The 5 best forex no deposit bonuses in Ivory Coast – Revealed. We have explored and tested several prominent Forex No Deposit Bonuses for forex trading in Ivory Coast to identify the 5 best. This is a complete guide to the 5 best Forex no-deposit bonuses in Ivory Coast.

In this in-depth guide you’ll learn:

- The Best Forex Brokers with a No-Deposit Bonus in the Ivory Coast – a List (2024)

- The Best $30, $50, $100, $500, $10’000 No Deposit Forex Bonuses

- Withdrawable No-Deposit Bonus Offers and Promotions

- Free, No Deposit, Sign-Up, Welcome Bonus Offers for Beginners.

and much, MUCH more!

The 5 Best Forex No Deposit Bonuses in Ivory Coast – a Comparison

| 🔎 Broker | 🎁 No-Deposit Bonus | 💶 Bonus Amount |

| 🥇 Admirals | ✅Yes | $100 USD |

| 🥈 Windsor Brokers | ✅Yes | $30 USD |

| 🥉 XM | ✅Yes | $30 USD |

| 🏅 HFM | ✅Yes | $30 USD |

| 🎖️ Tickmill | ✅Yes | $30 USD |

The 5 Best Forex No Deposit Bonuses in Ivory Coast (2024)

- ☑️ Admirals – Overall, the Best Forex Broker with a No-Deposit Bonus in the Ivory Coast

- ☑️ Windsor Brokers – USD 30 Welcome Account for Beginners

- ☑️ XM – Best Bonus with Withdrawable Gains

- ☑️ HF Markets – $30 Sign-Up Bonus

- ☑️ Tickmill – Popular Broker Choice amongst Ivorian Traders

Admirals

Admirals, also known as Admiral Markets, is a leading Forex services provider. Traders have the opportunity to trade Hundreds of Stocks and stock CFDs from various exchanges of the world commission-free. Admirals have a trust score of 83%.

Admirals Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 📍 Social Media Platforms | Facebook YouTube |

| 📈 BCEAO Regulation | None |

| 📉 Trading Accounts | Trade MT5 Account, Invest MT5, Zero MT5, Bets MT5, Trade MT4, Zero MT4 |

| 📊 Minimum Deposit in CFA Franc | 15033.94 CFA Franc or USD25 |

| 💹 Trading Assets | ESG Trading Instruments Forex Cryptocurrency CFDs Commodities Indices Stocks ETFs Bonds Spread Betting |

| 💴 CFA Franc-based Account | None |

| 💵 CFA Franc Deposits Allowed | None |

| 🎁 Bonuses for Ivorian traders | ✅Yes |

| 📔 Minimum spread | from 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

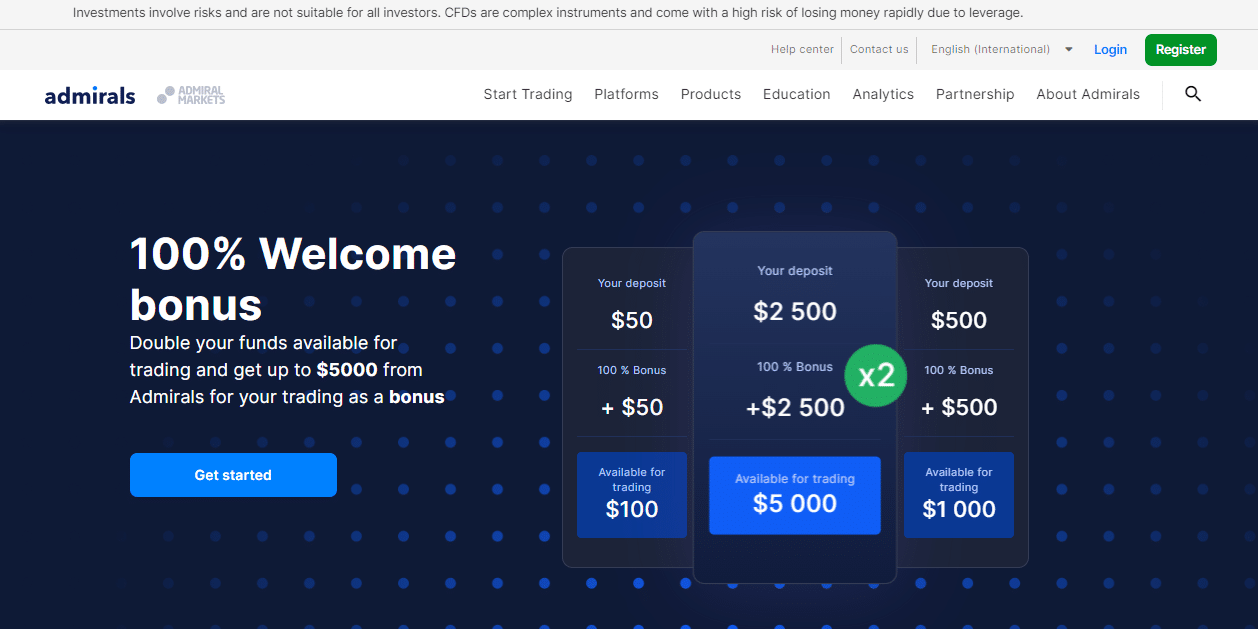

Admirals Bonus Offers and Promotions

Admirals’ “Exclusive Bonus” program provides Ivorian traders with a rare and advantageous opportunity. This incentive, funded by a one-time payment of $100, was painstakingly designed to help members of the Ivorian trade community.

The “Exclusive Bonus” helps traders by raising their available margin for transactions for 30 days following purchase. With more margin, traders can take on riskier positions, increasing their potential profits.

While the “Exclusive Bonus” does boost traders’ margin capacity, it is not intended to balance out trade deficits. Traders should be well-versed in their trading methods and employ stringent measures to mitigate risk.

The Admirals 100% Welcome Bonus comes with the following notable features:

- ✅ No Hidden Commissions

- ✅ Available to New and Existing Clients

- ✅ Available for Withdrawal

and much, MUCH more!

Admirals Pros and Cons

The Pros of trading with Admirals will include:

- ✅ Admirals are well-regulated in several countries throughout the world

- ✅ Admirals provide commission-free trading options

- ✅ The broker welcomes traders from the Ivory Coast of all experience levels and trading approaches Trading platforms are accessible from any web-enabled device

- ✅ A variety of markets, instruments, and leveraged products are available for trading

- ✅ Admirals provides its traders with the MetaTrader Supreme Edition

- ✅ Ivorian traders have access to advanced analytics

- ✅ A wealth of instructional materials, resources, and tools are available.

The Cons of Trading with Admirals may include:

- ✅ An inactivity fee is charged

- ✅ Currency conversion fees are levied against Ivorian traders

- ✅ Fees for making deposits and withdrawals are charged

- ✅ Administrative fees are levied against Islamic accounts.

What is the spread from Admirals?

Ivorian traders can expect a competitive spread that starts at 0.0 pips.

What is the minimum deposit for Admirals in Ivory Coast?

Ivorian traders will have a minimum deposit of 15033.94 CFA Franc or USD25.

Windsor Brokers

Windsor Brokers is a forex and CFD broker that appeals to both novice and experienced traders in the Ivory Coast because of its cheap spreads, abundant educational resources, and CySEC regulation.

Windsor Brokers offers tiered spreads for its various account tiers. Spreads on the Euro to US Dollar (EUR/USD) are 1.5 pips for Prime account holders but as low as zero for Ivorian traders who use Zero accounts. Windsor Brokers has a trust score of 92%

Windsor Brokers Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | CMA, CySEC, FCA, FSC |

| 📍 Social Media Platforms | Facebook Telegram YouTube |

| 📈 BCEAO Regulation | None |

| 📉 Trading Accounts | Prime or Zero MT4 Account |

| 📊 Trading Platform | MetaTrader 4 |

| 💴 Minimum Deposit CFA Franc | 59 998,99 CFA Franc or $100 |

| 💹 Trading Assets | Forex Metals Spot and CFD indices Spot and CFD energies Commodities Treasuries Shares |

| 💶 CFA Franc-based Account | None |

| 💷 CFA Franc Deposits Allowed | None |

| 🎁 Bonuses for Ivorian traders | ✅Yes |

| 📑 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

Windsor Brokers Bonus Offers and Promotions

Windsor Brokers offers access to a $30 Welcome Account for traders who sign up for a Prime Account with a US$, EUR €, GBP £, JPY ¥ currency base. The $30 Credit will be valid and available for a withdrawal request for 6 months.

Additionally, existing and new Clients traders who make a USD 500, will be eligible for the Windsor Brokers $10’000 Deposit Bonus Offer.

Windsor Brokers Pros and Cons

The Pros of Trading with Windsor Brokers will include:

- ✅ Well-regulated broker in several jurisdictions

- ✅ Commission-free trading available to Ivorian traders

- ✅ Technical Signals are updated up to four times a day.

- ✅ Over 33 years of experience in the global markets and a well-established reputation

The Cons of Trading with Windsor Brokers may include a Limited selection of trading platforms.

What are the deposit conditions at Windsor Brokers?

Deposits at Windsor Brokers can be done with credit or debit cards, bank transfers, and a variety of e-wallets such as Skrill and Neteller. Most clients do not incur deposit fees outside the EU.

Is Windsor Brokers safe for traders in Ivory Coast?

Yes, Windsor Brokers is a trustworthy and dependable broker that offers traders in the Ivory Coast a plethora of digital tools.

XM

XM is a market leader in the field of Forex and offers traders the opportunity to trade Forex, Crypto CFDs, Stocks, Metals, and much, MUCH more! Traders will have Free Access to Forex Market Research and Daily Forex Webinars. XM has a trust score of 84%

XM Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📍 Social Media Platforms | Facebook YouTube |

| 📈 BCEAO Regulation | None |

| 📉 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💴 Minimum Deposit in CFA Franc | 2 999,95 CFA Franc or $5 |

| 💹 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| ▶️ CFA Franc-based Account | None |

| 💷 CFA Franc Deposits Allowed | None |

| 🎁 Bonuses for Ivorian traders | ✅Yes |

| 🗂️ Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

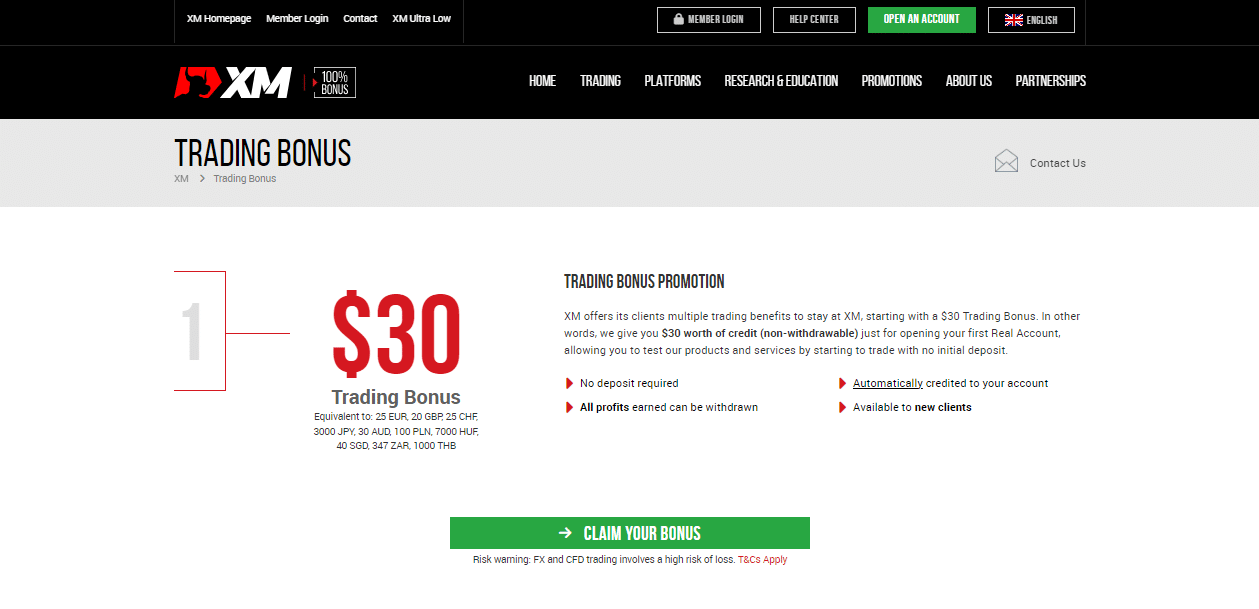

XM Bonus Offers and Promotions

When you open a Real Account with XM, you will receive $30 in non-withdrawable credit. There is no deposit required to receive the USD 30 Welcome Bonus, and all gains are withdrawable.

Because of its amazing platform, which is suitable for both new and experienced Ivorian traders, and features such as auto trading, no hidden fees or commissions, and lightning-fast order executions (99.35 percent in under a second), XM has a reputation as the next-generation broker for online Forex trading.

XM offers a variety of educational resources as well as a demo account with virtual cash totaling $100,000 for new traders to practice with.

XM Pros and Cons

The Pros of Trading with XM will include:

- ✅ XM has more than 5 million active clients from around the world

- ✅ Client fund safety is guaranteed, and XM offers investor protection to Ivorian traders

- ✅ XM has won several industry awards since its establishment in 2009

- ✅ There are no commissions charged on either deposits or withdrawals

- ✅ XM is a low-cost forex broker with a high trust score

The Cons of Trading with XM may Include:

- ✅ Inactivity fees apply

- ✅ There are no fixed spreads offered

How can Ivorian traders register for XM webinars?

Traders in Ivory Coast can register for webinars, free of charge, by checking the schedule for upcoming sessions.

Does XM offer trade ideas?

Yes, XM offers traders in Ivory Coast trade ideas and expert market analysis to all clients, free of charge.

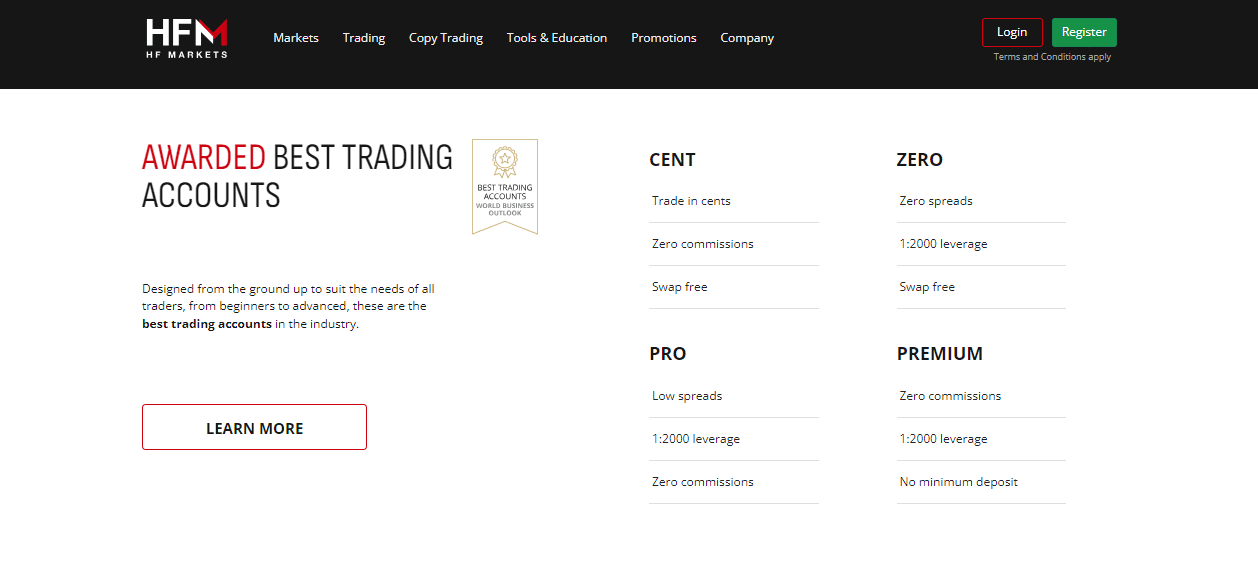

HF Markets

HFM (HotForex) also known as HF Markets is one of the most popular Broker choices globally. HFM is known for its ultra-fast execution, and access to trade CFDs on Forex, Commodities, Bonds, Metals, Energies, Shares, Indices, and more. HF Markets has a trust score of 83%.

HF Markets Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📍 Social Media Platforms | Facebook Telegram YouTube |

| 📈 BCEAO Regulation | None |

| 📉 Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📊 Trading Platform | MetaTrader 4 and MetaTrader 5 |

| 💴 Minimum Deposit in CFA Franc | 3 036,12 CFA Franc or $5 |

| 💹 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 💷 CFA Franc-based Account | None |

| 💶 CFA Franc Deposits Allowed | None |

| 🎁 Bonuses for Ivorian traders | ✅Yes |

| 📑 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

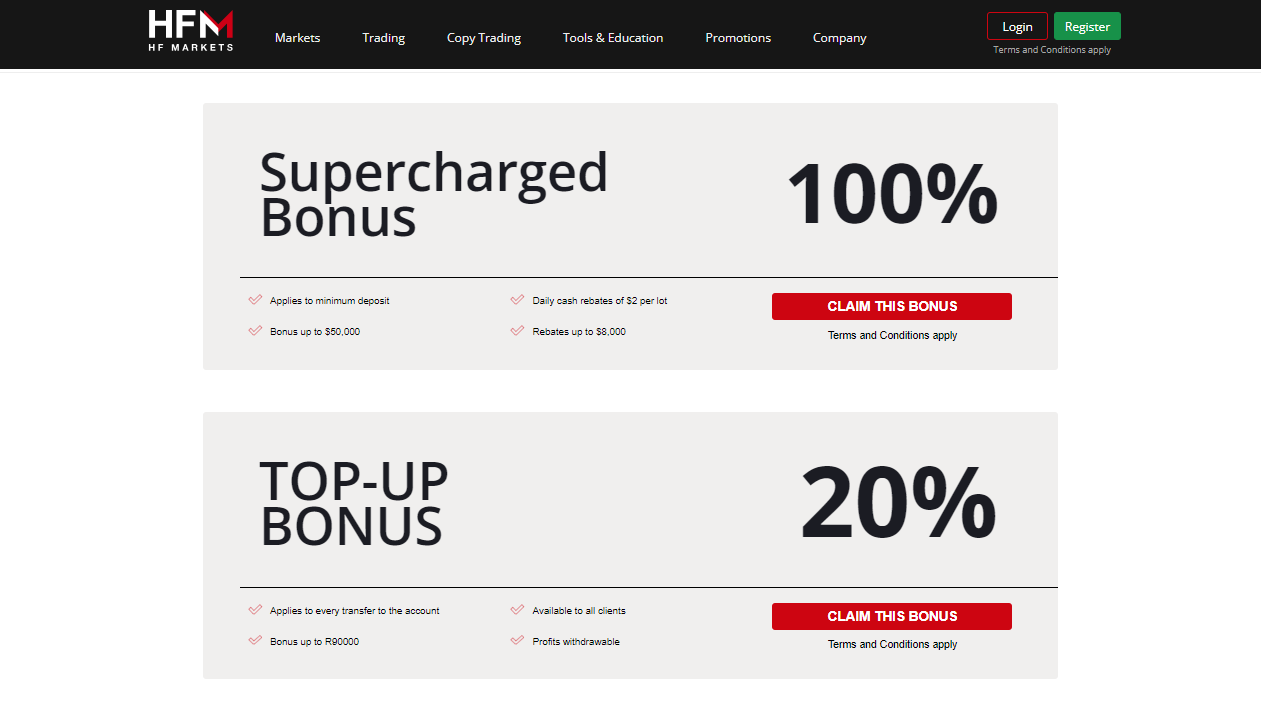

HF Markets Bonus Offers and Promotions

HFM offers a USD 30 Welcome Bonus to all qualifying clients who meet the conditions. A trading account with HFM must be opened to receive the USD 30 Welcome Bonus.

HFM provides a variety of account types, trading software, and tools to help individuals and institutions trade Forex and derivatives online. All Retail, Affiliate, and White Label clients have access to varied spreads and liquidity via cutting-edge automated trading platforms.

HF Markets Pros and Cons

The Pros of trading with HF Markets will include:

- ✅ Forex traders in Ivory Coast have the potential to profit from the low spread on the EUR/USD currency pair, which is just 0.9 pips. This spread is just one of the many ways that forex traders in Ivory Coast can save money.

- ✅ Traders with varied degrees of experience may benefit from using demo trading programs.

- ✅ Traders in Ivory Coast have access to HFM’s user-friendly MetaTrader 4 and 5 platforms, which enable users to trade several assets from any internet-connected device, including PCs, smartphones, and tablets. This gives traders in Ivory Coast the ability to trade in a variety of assets

The Cons of Trading with HF Markets include:

- ✅ The number of local withdrawal and deposit options that are available to traders in Ivory Coast is extremely restricted, and these options are not particularly straightforward

How do Ivory Coast traders qualify for the $30 bonus from HFM?

To qualify for the $30 welcome bonus from HGM you will have to register for an account with the broker.

Which trading platforms does HFM offer?

HFM provides access to both MetaTrader 4 and MetaTrader 5.

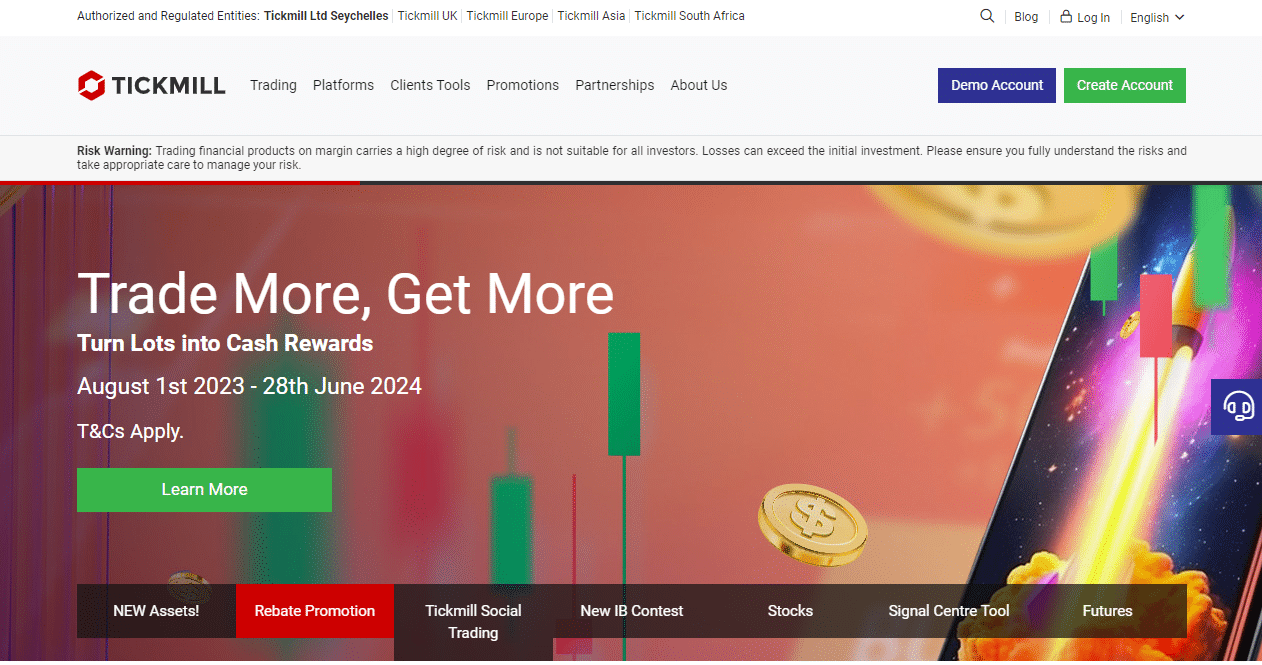

Tickmill

Tickmill is a Forex Broker that offers access to premium trading products and services. Tickmill is best known for posterizing client safety, and it is well-regulated by the Seychelles Financial Services Authority (FSA). Tickmill has a trust score of 81%

Tickmill Overview

| 🔎 Feature | ↪️ Information |

| 📌 Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 📍 Social Media Platforms | Facebook YouTube Telegram |

| 📈 BCEAO Regulation | None |

| 📉 Trading Accounts | Pro Account, Classic Account, VIP Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💴 Minimum Deposit in CFA Franc | 3 036,12 CFA Franc or $5 |

| 💹 Trading Assets | Forex, Stock Indices, Energies, Precious Metals, Bonds, Cryptocurrencies |

| 💵 CFA Franc-based Account | None |

| 💶 CFA Deposits Allowed | None |

| 🎁 Bonuses for Ivorian traders | ✅Yes |

| 📚 Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

Tickmill Bonus Offers and Promotions

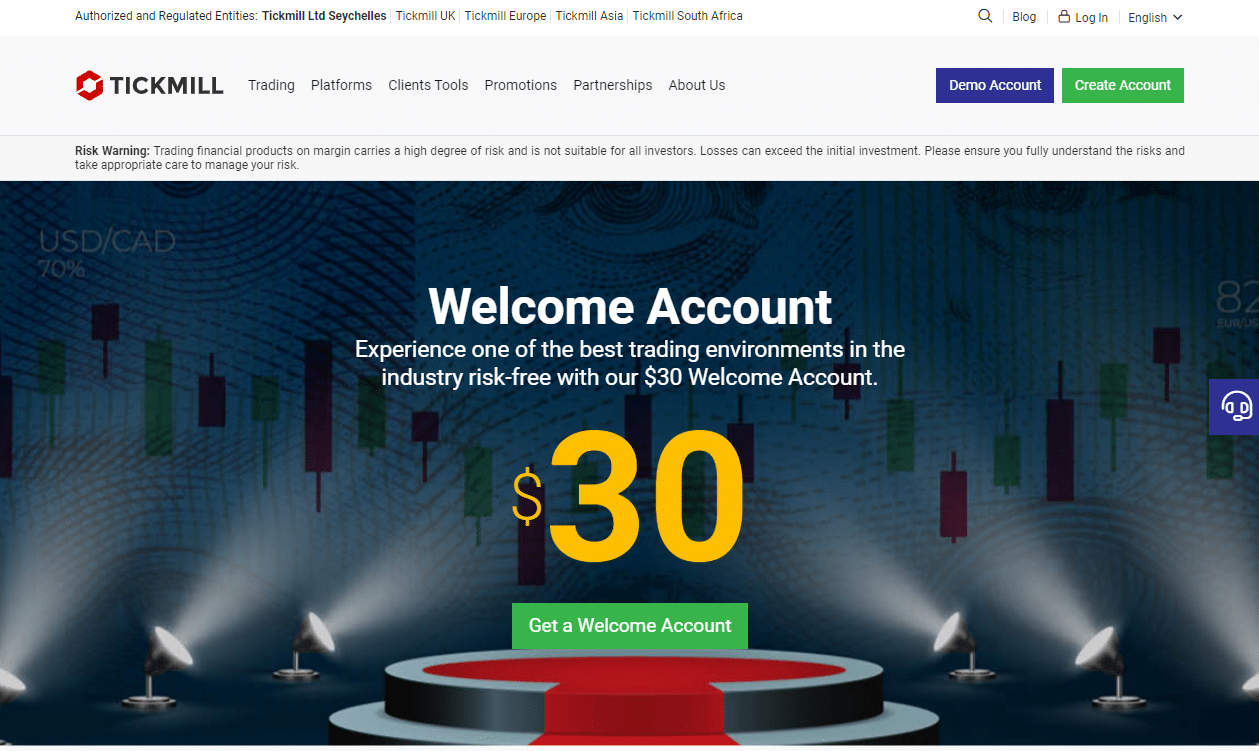

New traders from Ivory Coast may get their feet wet in the exciting world of Forex trading with Tickmill’s $30 Welcome Account. The purpose of this account is to let first-time traders practice their skills without risking their own money.

The Welcome Account is easy to use and comes with a free $30 deposit. Money can be taken out of this account at any time. Client Area registration, verification documents, and a $100 minimum Wallet balance are essential prerequisites for trading.

Furthermore, there are limitations, such as minimum trading volume requirements, that must be met before any earnings can be transferred from the Welcome Account to the Client’s Wallet.

An attractive feature of this deal is that even though the initial $30 deposit is non-refundable, profits can be cashed out at any time.

Tickmill Pros and Cons

The Pros of Trading with Tickmill will Include:

- ✅ Tickmill is a popular trading platform in Ivory Coast due to its low trading fees, high client satisfaction, and the availability of many convenient payment options, such as Skrill and Neteller.

- ✅ Tickmill’s features, such as the FIX API, AutoChartist, and virtual private servers, are a great match for the unique needs of professional traders in Ivory Coast.

The Cons of Trading with Tickmill may include:

- ✅ Fixed spreads are not available

What type of sign-up bonus does Tickmill offer to traders in Ivory Coast?

Traders in Ivory Coast can access the sign-up bonus from Tickmill when they sign up for the Welcome Account.

What trade features does Tickmill offer to Ivorian traders?

Some of the trading features provided by Tickmill include FIX API, AutoChartist, and virtual private servers.

How to choose the best Forex no-deposit bonus in Ivory Coast

Ivorian traders must evaluate the following components of forex no deposit bonus to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Ivorian traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirements, commissions and spreads, initial deposits, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Ivorian traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Ivorian traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Ivorian traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Ivorian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- ✅ eBooks

- ✅ Trading guides

- ✅ Trading knowledge on leveraged products

- ✅ A risk warning on complex instruments

- ✅ Educational videos

Research can include some of the following:

- ✅ Trading tools

- ✅ Commentary

- ✅ Status of International Markets

- ✅ Price movements

- ✅Market sentiments

- ✅ Whether there is a volatile market

- ✅ Exchange Rates

Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Ivory Coast

In this article, we have listed the best brokers that offer Forex sign-up bonuses to Ivorian traders. We have further identified the brokers that offer additional services and solutions to Ivorian traders.

Best MetaTrader 4 / MT4 Forex Broker

Overall, Alpari is the best MT4 Forex broker in Ivory Coast. Insiders in the forex industry hold Alpari in high regard due to its protracted history of success as a trustworthy market maker. Less than one millisecond of delay is what Alpari guarantees to its traders. Currently, more than 2 million people are utilizing Alpari.

Best MetaTrader 5 / MT5 Forex Broker

Overall, AvaTrade is the best MT5 Forex broker in the Ivory Coast. AvaTrade has established a good reputation as a trustworthy CFD and FX broker. Because it exclusively uses the most prestigious institutions in each regulatory country to hold its customers’ assets independently, AvaTrade has a strong reputation.

Best Forex Broker for beginners

Overall, eToro is the best Forex broker for beginners in Ivory Coast. Users can also access practice trading accounts, the eToro Academy, and the eToro Plus subscription membership plan to learn more about the site.

Best Low Minimum Deposit Forex Broker

Overall, Oanda is the best low minimum deposit Forex broker for traders in Ivory Coast. The cutting-edge trading platform from Oanda is useful for FX traders of all experience levels.

Best ECN Forex Broker

Overall, XM is the best ECN forex broker in the Ivory Coast. Cost, customer happiness, cash flow, and security are given top importance by XM.

Best Islamic / Swap-Free Forex Broker

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Ivory Coast. A dependable and trustworthy brokerage is Tickmill. Due to the flexibility of its account options, the cheap expenses related to those alternatives, and the low spreads, this broker is appropriate for a wide spectrum of investors. Tickmill can currently be used in a variety of settings and accessed in several languages.

Best Forex Trading App

Overall, Exness offers the best trading app for traders in Ivory Coast. Due to its numerous practical features and capabilities, the Exness Trader app can be quite helpful to traders in Ivory Coast. Technical indicators, candlestick charts, and quantitative strategies are advantageous for new traders.

Best Forex Rebates Broker

Overall, FxPro is the Best Forex Rebates Broker in the Ivory Coast. Users of the FxPro trading platform have access to STP and ECN connectivity. Retail traders can receive 30% monthly cash returns from the forex market.

Best Lowest Spread Forex Broker

Overall, Pepperstone is the best lowest spread forex broker in the Ivory Coast. Pepperstone’s spreads for trading the US dollar versus the euro start at 0.0 pip. Pepperstone Markets is one of the top brokerages due to its long history of success.

Best Nasdaq 100 Forex Broker

Overall, IG is the best Nasdaq 100 forex broker in the Ivory Coast. IG’s ascension into the top 20 platforms has been facilitated by modern trading tools, a wide range of goods, and advantageous market circumstances. By abiding by stringent guidelines and giving customers access to a wide range of assets, IG stands out from other respectable online brokers serving the Ivory Coast ma

Best Volatility 75 / VIX 75 Forex Broker

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in the Ivory Coast. Modern trading tools from IC Markets enable traders to now take part in transactions on global financial marketplaces.

Best NDD Forex Broker

Overall, BDSwiss is the best NDD forex broker in Ivory Coast. BDSwiss is a key player on the global stage when it comes to CFD and forex services. The amount of monthly foreign exchange transactions can reach €20 billion, and there are more than 16,000 affiliate accounts.

Best STP Forex Broker

Overall, OctaFX is the best STP forex broker in Ivory Coast. OctaFX has won more than 28 industry honors. OctaFX has almost halved its trading costs by implementing STP (Straight-Through-Processing) and ECN (Electronic Communication Network).

Best Sign-up Bonus Broker

Overall, HFM is the best sign-up bonus broker in Ivory Coast. Investors use HFM’s trading platform because of its high caliber and affordable fees. The HFM website offers access to a range of account types and asset markets to accommodate users with various levels of expertise in foreign currency trading.

Guide to claiming a Forex no-deposit bonus in Ivory Coast

The foreign exchange market is the largest financial market in the world, with daily transactions totaling trillions of dollars. There are a lot of ways to generate money just by speculating where one currency will go against another.

Many forex brokers use the forex no deposit bonus as one of many promotional incentives meant to entice and encourage new traders to begin trading with them.

Brokers in the foreign exchange market sometimes reward new customers with free money to use in their trading accounts. It’s effectively risk-free capital with which traders can get their feet wet.

However, getting your hands on and cashing out a forex no deposit bonus is trickier than it sounds. Here, we’ll show you just how to get your hands on that no-deposit forex bonus.

Choose a reputable broker

Obtaining a forex no-deposit bonus requires first identifying a reputable forex broker that provides such bonuses. While there is no shortage of brokers available, not all of them can be relied upon.

It is crucial to conduct one’s homework and select a reliable broker who is supervised by a credible financial regulator. Research their reputation, star rating, and bonus terms and conditions.

Sign up for an account

Finding a trustworthy forex broker is the first step towards opening an account with them. The account opening procedure with most brokers is quick, easy, and painless.

In most cases, you’ll need to provide some identifying data before proceeding. A copy of your government-issued photo identification may also be requested by some brokers.

Complete the verification process

You will need to authenticate your account with the broker after opening an account. This verification process is essential in determining that you are not a fraudster.

Providing further documentation, like a utility bill or a bank statement, to verify your residence is standard procedure. It’s not uncommon for brokers to ask for a selfie with the client uploading an ID as further proof of identity.

Claim your sign-up bonus

You can get your Forex no-deposit bonus after you verify your account. The incentive is offered and redeemed in a variety of ways by various brokers. If you register an account with a broker and pass their verification process, you may be eligible for a bonus.

However, some brokers may ask you to follow a special link or input a special code to receive the bonus. To receive the bonus, follow the broker’s instructions exactly.

Start trading and make sure you follow the bonus conditions

You can immediately put the bonus money to use in trading. The Forex no-deposit bonus is not cashable right away, so bear that in mind. To cash out the bonus and any profits gained from it, brokers typically require you to fulfill several requirements.

Typical terms include a minimum trading volume, a maximum trading period, and occasionally other trading restrictions. To avoid any confusion, please read the bonus terms and conditions carefully.

Withdraw your trading profits

After finishing the bonus requirements, you can cash out your earnings. Typically, you’ll either submit a withdrawal request through your trading account or get in touch with your broker’s customer care to initiate a withdrawal.

For safety reasons, certain brokers may insist on a minimum deposit or additional documentation before approving a withdrawal.

Finally, a forex no deposit bonus might be a fantastic way to get started trading forex without having to risk any of your own money. However, pick a trustworthy broker and study the fine print of any bonuses you may be offered.

Understanding how No Deposit Bonuses work

Forex brokers sometimes offer no-deposit bonuses as an enticement for prospective traders to open an account with them. Deposits are not necessary to receive these bonuses, which are given to new traders as a gesture of goodwill. The trader can utilize the bonus money to try out the broker’s trading platform, with the hopes of eventually placing a deposit.

Forex brokers offering no-deposit bonuses to new customers is a common marketing strategy. Traders can try out a broker’s platform and trading conditions without risking their own money thanks to these bonuses, which might take the shape of cash, demo accounts, or other incentives.

With a Forex no-deposit bonus, a trader can test out a new Forex broker’s trading platform without risking any of their own money.

In Conclusion

Overall, in terms of no-deposit bonus brokers the Forex trading environment in Ivory Coast is dynamic and promising. These bonuses have become a critical recruitment tool for brokers, allowing potential clients to try out the market with no financial risk.

Frequently Asked Questions

Can I withdraw a Forex no-deposit bonus?

Some brokers may also set restrictions on the maximum trading volume permitted while a no-deposit incentive is active. The bonus money is frequently non-cashable; only the linked profits can be taken. To unlock the bonus-related earnings, you must, of course, trade with your funds.

Are there certain criteria to receive a Forex no-deposit bonus?

Typically the bonus criteria apply to withdrawing the profits or the bonus itself, such as trade volume.

Are Forex no deposit bonuses worth it?

Forex no deposit bonus is a good way to start practicing trading in a live market environment without risking your own money. However, such a bonus should only be accepted by a regulated Forex broker to ensure your trading activity is secure.

Is a Forex no-deposit bonus safe?

It is safe to use a Forex no-deposit bonus but only from a regulated Forex broker. If you choose to use a bonus from an unregulated broker there are no safeguards against financial fraud or from signing up with a potential scam broker.

Why do Forex brokers give a no-deposit bonus?

Forex brokers offer no deposit bonuses as a reward to new traders who open an account with them. These bonuses also provide an incentive for new traders to sign up with the broker. As such, traders should check on the bonus conditions before deciding whether to use it.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Ivory Coast

Scam Forex Brokers in Ivory Coast