor profits.

Money managers can create Premium or Premium Plus HFM PAMM accounts exclusively on the MT4 platform.

The Premium account offers spreads starting at 1.1 pips, while the Premium Plus account has lower spreads starting at 0.3. Premium accounts have no trading fees, while Premium Plus accounts incur a $5.00 per 100,000 USD traded charge.

Both PAMM packages support investments in Forex, oil, metals, and indices, with a maximum leverage ratio of 300:1. These accounts provide a substantial cash pool and allow inexperienced traders to profit from Forex and similar markets without active trading.

HFM App

The upgraded HFM App is a portal for both MT4 and MT5 platforms. It offers a sleek design and an intuitive interface, empowering traders to customise chart types, views, and trading settings. Traders can place orders based on their preferred amount, lots, or units.

The app facilitates convenient fund transfers, withdrawals, and deposits. It also integrates an economic calendar, informing traders about upcoming events.

Additionally, the HFM App provides access to educational materials, including webinars for traders at various skill levels and news related to their preferred instruments.

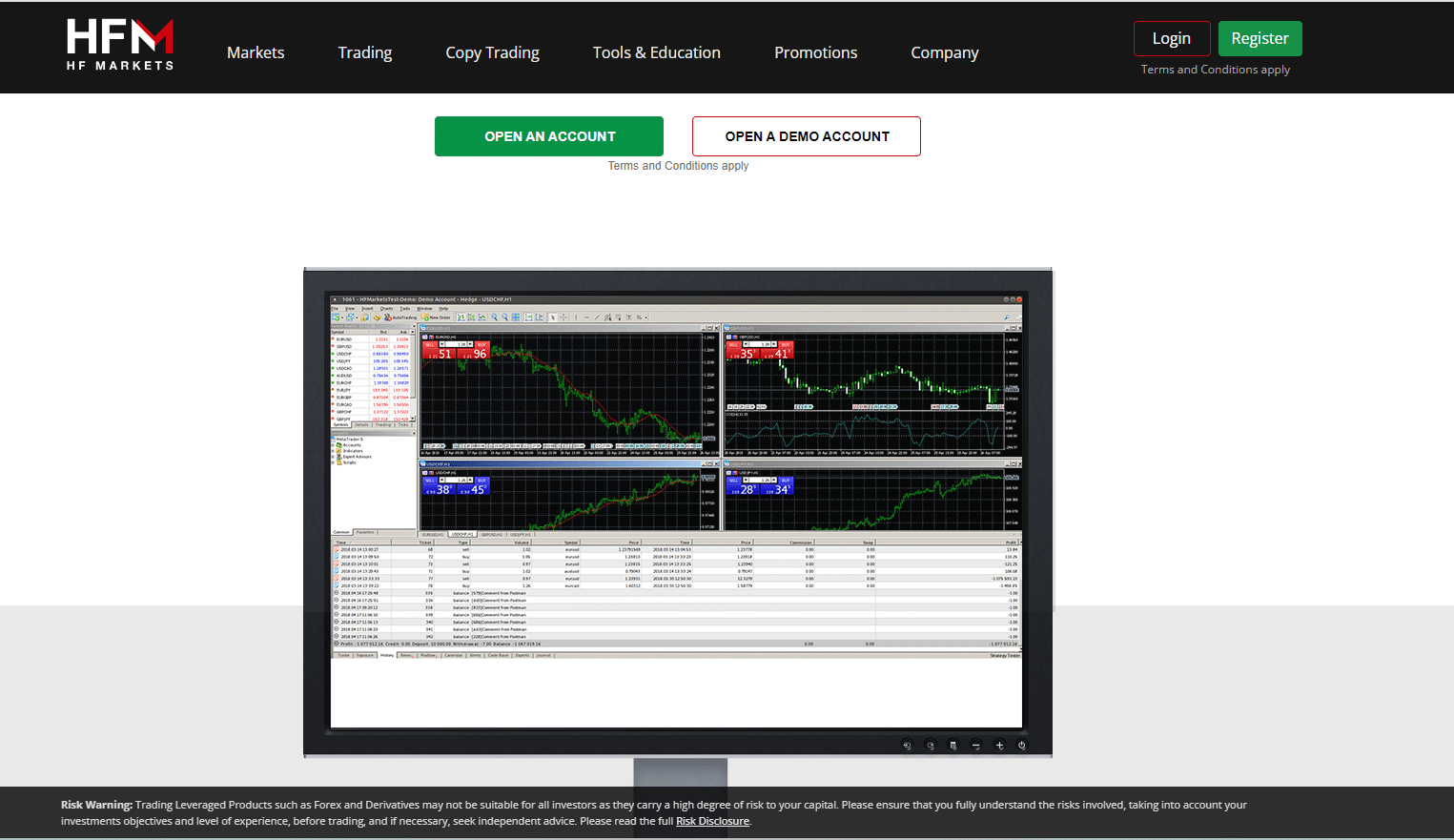

MetaTrader 4 and MetaTrader 5

HFM recognises the suitability of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for Ivory Coast traders starting their market journey due to their simplicity and user-friendly nature.

MT4 is a well-established and widely used trading platform known for its reliability, flexibility, and comprehensive features.

HFM’s MT4 platform grants traders access to various financial assets, including Forex, commodities, indices, and more. It offers nine timeframes and 30 technical indicators, enabling traders to conduct thorough market analysis and make informed trading decisions.

MT5, the successor to MT4, enhances the trading experience with additional features and expanded capabilities. In addition to Forex and commodities, HFM’s MT5 platform provides access to a broader range of financial instruments, such as stocks and futures.

Pros and Cons HFM Trading Platforms

| ✅ Pros | ❎ Cons |

| MetaTrader 4 and 5 are available across devices | There is no dedicated desktop or web-based proprietary HFM platform |

| Innovative HF App with useful features for Ivory Coast traders | Limited functionality on the HF App |

Which Markets Can You Trade with HFM?

Ivory Coast traders can expect the following range of markets from HFM:

- ✅ Precious Metals

- ✅ Energies

- ✅ Spot Indices

- ✅ Futures Indices

- ✅ Individual Stocks and Stock CFDs

- ✅ Commodities

- ✅ Cryptocurrencies

- ✅ Bonds

- ✅ DMA Stocks

- ✅ ETFs

Financial Instruments and Leverage offered by HFM

| 🔍 Instrument | 🔢 Number of Assets Offered | ⬆️ Max Leverage Offered |

| 🥇Forex | 53 | 1:2000 |

| 💍Precious Metals | 6 | Gold: 1:2000 Silver: 1:100 Platinum: Floating Palladium: 1:20 |

| 🖥️ETFs | 34 | 1:5 |

| 📈Stocks DMA | 864 | 1:5 |

| 📉Indices | 24 | 1:200 |

| 📊CFD Stocks | 111 | 1:14 |

| 💰Cryptocurrency | 40 | 1:50 |

| 📌Energies | 4 | 1:66 |

| 🚩Bonds | 3 | 1:50 |

| 🍎Agricultural Commodities | 5 | 1:66 |

Pros and Cons HFM Range of Markets

| ✅ Pros | ❎ Cons |

| Traders can easily diversify a portfolio with the range of markets available from HFM | There are no local CFDs offered in the Ivory Coast |

HFM Fees, Spreads, and Commissions

Spreads

The spreads a trader might expect from HFM are affected by their account type, market conditions, and the financial instrument they choose to trade. The following are typical spreads by account type:

- ✅ Cent Account – from 1.2 pips

- ✅ Premium Account – from 1.2 pips

- ✅ Zero Account – from 0.0 pips

- ✅ Pro Account – 0.5 pips

According to the financial instruments offered by HFM, traders can expect these average spreads:

| 🔍 Instrument | ⌛ Average Spread |

| 📌EUR/USD | 1.2 pips |

| 🚩NZD/USD | 2.1 pips |

| 📍XAG/USD | 0.03 pips |

| 🔖XAU/USD | 0.26 pips |

| 🛎️US OIL Spot | 0.06 pips |

| 💡US OIL Futures | 0.11 pips |

| 🏷️US Tech 100 Spot | 2.03 pips |

| 🖥️US Tech 100 Futures | 3.13 pips |

| ✏️Volatility Index SP 500 (VIX.F) | 0.14 pips |

| 🍎APPLE (NASDAQ – APPLE) | 0.5 pips |

| 📈Commodities | From 0.008 (Copper) |

| 📉BTC/USD | 12 pips |

| ➡️Bonds | From 0.05 pips to 0.06 pips |

Commissions

Commissions only apply to the HFM Zero Account as follows.

Forex

| ➡️Trade Size | 1,000 | 10,000 | 100,000 |

| 📌Per Side | $0.03 | $0.3 | $3 |

| 🚩Round Turn | $0.06 | $0.6 | $6 |

Gold

| ➡️Trade Size | 1 Ounce | 10 Ounces | 100 Ounces |

| 📌Per Side | $0.07 | $0.7 | $7 |

| 🚩Round Turn | $0.14 | $1.4 | $14 |

Overnight Fees, Rollovers, or Swaps

HFM implements overnight fees, and swaps, for various trading instruments based on market conditions and rates obtained from price suppliers. Here is a breakdown of the overnight fees for different asset classes tailored for Ivory Coast traders:

Individual Stocks:

- ✅ Daily swaps are adjusted according to market conditions and rates provided by price suppliers.

- ✅ All positions are subject to these swaps, with triple swaps applied specifically on Wednesdays.

- ✅ Precious Metals (XAU and XAG):

- Swaps for XAU and XAG are updated daily in response to market changes and rates from price suppliers.

- Ivory Coast traders should be aware that triple swaps are applied on Wednesdays.

- Swaps for XAU and XAG are denoted as 1 pip per lot.

- ✅ Energy:

- Energy swaps undergo daily adjustments based on market conditions and prices from price providers.

- Wednesdays are subject to triple swaps.

- USOil and UKOil swaps are specified in US Dollar values, and traders should note this information.

- ✅ Other Instruments (Indices, Bonds, DMA Stocks, ETFs, Cryptocurrencies):

- Swap rates for these instruments are modified daily per market circumstances and rates obtained from price providers.

- All positions are subject to these swaps, with quadruple swaps specifically applied on Fridays.

Some typical overnight fees that Ivory Coast traders can expect are as follows:

| 🔍 Instrument | 📌 Swap Short | 🚩Swap Long |

| ➡️EUR/USD | 0.0 pip | -6.9 pips |

| 💡XAG/USD | 0.0 pips | -1.79pips |

| 🛎️XAU/USD | 0.0 pips | -26.52 pips |

| 🏷️US OIL Spot | -0.87 pips | -0.75 pips |

| ⌛US OIL Futures | -0.87 pips | 0.0 pips |

| ⚙️US Tech 100 Spot | 0.92 pips | -3.87 pips |

| 🖥️US Tech 100 Futures | 0.0 pips | 0.0 pips |

| 👉Volatility Index SP 500 (VIX.F) | 0.0 pips | 0.0 pips |

| 🍎APPLE (NASDAQ – APPLE) | 1.32 pips | -8.82 pips |

| 🥉Copper | -0.53 pips | -1.58 pips |

| 💎BTC/USD | -6000.0 pips | -6000.0 pips |

| 📊Bonds | 0.0 pips | 0.0 pips |

| 📌DMA Stocks NASDAQ | -2.93 pips | -4.57 pips |

| ↘️ETFs | 1.32 pips | -8.82 pips |

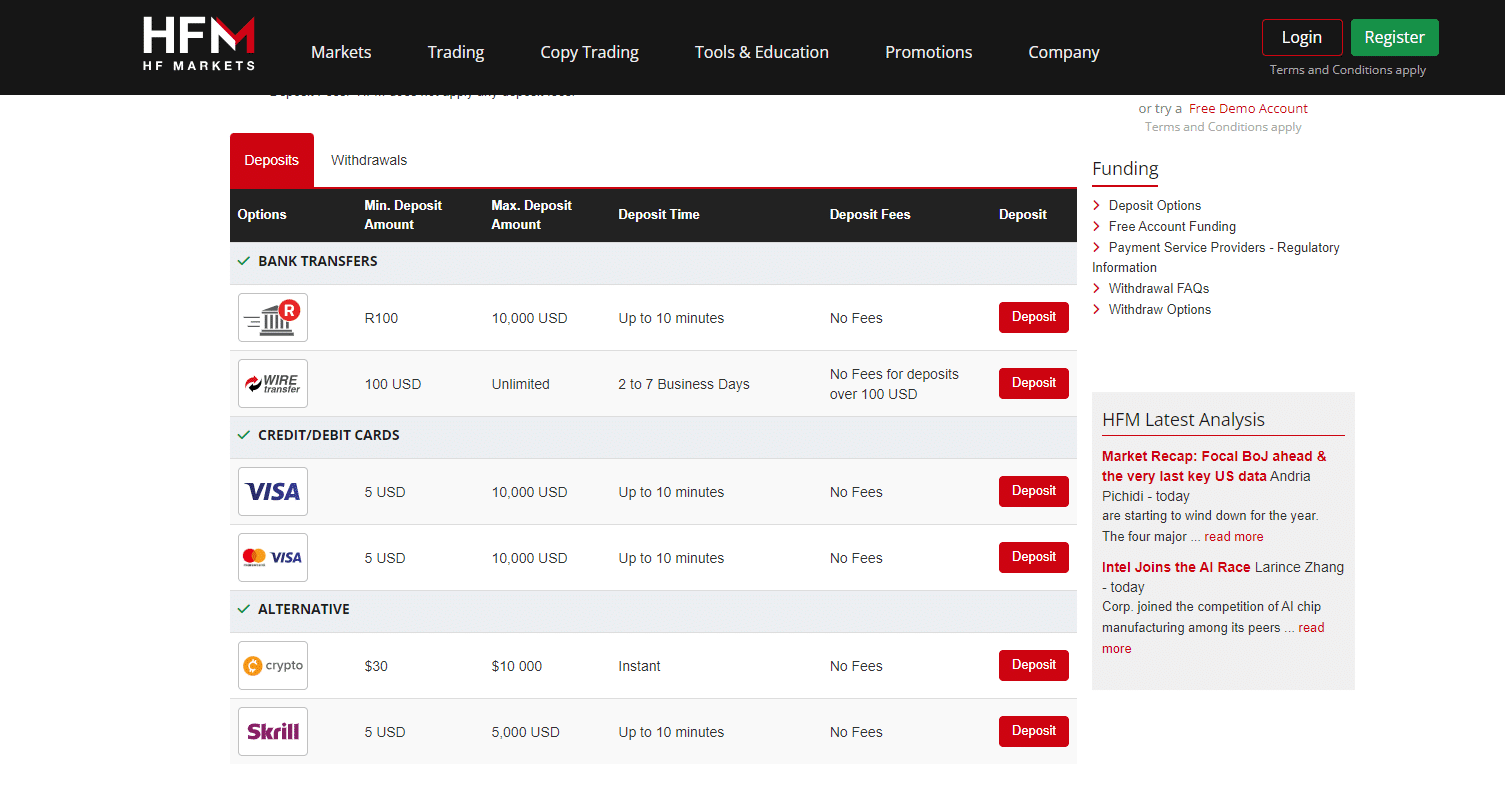

Deposit and Withdrawal Fees

HFM guarantees that all deposit and withdrawal methods provided are completely free of charge. However, it is important to consider that deposits exceeding $100 are exempt from bank wire transfer fees.

Ivory Coast traders should be aware that deposits made through bank wire transfers below the value of 61,000 XAF or the equivalent of 100 USD based on the current exchange rate between USD and XAF may incur fees.

We urge Ivory Coast traders to take note of these fee exemptions and potential charges when making deposits or withdrawals through bank wire transfers. Keeping this information in mind will help ensure a smooth and cost-effective transaction process.

Inactivity Fees

HFM applies a $5 inactivity fee to dormant accounts after 6 months.

Currency Conversion Fees

Ivory Coast traders who deposit or withdraw in XAF could face currency conversion fees.

Pros and Cons HFM Trading and Non-Trading Fees

| ✅ Pros | ❎ Cons |

| HFM has a transparent fee schedule that can be viewed on the website and trading platforms | There are withdrawal fees that will apply for all bank wire transfers under $100 |

| Commission-free trading is available | HFM charges inactivity fees on dormant accounts |

| Traders can make deposits for free | Deposits and withdrawals in XAF could be subject to currency conversion fees |

HFM Deposits and Withdrawals

HFM offers Ivory Coast traders the following deposit and withdrawal methods:

- ✅ Bank Wire Transfer

- ✅ Electronic Transfer

- ✅ Credit Card

- ✅ Debit Card

- ✅ Skrill

Broker Comparison: Deposit and Withdrawals

| 🔍 Broker | 🥇 HFM | 🥈 NinjaTrader | 🥉 FP Markets |

| ⌛Minimum Withdrawal Time | 10 Minutes | Within 24 hours | Instant |

| ⏱️Maximum Estimated Withdrawal Time | 10 business days | Between 5 to 7 working days | Up to 5 working days |

| 💵Instant Deposits and Instant Withdrawals? | None | None | ✅ Yes, Sticpay wallet withdrawals |

HFM Deposit and Withdrawal Details – Payment Methods, currencies, processing time, etc.

| 🔍 Payment Method | 💴 Deposit Currencies | ⌛ Deposit Processing | 💳 Withdrawal Processing | ⬆️ Max Deposit | ⬇️ Min Withdrawal |

| ⚠️Bank Wire Transfer | Depends on region | 2 to 7 working days | 2 to 10 working days | Unlimited | 100 USD |

| 🖥️Electronic Transfer | Depends on region | Up to 10 min | Up to 2 working days | 10,000 USD | 10 USD or 70 ZAR |

| 💳Credit Card | Depends on region | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| ℹ️ Debit Card | Depends on region | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| ➡️Skrill | Depends on region | Up to 10 min | Up to 10 Min | 10,000 USD | 5 USD |

How to Deposit Funds with HFM

To deposit funds to an account with HFM, Ivory Coast traders can follow these steps:

- ✅ Log in to your trading account on the HFM website using your credentials.

- ✅ Once logged in, locate the “Deposit” or “Fund Your Account” option.

- ✅ HFM accepts deposits through various methods, including bank wire transfers, credit/debit cards, e-wallets, and other online payment systems. Choose the method that suits you best.

- ✅ Enter the desired deposit amount, ensuring you meet minimum deposit requirements.

- ✅ Depending on the chosen deposit method, you may be required to provide additional information, such as credit card details or e-wallet account information. Follow the instructions and provide accurate information.

- ✅ Before proceeding, carefully review the deposit details, including the amount and chosen payment method. Take note of any applicable fees or charges.

- ✅ Once you have reviewed and confirmed the deposit details, proceed with the transaction following the steps.

- ✅ After submitting the deposit, allow time for the transaction to be processed. You should receive a confirmation notification or email once the funds have been successfully credited to your HFM trading account.

HFM Fund Withdrawal Process

To withdraw funds from an account with HFM, Ivory Coast traders can follow these steps:

- ✅ Log in to your HFM account.

- ✅ Navigate to the account management or banking page.

- ✅ Look for an option labelled “Withdraw,” “Withdraw Funds,” or similar.

- ✅ Enter the desired withdrawal amount.

- ✅ Confirm your withdrawal request and wait for the funds to be transferred to your designated bank account or chosen withdrawal method.

Pros and Cons HFM Deposits and Withdrawals

| ✅ Pros | ❎ Cons |

| The minimum deposit requirement is competitively low | There is no comprehensive list of all deposit and withdrawal regions |

| Traders can expect quick deposit and withdrawal processing | There are limited payment methods offered when compared to other brokers |

| There are flexible payment methods offered per region | Withdrawal fees apply for withdrawals under $100 through bank wire transfers |

How long do HFM Deposits take?

Deposits are typically processed within a few minutes, except for bank wire transfers, which can take up to 7 days.

How long do HFM Withdrawals take?

Withdrawals are typically processed within a few minutes. However, certain payment methods, such as bank wire transfers, can take up to a week for the funds to be credited to your account.

HFM Education and Research

Education

HFM offers the following Educational Materials to Ivory Coast traders:

- ✅ HFM Educational Videos

- ✅ Training Course Videos

- ✅ Forex Education

- ✅ eCourses

- ✅ Live Webinars

- ✅ Events

- ✅ Podcasts

HFM Research and Trading Tool Comparison

| 🔍 Broker | 🥇 HFM | 🥈 NinjaTrader | 🥉 FP Markets |

| 📆Economic Calendar | ✅ Yes | ✅ Yes | ✅ Yes |

| 💻VPS | ✅ Yes | ✅ Yes | ✅ Yes |

| ➡️AutoChartist | ✅ Yes | None | ✅ Yes |

| ✔️Trading View | None | ✅ Yes | None |

| 📌Trading Central | None | None | None |

| 📊Market Analysis | ✅ Yes | ✅ Yes | ✅ Yes |

| 📰News Feed | ✅ Yes | ✅ Yes | ✅ Yes |

| ↘️Blog | ✅ Yes | ✅ Yes | ✅ Yes |

HFM also offers Ivory Coast traders the following additional Research and Trading Tools:

- ✅ HFM App

- ✅ VPS Hosting Services

- ✅ Premium Trader Tools

- ✅ AutoChartist Tools

- ✅ Trading Calculators

- ✅ myHF Client Area

- ✅ Advanced Insights

- ✅ Economic Calendar

- ✅ Traders’ Board

- ✅ Auto Trading through MQL5

- ✅ Forex News presented by FxStreet

- ✅ One-Click Trading

- ✅ Events

- ✅ HFM Exclusive Analysis

Pros and Cons HFM Education and Research

| ✅ Pros | ❎ Cons |

| HFM provides VPS services to enhance the trading experience | The HF App has limited functionality when compared to other trading apps |

HFM Customer Support

| ℹ️ Customer Support | ➡️ HFM Customer Support |

| ⌚Operating Hours | 24/5 |

| 👥Support Languages | Multilingual |

| 🗣️Live Chat | ✅ Yes |

| 💻Email Address | [email protected] |

| ☎️Telephonic Support | ✅ Yes, several regions have local telephonic support |

| 💯The overall quality of HFM Support | 4/5 |

Pros and Cons HFM Customer Support

| ✅ Pros | ❎ Cons |

| Traders can use several avenues to contact HFM support | The lack of 24/7 customer support could be problematic when traders experience problems or have questions over weekends |

HFM VPS Review

HFM is dedicated to continuous innovation and providing exceptional services to enhance the trading experience. HFM has partnered with Beeks Financial Cloud, a leading provider, to offer high-quality VPS hosting solutions as part of this commitment.

Ivory Coast traders can choose a plan that suits their specific trading needs, benefiting from Beeks Financial Cloud’s presence in nine foreign data centres.

This partnership ensures lightning-fast response times and superior connectivity, focusing on delivering low-latency and reliable VPS and infrastructure solutions for traders’ platforms.

Ivory Coast traders may access HFM’s free VPS plans based on specific deposit and trading conditions. Paid subscriptions are also available for those requiring additional features and resources at a monthly cost of $30.

HFM Corporate Social Responsibility

HFM is constantly involved in several CSR initiatives and projects. Furthermore, here are a view recent projects of HFM:

- ✅ HFM’s Response to the Covid-19 Pandemic:

- HFM actively supports the World Health Organization’s efforts in combating the Covid-19 pandemic.

- The company has provided substantial financial support to minimise the impact of the pandemic on vulnerable regions.

- ✅ Partnership with The Rainforest Alliance:

- HFM Group demonstrates its commitment to environmental preservation through a philanthropic contribution to The Rainforest Alliance.

- The contribution aims to support indigenous communities in their fight against the devastating fires in the Amazon rainforest.

- ✅ Support for the Larnaca Lions Club:

- HFM generously supports the Larnaca Lions Club, a regional chapter of Lions Club International.

- The financial contributions made by HFM empower local communities and positively impact the lives of young individuals.

- ✅ Holiday Giving Initiative:

- In 2017, HFM initiated a holiday-giving program in Larnaca, Cyprus.

- The company provided cash aid and positive reinforcement to select young people to bring joy and create memorable experiences during the holiday season.

Social Trading with HFM

HFM introduces HFCopy, a unique Copy/Social Trading feature that fosters collaboration and accessibility among traders. With HFCopy, traders can join forces, share strategies, and potentially master the markets together.

HFCopy’s key advantage lies in its automated trading capabilities. Traders can act as Strategy Providers, creating strategies and allowing others to copy their trades. Strategy Providers earn a Performance Fee based on the success of their strategies.

For those who prefer to follow and replicate successful traders, HFCopy allows individuals to become Followers. Followers can benefit from the expertise and strategies of experienced traders without actively trading or monitoring the markets.

With HFCopy, traders have full control over their accounts. They can choose Strategy Providers, adjust risk management settings, and customise their trading experience to suit their preferences and goals.

HFCopy’s diverse trading strategies unite traders from different backgrounds, creating a vibrant and dynamic trading community. Followers can choose strategies that align with their risk tolerance and investment objectives.

HFM’s HFCopy feature offers a unique social trading experience, enabling collaboration and accessibility among traders. By joining HFCopy, traders can form a community, share strategies, and potentially achieve success together.

One notable advantage of HFCopy is its automation capability. Traders can become Strategy Providers, developing their trading strategies and allowing others to copy their trades. Strategy Providers earn a Performance Fee based on the success of their strategies, providing an incentive for them to excel.

For those who prefer to follow and replicate the trades of experienced traders, HFCopy allows individuals to become Followers. Followers can benefit from the expertise and strategies of successful traders without needing to trade or closely monitor the market actively.

HFCopy grants traders full control over their accounts, empowering them to choose which Strategy Providers to follow, customise risk management settings, and tailor their trading experience according to their preferences and goals.

The strength of HFCopy lies in its diverse range of trading strategies. Traders with different backgrounds and approaches can unite, creating a vibrant and dynamic trading community.

In our experience, this diversity allows Followers to select strategies that align with their risk tolerance and investment objectives, fostering a personalised and enriching trading experience.

HFM Cashback Rebates Features and Conditions

HFM Cashback Rebates Features and Conditions for Ivory Coast Traders:

HFM offers cashback rebates, allowing affiliates in Ivory Coast to increase their earnings by referring traders to the platform. Affiliates can enjoy a generous revenue share of 60% based on the net spreads generated by referred clients.

Additionally, affiliates can receive up to $15 in cashback rebates for every lot the referred clients trade. This lucrative program provides substantial rewards for successful referrals, allowing affiliates to earn ongoing income as the referred traders engage in trading activities.

RevShare+

HFM recently introduced RevShare+ to boost affiliate earnings beyond the standard Revenue Sharing commission.

Affiliates who join RevShare+ can earn monthly bonuses and regular commissions. The program rewards affiliates based on the number of new clients, lots traded, and generated cash flow.

Meeting specific targets for these criteria results in monthly rewards ranging from $100 to $5,000.

Furthermore, by participating in RevShare+, affiliates can enhance their earnings with additional monthly bonuses, increase revenue by attracting new clients and driving trading activity, and access a comprehensive affiliate program beyond traditional commission structures.

HFM Web Traffic Report

| 🌐Global Rank | 30,430 |

| 🌎Country Rank | 826 |

| 📈Category Rank | 45 |

| 🔢Total Visits | 1.6 million |

| 📌Bounce Rate | 41.43% |

| 📖Pages per Visit | 6.84 |

| ⌚Average Duration of Visit | 00:08:37 |

| 📆Total Visits in the last three months | March – 1.2m April – 871.3K |

HFM Geographic Reach and Limitations

Most of HFM’s market share is concentrated in these areas:

- ✅ Nigeria – 25.21%

- ✅ Malaysia – 10.84%

- ✅ Japan – 9.88%

- ✅ South Africa – 9.41%

- ✅ Thailand – 6.22%

HFM’s Current Expansion Focus

HFM is currently expanding globally across Asia, Africa, Europe, etc.

Countries not accepted by HFM

HFM does not accept clients from these countries:

- ✅ The United States

- ✅ Canada

- ✅ North Korea

- ✅ Syria

- ✅ Sudan

Popularity among Ivory Coast traders who choose HFM

HFM is one of Africa’s best Forex and CFD brokers, ranking it among the Top 10 for traders in the Ivory Coast.

HFM vs NinjaTrader vs FP Markets – A Comparison

| 🔍 Broker | 🥇 HFM | 🥈 NinjaTrader | 🥉FP Markets |

| 📈Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | NFA | ASIC, CySEC |

| 📉Trading Platform | MetaTrader 4 MetaTrader 5 HFM App | NinjaTrader Desktop NinjaTrader Mobile CQG Mobile | MetaTrader 4 MetaTrader 5 Myfxbook AutoTrade FP Markets App |

| 💴Withdrawal Fee | None | ✅ Yes | ✅ Yes |

| 🗂️Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 💵Min Deposit | 3,050 XAF | 30,000 XAF | 40,200 XAF |

| 📊Leverage | 1:2000 | 1:50 | 1:500 |

| 📝Spread | 0.0 pips | 1.1 pips | 0.0 pips |

| 💶Commissions | $6 per round turn | From $0.09 | From US$3 |

| 🛑Margin Call/Stop-Out | 50%/20% | None | 100%/50% |

| 🧑⚖️Order Execution | Market | Instant, Market | Market |

| 💷No-Deposit Bonus | None | None | None |

| 💰Cent Accounts | None | None | None |

| 👉Account Types | Cent Account Premium Account Zero Account Pro Account | Forex Account Futures Account | MT4/5 Standard Account MT4/5 Raw Account MT4/5 Islamic Standard Account MT4/5 Islamic Raw Account |

| 🏦Banking Commission of WAEMU Regulation | None | None | None |

| 📌XAF Deposits | ✅ Yes | None | ✅ Yes |

| ➡️XAF Account Offered? | None | None | None |

| 🕰️Customer Service Hours | 24/5 | 24/5 | 24/7 |

| ↘️Retail Investor Accounts | 4 | 2 | 4 |

| ☪️Islamic Account | ✅ Yes | None | ✅ Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | 500 lots | 100 lots | 50 lots |

| ⏲️Minimum Withdrawal Time | 10 Minutes | Within 24 hours | Instant |

| ⌚Maximum Estimated Withdrawal Time | 10 business days | Between 5 to 7 working days | Up to 5 working days |

| ✔️Instant Deposits and Instant Withdrawals? | None | None | ✅ Yes, Sticpay wallet withdrawals |

Broker Comparison for a Range of Markets

| 🔍 Broker | 🥇 HFM | 🥈 NinjaTrader | 🥉 FP Markets |

| ➡️Forex | ✅ Yes | ✅ Yes | ✅ Yes |

| 💎Precious Metals | ✅ Yes | None | ✅ Yes |

| 💻ETFs | None | None | None |

| 🛎️CFDs | ✅ Yes | None | ✅ Yes |

| 💡Indices | ✅ Yes | None | ✅ Yes |

| 📈Stocks | ✅ Yes | None | ✅ Yes |

| 💰Cryptocurrency | ✅ Yes | None | ✅ Yes |

| 📊Options | None | None | None |

| ℹ️Energies | ✅ Yes | None | ✅ Yes |

| 🏷️Bonds | ✅ Yes | None | None |

HFM Alternatives

- 🥇 Exness offers many features, including low spreads, unlimited leverage (in some cases), free VPS hosting, and educational tools. The platform supports the popular MetaTrader 4 and MetaTrader 5 platforms and provides an in-house financial news wire service.

- 🥈 AvaTrade is committed to expanding its market presence by offering a wide range of trading platforms and assets. SharpTrader provides traders with access to a variety of high-quality educational resources. AvaTrade provides a range of trading platforms to accommodate a variety of trading preferences, thereby ensuring a seamless trading experience. With a large selection of assets, traders can diversify across asset classes, enhancing their investment strategies.

- 🥉 Due to its exceptional trading experience, competitive fee structure, and superior customer service, Pepperstone has earned its reputation as a top-tier forex broker. The prevalent Pepperstone razor account provides tight spreads, as low as 0 pips in major currency pairs such as EUR/USD, and a commission of $3.50 per traded lot. Pepperstone is a popular choice

HFM Awards and Recognition

According to HFM’s website, the company has been recognised for the following honours in the past year:

- ✅ Best Forex Broker Globally (2022)

- ✅ Top 100 Companies (2022)

- ✅ Best Forex Introducing Broker Provider (2022)

- ✅ Best Forex Trading App (2022)

- ✅ Best Forex Broker South Africa (2022)

- ✅ Best Forex Broker Middle East (2022)

- ✅ Best Forex Broker in Asia (2022)

- ✅ Best Educational Broker (2022)

- ✅ Best Forex Partners Program Globally (2022)

and many, MANY more!

Recommendations according to our in-depth review of HFM

- ✅ Enhance the functionality of the HF App: To compete with other trading apps, HFM could consider adding more features and tools to its HF App. This could significantly improve the mobile trading experience for users.

- ✅ Introduce local CFDs in the Ivory Coast: By offering local CFDs, HFM could cater to a wider range of traders in the Ivory Coast and provide more trading options.

- ✅ Improve fee transparency: HFM could provide more clarity and transparency around its fees, including spreads and commissions. This would help traders make more informed decisions about their trading activities.

- ✅ Expand educational resources: While HFM already offers a variety of educational materials, the platform could consider adding more resources, such as advanced trading tutorials and strategy guides. This could help traders further enhance their trading skills and knowledge.

HFM Customer Reviews

🥇 A Solid Platform!

“I have been using HFM for a few months, and I am impressed with their educational resources. The customer service has been responsive and helpful as well. A solid platform for trading.” – Adjoa Anderson (June 2024)

🥈 User Friendly!

“One thing I appreciate about HFM is its user-friendly interface. It is so easy to navigate and perform trades. However, I have had a few instances where trades executed slower than expected.” – Bakary Doumbia (June 2024)

🥉 Competitive Spreads!

“HFM has been an excellent platform for my forex trading. The spreads are competitive, and they offer a good range of instruments. Withdrawals could be a bit faster, though.” – Fanta Diakité (May 2024)

Pros and Cons of Trading with HFM

| ✅ Pros | ❎ Cons |

| HFM is a seasoned broker with over a decade of experience that has received numerous industry awards, indicating their dependability and high-quality service. | While HFM operates in various jurisdictions, protections and benefits can differ. For example, negative balance protection policies and compensation schemes in case of insolvency are offered to customers in the UAE and Europe but not to customers in Africa and other regions. |

| HFM is regulated by multiple esteemed financial authorities, like the UK’s Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), ensuring the safety of clients’ funds. | The deposit and withdrawal methods available vary by region, which can limit options. |

In Conclusion

Based on our research and experience with HFM, it is clear that the platform offers a comprehensive range of services and tools for traders.

HFM provides a variety of educational materials, including videos, training courses, webinars, and podcasts, which can significantly enhance the trading experience.

According to our findings, the platform also offers a range of research and trading tools, such as the HF App, VPS Hosting Services, Premium Trader Tools, and more, which can be particularly beneficial for traders in the Ivory Coast.

However, there are some areas where HFM could improve. For instance, the HF App has limited functionality compared to other trading apps.

This could potentially hinder traders who rely heavily on mobile trading. Additionally, while HFM provides VPS services to enhance the trading experience, it does not offer local CFDs in the Ivory Coast, which could limit the trading options for some traders.

Regarding market offerings, HFM allows traders to diversify their portfolios with a wide range of markets. However, the absence of local CFDs in the Ivory Coast could be a potential drawback for some traders.

On the positive side, HFM offers high leverage but applies negative balance protection to accounts, which can be a significant advantage for traders.

Overall, HFM offers a robust platform with a wide range of tools and services. However, there are areas where the platform could improve to provide a more comprehensive and user-friendly experience for traders.

HFM Risk Warning and Disclaimer for Traders: Trading in financial markets involves inherent risks and may not be suitable for all investors. The fluctuation of prices can result in financial losses, and past performance does not guarantee future results.

Before trading, traders should carefully consider their financial situation and risk tolerance.

HFM does not provide investment advice and cannot guarantee the accuracy or completeness of the information provided. It is recommended that traders seek independent financial advice if necessary.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyse, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Now it is your turn to participate:

- ✅ Do you have any prior experience with HFM?

- ✅ What was the determining factor in your decision to engage with HFM?

- ✅ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

- ✅ Have you experienced issues with HFM, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk.

In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment

Frequently Asked Questions

What are the different account types offered by HFM?

HFM offers various account types, including Cent Account, Premium Account, Zero Account, and Pro Account, each with different features and benefits.

How can I contact HFM customer support?

HFM customer support can be contacted via live chat or email for any queries or assistance.

Does HFM have Nasdaq 100?

Yes, HFM offers trading on the Nasdaq 100 under the name “US Tech 100” as spot contracts on Indices and Futures contracts on Indices.

Is HFM Safe or a Scam?

HFM is a reputable and safe brokerage firm with a global presence in the industry. Traders can trust HFM for their trading needs.

What are the trading fees on HFM?

Trading fees on HFM are affected by account type, market conditions, and the financial instrument chosen, with spreads starting from 0.0 pips for the Zero Account.

Is HFM regulated?

Yes, HFM is regulated by several reputable authorities, including FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA. These regulatory bodies ensure that HFM operates within legal frameworks and upholds certain standards of conduct.

How can I open an account with HFM?

You can open an account with HFM by providing your personal information, choosing a trading platform, and uploading the requested documentation for verification.

What markets can I trade with HFM?

With HFM, you can trade various markets, including Forex, commodities, indices, and more.

How long does it take to withdraw from HFM?

Withdrawal times from HFM vary depending on the chosen payment method and can range from as quick as 10 minutes to several days.

What is the minimum deposit for HFM accounts?

The minimum deposit for HFM accounts varies, starting from 3,050 XAF.

Does HFM offer a demo account?

Yes, HFM offers a demo account for traders to practice and familiarise themselves with the platform.

Does HFM have VIX 75?

Yes, HFM provides access to the Volatility 75 index, with competitive spreads starting from 0.14 pips.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn up to 30% Cashback Rebates from Forex Brokers such as HFM.

This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as HFM to ensure you get the most back from your trading activities.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Ivory Coast

Scam Forex Brokers in Ivory Coast