Overall, Tickmill can be summarised as a trustworthy and highly regulated Forex Broker that is very competitive in terms of its trading fees. Tickmill offers an easy-to-use social copy trading platform with excellent customer support. Tickmill offers three different retail trading accounts: a Pro Account, Classic Account, and VIP Account. Tickmill has a trust score of 83 out of 99.

| 🧑⚖️Order Execution | 4/5 |

| 💵Commissions and Fees | 4/5 |

| 📈Range of Markets | 3/5 |

| 📊Variety of Markets | 4/5 |

| ⏱️Withdrawal Speed | 3/5 |

| 👩👧👧Customer Support | 3/5 |

| 📉Trading Platform | 4/5 |

| 🎓Education | 4/5 |

Tickmill Review – Analysis of Brokers’s Main Features

- ☑️ Tickmill Overview

- ☑️ Tickmill Detailed Summary

- ☑️ Tickmill – Advantages over Competitors

- ☑️ Who will Benefit from Trading with Tickmill?

- ☑️ Tickmill Safety and Security

- ☑️ Tickmill Bonuses and Promotions

- ☑️ Tickmill Affiliate Program Features

- ☑️ Tickmill Account Types and Features

- ☑️ Tickmill Base Account Currencies and Basic Order Types

- ☑️ Tickmill – Slippage and Requote Policy

- ☑️ How to Open and Close an Tickmill Account

- ☑️ Tickmill Trading Platforms

- ☑️ Which Markets Can You Trade with Tickmill?

- ☑️ Tickmill Fees, Spreads, and Commissions

- ☑️ Tickmill Deposits and Withdrawals

- ☑️ Tickmill Education and Research

- ☑️ Tickmill Customer Support

- ☑️ Tickmill VPS Review

- ☑️ Tickmill Corporate Social Responsibility

- ☑️ Tickmill Trading Signals

- ☑️ Tickmill Cashback Rebates Features and Conditions

- ☑️ Tickmill Web Traffic Report

- ☑️ Tickmill Geographic Reach and Limitations

- ☑️ Tickmill vs InstaForex vs FXTM – A Comparison

- ☑️ Tickmill Alternatives

- ☑️ Tickmill Awards and Recognition

- ☑️ Recommendations according to our in-depth review of Tickmill

- ☑️ Tickmill Customer Reviews

- ☑️ Pros and Cons of Trading with Tickmill

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Tickmill Overview

Tickmill is a well-established, FSA Regulated Forex Broker that offers access to ultra-fast execution, superior trading conditions, and dedicated customer support. Tickmill’s asset classes include Forex (60+ currency pairs), Stock Indices (15+ Indices), Commodities and Cryptos.

Tickmill traders can choose between multiple account types (Classic, Pro, etc.) with the MetaTrader Suit at their disposal. Additionally, Tickmill offers access to a $30 USD Welcome Account.

Tickmill Detailed Summary

| Broker | Tickmill |

| 🏦Headquartered | London, United Kingdom |

| 🌎Global Offices | Cyprus, South Africa, Seychelles, Malaysia |

| ➡️Local Market Regulator in Ivory Coast | Banking Commission of the West African Economic Monetary Union (WAEMU) |

| 📌Foreign Direct Investment in Ivory Coast | 1.4 billion USD (2021) |

| 💷Foreign Exchange Reserves in Ivory Coast | 2.5 million USD (April 2024) |

| 🏪Local office in Yamoussoukro | None |

| 👤Governor of SEC in Ivory Coast | None |

| ✔️Accepts Ivory Coast Traders? | ✅ Yes |

| 🔢Year Founded | 2015 |

| ☎️Ivory Coast Office Contact Number | None |

| 💻Social Media Platforms | Facebook YouTube Telegram |

| 📈Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 🥉Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 🥈Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) Financial Sector Conduct Authority (FSCA) Dubai Financial Services Authority (DFSA) |

| 🥇Tier-3 Licenses | Financial Services Authority (FSA) Financial Services Authority Labuan (LFSA) |

| 🔢License Number | Seychelles – SD008 United Kingdom – 71720 Cyprus – 278/15 Labuan – MB/18/0028 South Africa – FSP 49464 Dubai – F007663 |

| 🖋️Registrations | Germany – BaFin ID 10146511 Spain – 4082 France – 75473 Italy – 4082 |

| ☑️Banking Commission of WAEMU Regulation | None |

| ✴️Regional Restrictions | The United States |

| ☪️Islamic Account | ✅ Yes |

| 🗂️Demo Account | ✅ Yes |

| 👉Non-expiring Demo | ✅ Yes |

| ⏰Demo Duration | Unlimited |

| 🚩Retail Investor Accounts | 3 |

| 🔖PAMM Accounts | MAM Accounts |

| ➡️Liquidity Providers | Barclays and other top-tier banks, as well as hedge funds |

| 🤝Affiliate Program | ✅ Yes |

| 🧑⚖️Order Execution | Market |

| ✏️OCO Orders | None |

| 🖥️One-Click Trading | ✅ Yes |

| ↘️Scalping | ✅ Yes |

| 🗝️Hedging | ✅ Yes |

| 🗣️Expert Advisors | ✅ Yes |

| 📰News Trading | ✅ Yes |

| 🏷️Trading API | ✅ Yes |

| 📝Starting spread | From 0.0 pips |

| 💵Minimum Commission per Trade | $1 per side, per standard lot traded |

| 💰Decimal Pricing | 5th decimal pricing after the comma |

| 🏷️Margin Call | 100% |

| 🛑Stop-Out | 30% |

| ⬇️Minimum Trade Size | 0.01 lots |

| ⬆️Maximum Trade Size | 100 lots |

| ☑️Crypto trading offered? | ✅ Yes |

| ✅Offers an XAF Account? | None |

| 👤Dedicated Ivory Coast Account Manager? | None |

| 📈Maximum Leverage | 1:500 |

| 📉Leverage Restrictions? | None |

| 💴Minimum Deposit (XAF) | 60,000 XAF ($100) |

| € Deposit Currencies | USD, GBP, EUR, IDR, CNY, VND, RUB |

| 💡Are XAF Deposits Allowed? | None |

| 💷Account Base Currency | USD, EUR, GBP, PLN |

| ✔️Active Ivory Coast Trader Stats | Unknown |

| 👥Active Tickmill customers | 668,000+ |

| 👩👧👧Active Tickmill customers in Ivory Coast | Unknown |

| 💸Ivory Coast Daily Forex Turnover | $5 trillion+ (Overall Forex Globally) |

| 💳Deposit and Withdrawal Options | Bank Transfer Crypto Payments Debit Card Credit Card Skrill Neteller Dotpay PayPal Trustly Sticpay FasaPay UnionPay WebMoney Sofort Rapid (by Skrill) |

| ⏲️Minimum Withdrawal Time | 1 Business Day |

| 🕰️Maximum Estimated Withdrawal Time | 2 to 7 Business Days |

| 💵Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🗂️Segregated Accounts? | ✅ Yes |

| ⚠️Segregated Accounts in Ivory Coast? | None |

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 Tickmill Mobile App |

| ⌚Trading Platform Time | UTC +02:00 |

| 🧐Observe DST Change | ✅ Yes |

| ⏱️DST Change Time zone | New York Time |

| 💍Tradable Assets | Forex Stock Indices Energy Indices Precious Metals Bonds Cryptocurrencies Stocks |

| $ Tickmill USD/XAF Forex Pair? | None |

| 📊Are local Stocks and CFDs offered? | None |

| 🗣️Languages supported on the Website | English, Indonesian, Russian, Arabic, Italian, Thai, Vietnamese, German, Chinese (Simplified), Spanish, Polish, Korean, Malay, Portuguese |

| 👥Customer Support Languages | Multilingual |

| 📝Copy Trading Support | Yes, Myfxbook |

| 🕰️Customer Service Hours | 24/5 |

| 👩👧👧Customer Support in Ivory Coast? | None |

| 🎁Bonuses and Promotions for Traders? | ✅ Yes |

| 🎓Education for beginners | ✅ Yes |

| 💻Proprietary trading software | ✅ Yes, App |

| ✔️Most Successful Ivory Coast Trader | Unknown |

| ☑️Is Tickmill a safe broker for traders? | ✅ Yes |

| 🔢Rating for Tickmill in Ivory Coast | 9/10 |

| 💯Trust score for Tickmill in Ivory Coast | 83% |

Tickmill – Advantages over Competitors

Tickmill has the following notable advantages over competitors:

- ✅ Regulation: Tickmill is regulated in one tier-1 jurisdiction (UK’s FCA) and three tier-2 jurisdictions, providing high safety and security for traders.

- ✅ Access to MetaTrader suite: Tickmill offers access to the full suite of MetaTrader platforms, including MetaTrader 4 and MetaTrader 5, along with various platform add-ons. This positions Tickmill favourably among brokers using MetaTrader.

- ✅ Competitive pricing: Tickmill’s Pro and VIP accounts offer highly competitive pricing, making it attractive for traders looking for cost-effective trading options.

- ✅ Futures and options trading: Tickmill provides access to the CQG and AgenaTrader platforms, allowing traders to trade futures and options alongside forex and CFD trading.

- ✅ Professional trading features: Tickmill is known for catering to professional traders, offering a solid choice of platforms and trading tools suitable for their needs.

- ✅ Educational resources: Tickmill offers educational resources from the CME, interactive sentiment data, and website widgets from Acuity Trading, providing valuable research and insights for traders.

- ✅ TradingView platform: Tickmill supports the popular TradingView platform, which offers advanced charting and technical analysis tools.

Finally, Tickmill recently introduced Signal Centre, powered by Acuity Trading, providing traders with actionable trading signals and research to enhance their decision-making process.

Who will Benefit from Trading with Tickmill?

- ✅ Forex traders: Tickmill is particularly recommended for forex trading due to its low fees. The broker’s regulatory status adds an important layer of safety for forex traders.

- ✅ Low-cost traders: Tickmill is recognised as a low-cost forex and CFD broker, making it suitable for traders conscious of transaction costs.

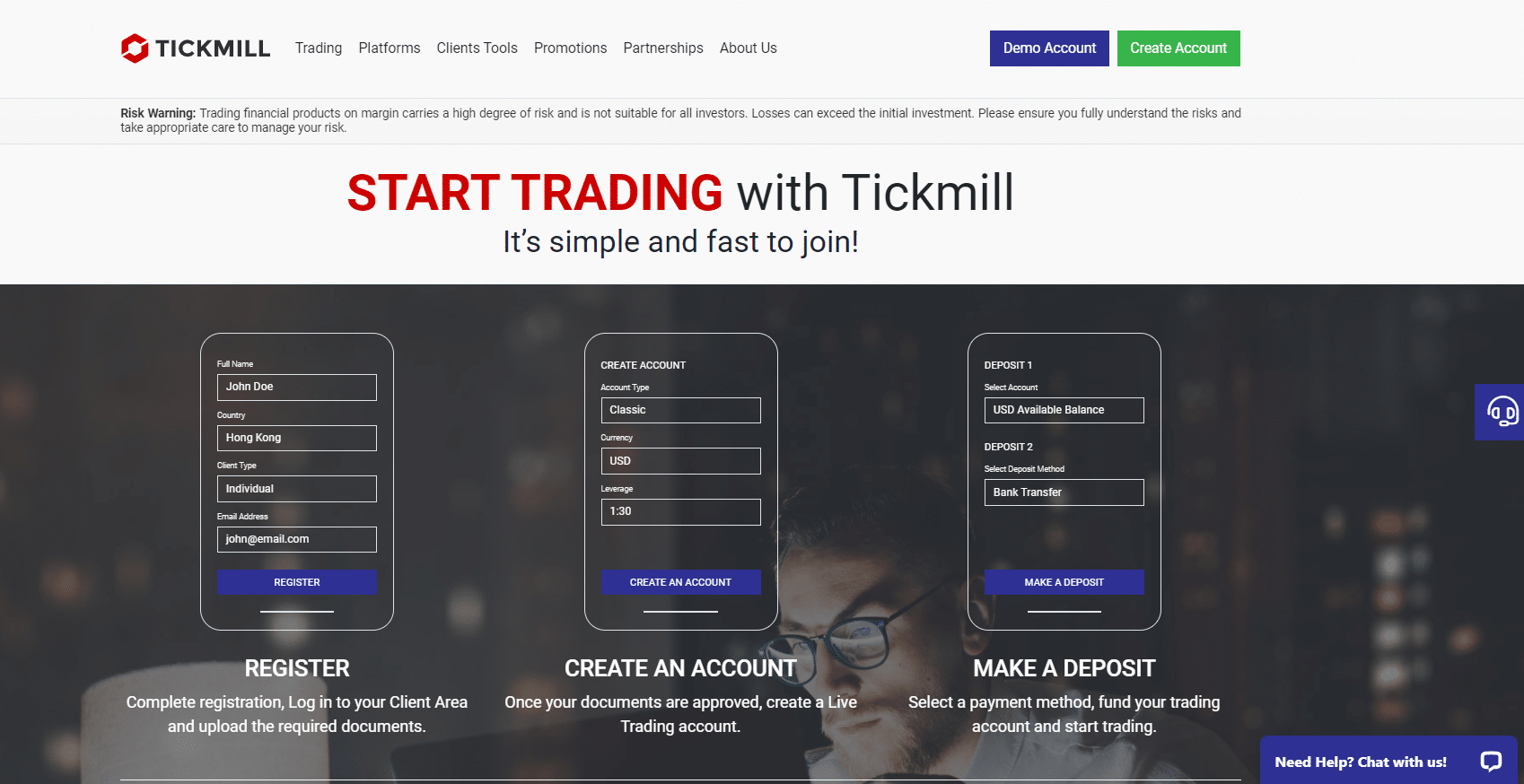

- ✅ Digital account opening experience: Tickmill offers a fast, easy, and fully digital account opening process, appealing to those who prefer a seamless and convenient onboarding experience.

- ✅ Commission-free deposits and withdrawals: Tickmill provides multiple free options for deposit and withdrawal, making it convenient for traders to manage their funds without incurring additional costs.

Tickmill Safety and Security

Tickmill Regulations in Ivory Coast

Tickmill is not currently regulated by the Banking Commission of the West African Economic Monetary Union (WAEMU). However, per the table in the following section, Tickmill is well-regulated by several reputable market regulators in other countries.

Tickmill Global Regulations

| 🖋️ Registered Entity | 🌎 Country of Registration | 🔢 Registration Number | 🔍 Regulatory Entity | 🏅 Tier | 💯 License Number/Ref |

| ✴️Tickmill UK Ltd. | United Kingdom | 09592225 | FCA | 1 | 71720 |

| ☑️Tickmill Europe Ltd | Cyprus | 340249 | CySEC | 2 | 278/15 |

| 🎖️Tickmill South Africa (Pty) Ltd. | South Africa | 2017/531268/07 | FSCA | 2 | FSP 49464 |

| ➡️Tickmill Ltd. | Seychelles | N/A | FSA | 3 | SD008 |

| 📌Tickmill Asia Ltd. | Labuan | N/A | LFSA | 3 | MB/18/0028 |

| 🚩Tickmill UK Ltd. | Dubai | N/A | DFSA | 2 | F007663 |

How Tickmill Protects Ivory Coast Traders and Client Funds

| 🔍 Security Measure | ℹ️ Information |

| 🗂️Segregated Accounts | ✅ Yes |

| 👤Compensation Fund Member | ✅ Yes, FSCS and ICF |

| 💵Compensation Amount | FSCS - £85,000 ICF – 20,000 EUR |

| 📝SSL Certificate | None |

| 📈2FA (Where Applicable) | None |

| ⛔Privacy Policy in Place | ✅ Yes |

| ⚠️Risk Warning Provided | ✅ Yes |

| ❌Negative Balance Protection | ✅ Yes |

| 🛑Guaranteed Stop-Loss Orders | None |

Security while Trading

When trading with Tickmill, Ivory Coast traders can benefit from the relatively high level of security the broker provides. Tickmill is a well-regulated broker with regulatory oversight from one tier-1 and three tier-2 jurisdictions.

This regulatory framework helps ensure the broker operates per established standards and practices, protecting traders.

One of the notable regulatory authorities overseeing Tickmill is the UK’s Financial Conduct Authority (FCA), a top-tier financial regulator.

The FCA is known for its stringent regulatory requirements and strong enforcement actions, making its oversight an important factor in enhancing the broker’s security. Traders from Ivory Coast can find reassurance in Tickmill’s FCA regulation, as it adds a layer of safety to their trading activities.

It is important to note that regulatory oversight does not guarantee absolute security but significantly reduces the risk of trading forex and CFDs.

Tickmill’s compliance with regulatory requirements indicates that they meet certain standards related to financial stability, client fund segregation, risk management, and operational procedures.

In addition to regulatory oversight, Tickmill offers certain measures to enhance the security of traders. They provide compensation in case of broker bankruptcy, which can help protect clients’ funds in such unfortunate circumstances.

However, reviewing this compensation policy’s terms and conditions is important to understand its coverage and limitations.

Tickmill also offers negative balance protection, meaning traders cannot lose more than their account balance even in highly volatile market conditions. This protection helps safeguard traders from potential losses exceeding their deposited funds.

However, it is essential to carefully review the terms and conditions of this protection to understand its scope and any applicable conditions.

While Tickmill provides regulatory oversight and certain security measures, Ivory Coast traders must be mindful of their responsibilities.

Traders should practice prudent risk management, carefully review the broker’s terms and conditions, and understand the risks of forex and CFD trading.

In our experience, by adopting a cautious approach and being well-informed, traders can make the most of the security measures provided by Tickmill while trading.

Pros and Cons Regulation and Safety of Funds

| ✅ Pros | ❎ Cons |

| Traders can expect client fund security with Tickmill as it is regulated by top entities worldwide | Local entities in the Ivory Coast do not currently regulate Tickmill |

Tickmill Bonuses and Promotions

Tickmill currently offers the following bonuses:

- ✅ Trader of the Month:

- Tickmill recognises and rewards the top-performing trader each month with a $1,000 prize.

- The winner is chosen based on profitability, money management skills, and risk management.

- Participation is automatic for live account holders.

- ✅ Welcome Account Bonus:

- New customers can register for a Welcome Account on the Tickmill website to receive a bonus.

- Upon registration, the bonus is automatically credited to the trading account and can be used for trading purposes.

- Conditions apply, including the bonus being available once per client and withdrawal limits for profits (minimum $30, maximum $100).

- Hedging is prohibited.

Tickmill Affiliate Program Features

Tickmill’s affiliate program offers various advantages and features for its partners:

- ✅ Referral Earnings: As an affiliate, you can earn $10 for each regular account transaction and $2 for each Pro or VIP account transaction when you refer a new client to Tickmill.

- ✅ Additional Commission: If you recommend your referral to sign up for a Pro account, you can earn an additional 5% commission on their trading activity.

- ✅ IB Room Access: All partners gain access to the IB Room, which provides comprehensive fund and account administration features. This allows you to manage your affiliate activities and monitor your earnings efficiently.

- ✅ Advertising and Promotional Materials: Tickmill provides pre-made advertising and promotional materials to assist you in attracting new clients. These materials help you effectively promote Tickmill’s services and features to your audience.

By participating in Tickmill’s affiliate program, you can earn referral earnings, and additional commission, access the IB Room, and utilise marketing materials to support your affiliate activities.

How to open an Affiliate Account with Tickmill

To register an Affiliate Account, Ivory Coasts can follow these steps:

- ✅ Visit the Tickmill website and select your preferred jurisdiction from the drop-down menu. Seychelles, South Africa, the United Kingdom, Malaysia, and Cyprus are available options.

- ✅ On the webpage, hover over the “Partnership” option in the menu and choose “Introducing Broker” from the dropdown.

- ✅ Review the details of Tickmill’s affiliate program provided on the webpage. Familiarise yourself with the program’s features and requirements.

- ✅ If you decide to join the affiliate program, click on the option to join or sign up.

- ✅ Fill in the required fields on the application form. Provide accurate personal information and details about your skills and experience as requested.

- ✅ Complete the registration process for the Tickmill website’s Client Area. This will involve creating a username and password for your account.

- ✅ To finalise your profile, submit a confirmation of your identification and address as required by Tickmill. This step is necessary to verify your identity and comply with regulatory requirements.

- ✅ Once your profile is complete and verified, log in to the IB Room. This is where you will activate your affiliate account and gain access to Tickmill’s complete content for recruiting and recommending clients.

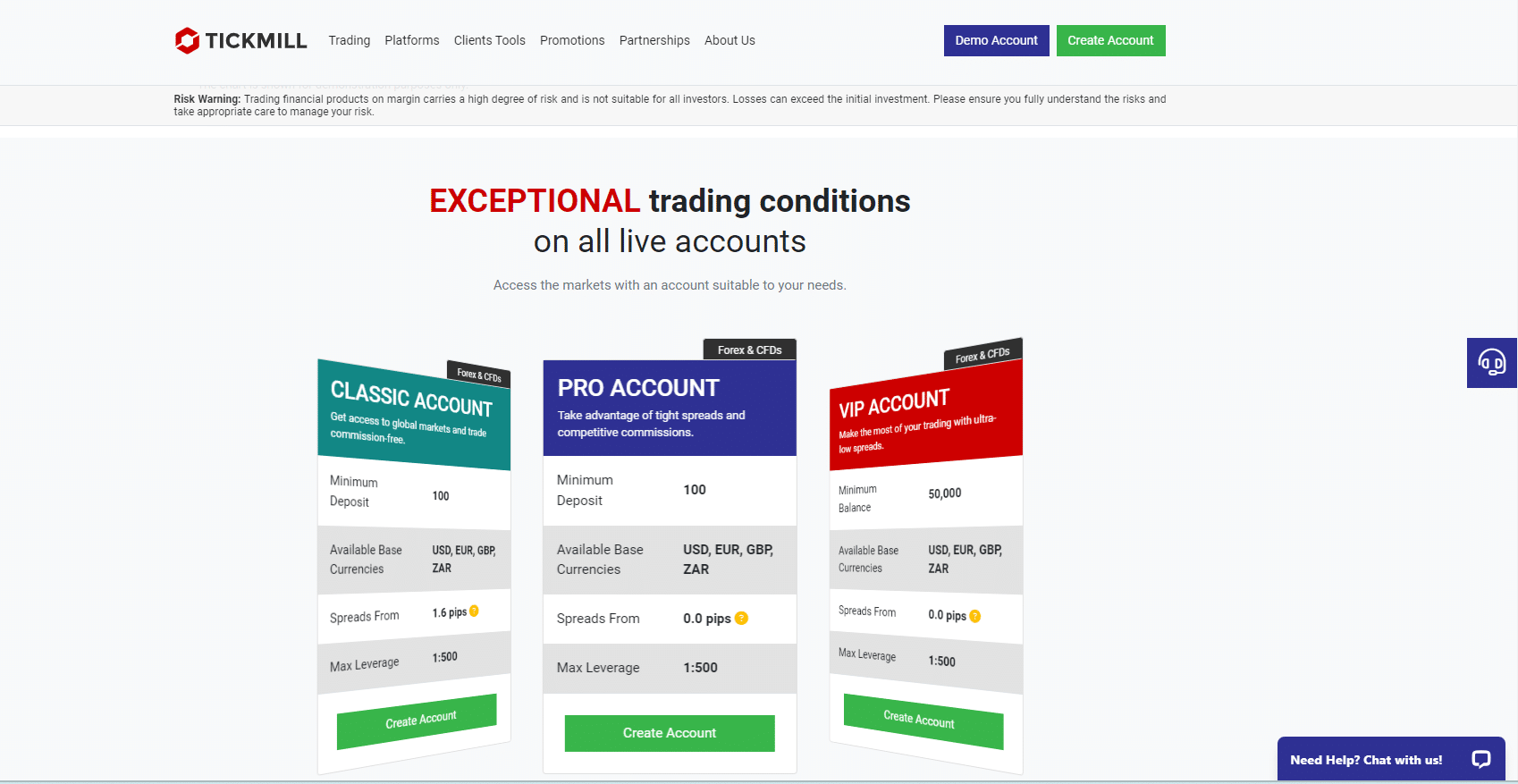

Tickmill Account Types and Features

| 📌 Live Account | 💵 Minimum Dep. | ⏱️ Average Spread | 💷 Commissions | 💶 Average Trading Cost |

| 🥇Pro Account | 60,000 XAF / $100 | 0.0 pips | $4 per lot | 4 USD |

| 🥈Classic Account | 60,000 XAF / $100 | 1.6 pips | None | 16 USD |

| 🥉VIP Account | 30.2 million XAF / $50,000 | 0.0 pips | $2 per lot | 2 USD |

Tickmill Live Trading Account Details

Pro Account

Tickmill’s Pro account is highly recommended for Ivory Coast investors seeking competitive pricing, especially for trading specific forex pairs. This account offers the following features:

| 🔍 Account Feature | 💵 Value |

| 💷Minimum Deposit | 60,000 XAF / $100 |

| ⬇️Minimum Account Balance | None |

| 📌Base Currency Options | USD EUR GBP PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📝Spreads From | 0.0 pips |

| ⬆️Maximum Leverage Ratio | Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) Cyprus: 1:30 (Retail), 1:300 (Pro) Malaysia: 1:500 South Africa: 1:500 |

| ⬇️Minimum Lots that can be traded | 0.01 lots |

| 💴Commission charges | $2 per side per standard lot of 100,000 |

| ✔️Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️Swap-Free Islamic Account Option | ✅ Yes |

Classic Account

The Tickmill Classic account is suitable for entry-level investors in Ivory Coast, providing a straightforward trading experience without additional commissions. The account features include the following:

| 🔍 Account Feature | 💵 Value |

| 💷Minimum Deposit | 60,000 XAF / $100 |

| ⬇️Minimum Account Balance | None |

| 📌Base Currency Options | USD EUR GBP PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📝Spreads From | 1.6 pips |

| ⬆️Maximum Leverage Ratio | Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) Cyprus: 1:30 (Retail), 1:300 (Pro) Malaysia: 1:500 South Africa: 1:500 |

| ⬇️Minimum Lots that can be traded | 0.01 lots |

| 💴Commission charges | None |

| ✔️Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️Swap-Free Islamic Account Option | ✅ Yes |

VIP Account

The Tickmill VIP account offers the most competitive pricing available from the broker and is suitable for professional investors. The account features include the following:

| 🔍 Account Feature | 💵 Value |

| 💷Minimum Deposit | 30.2 million XAF / $50,000 |

| ⬇️Minimum Account Balance | $50,000 |

| 📌Base Currency Options | USD EUR GBP PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📝Spreads From | 0.0 pips |

| ⬆️Maximum Leverage Ratio | Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) Cyprus: 1:30 (Retail), 1:300 (Pro) Malaysia: 1:500 South Africa: 1:500 |

| ⬇️Minimum Lots that can be traded | 0.01 lots |

| 💴Commission charges | $1 per side per standard lot of 100,000 |

| ✔️Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️Swap-Free Islamic Account Option | ✅ Yes |

Tickmill Demo Account

Tickmill’s demo account allows Ivory Coast traders to compare the broker’s product offerings and trading conditions with its competitors. Key features of the demo account include:

- ✅ A realistic simulation of a live account trading environment.

- ✅ Safe and risk-free practice for new traders.

- ✅ Non-expiring accounts allow traders to test account types, pricing options, and financial instruments without real risk.

Tickmill Islamic Account

Muslim clients who open Classic, Pro, or VIP accounts with Tickmill can convert their accounts to Islamic accounts, offering the best trading conditions. Key features of the Islamic account include:

- ✅ Identical terms and conditions to conventional accounts except for the absence of swaps.

- ✅ Once Tickmill’s Customer Support staff processes the request for an Islamic account status, traders will receive an email confirmation.

- ✅ Subsequently, all future trading accounts will automatically be categorised as swap-free, eliminating the need for further contact with Tickmill.

It is important to note that holding certain complex instruments overnight for more than three consecutive nights may incur a handling cost. Traders should review the terms and conditions of the Islamic account to understand the specific details and any applicable fees.

Tickmill Professional Account

Tickmill does not provide any professional account other than the one included in the retail accounts. Traders should refer to the Pro and VIP account types for professional trading features and benefits.

Pros and Cons Tickmill Account Types and Features

| ✅ Pros | ❎ Cons |

| Tickmill offers three flexible account types | The Classic Account features expensive spreads that might not be suitable for beginner traders |

| Traders can register a demo account to practice trading, test strategies, and more | There are commissions charged on positions held for more than 3 days on the Islamic Account |

Tickmill Base Account Currencies and Basic Order Types

Tickmill Base Account Currencies

Tickmill offers base currency options of USD, EUR, GBP, and PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.). However, it is unfortunate that Tickmill does not offer a trading account denominated in XAF (Central African CFA franc).

This limitation may disappoint Ivory Coast traders with XAF bank accounts, as other international brokers often provide a wider range of services and account currency options.

Traders using Tickmill from Ivory Coast may need to convert their local currency to one of the available base currencies, which can result in additional fees and potentially impact overall trading expenses and profitability.

Therefore, traders are urged to consider the currency conversion costs and evaluate their requirements before choosing Tickmill as their preferred broker.

Tickmill Basic Order Types

Tickmill’s basic order types are as follows:

- ✅ Market Orders

- ✅ Pending Orders

- ✅ Take Profit

- ✅ Stop-Loss Orders

Market Orders

A Market Order is a request to buy or sell a Contract for Difference (CFD) at the prevailing market price as promptly as possible, opening a trade position. CFDs are purchased at the ASK price and sold at the BID price.

Furthermore, with Tickmill, Market Orders are available for all accounts. In addition, Market Orders can be accompanied by Stop Loss and Take Profit Orders.

Pending Orders

Pending Orders are requests to buy or sell a CFD at a pre-defined price in the future once a certain price is reached. Tickmill offers four Pending Orders: Buy Limit, Buy Stop, Sell Limit, and Sell Stop.

These orders are executed when the price reaches the specified level. However, executing at the requested price may be impossible under certain trading conditions. Tickmill can execute the order at the first available price in such cases.

Stop Loss and Take Profit Orders can be attached to a Pending Order and are valid until cancelled. In addition, Pending Orders are available for all accounts with Tickmill.

Take Profit

Take Profit Orders are intended to secure profit when the price of a CFD reaches a specific level. The execution of this order results in the complete closure of the entire position and is always connected to an open, market, or pending order.

In addition, the Tickmill platform checks long positions with the BID price and short positions with the ASK price to determine if the provisions of the Take Profit Order have been met.

Stop-Loss Orders

Stop-Loss Orders are used to minimise losses if the price of a CFD begins to move in an unprofitable direction. If the price of the CFD reaches the Stop-Loss level, the entire position will be automatically closed.

Stop-Loss Orders are always connected to an open, market, or pending order. The Tickmill platform checks long positions with the BID price and short positions with the ASK price to determine if the provisions of the Stop-Loss Order have been met.

Tickmill – Slippage and Requote Policy

Tickmill acknowledges the possibility of slippage, which refers to the difference between the expected price of a trade and the actual price at which it is executed. To manage slippage, Tickmill has implemented policies to address this potential issue.

According to Tickmill’s policies, the broker reserves the right to adjust the price at which a trade is executed to either the price at which Tickmill hedged the trade or the historically correct market price. This adjustment helps mitigate the impact of slippage on traders’ positions.

Regarding requotes, Tickmill’s client agreement does not explicitly mention this term. However, the document states that Tickmill has the authority to change the execution price of a client’s order to the market value at the time the order was received.

This can be interpreted as requoting, where the broker adjusts the execution price to reflect the current market conditions. Traders must know this possibility and understand its potential impact on their trading experience.

Overall, Tickmill acknowledges the existence of slippage and has policies to manage it.

While the client agreement does not explicitly mention requotes, the provision that allows Tickmill to change the execution price to the market value at the time of order reception can be seen as a form of requoting.

Traders should review Tickmill’s policies and client agreement to understand how slippage and potential requotes may affect their trading activities with the broker.

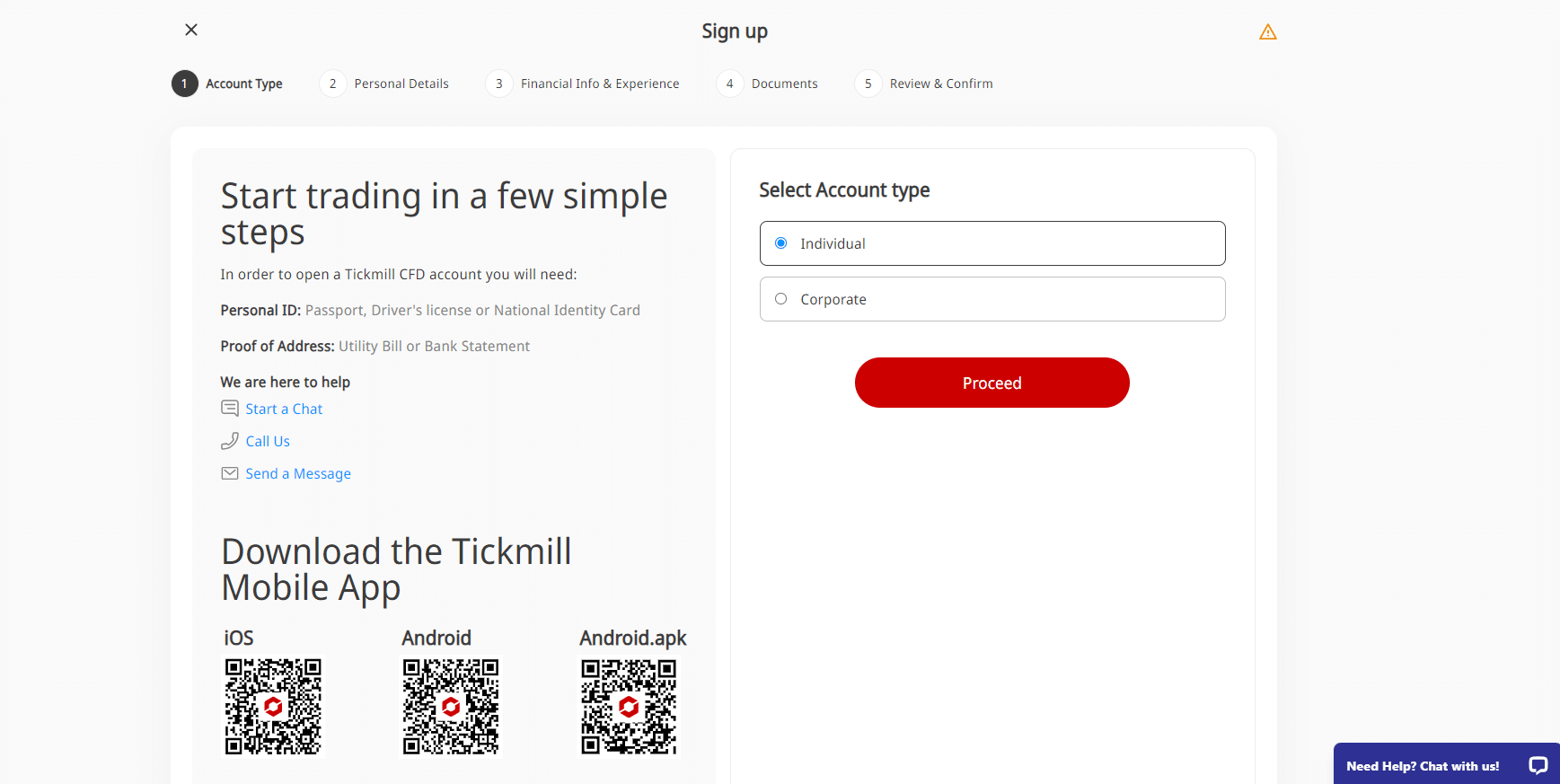

How to Open and Close an Tickmill Account

How to open an Account with Tickmill

To register an account with Tickmill, Ivory Coast, traders can follow these easy steps:

- ✅ Visit Tickmill’s official website.

- ✅ Look for the “Open an Account” button on the homepage.

- ✅ Click on the button to proceed to a new page, where you must provide your personal information, including your full name, email address, phone number, and country of residence.

- ✅ Complete the additional sections regarding your employment status, financial situation, and trading experience.

- ✅ Read and agree to Tickmill’s terms and conditions.

- ✅ Tickmill will require you to verify your identity and address as part of the standard regulatory process to prevent fraud and money laundering. You must upload a copy of your identity document (such as a passport or driver’s license) and a recent utility bill or bank statement displaying your full name and address.

- ✅ Once Tickmill verifies your documents, your account will be activated, and you can proceed to make a deposit and start trading.

How to close My Account with Tickmill

To close a live trading account with Tickmill, Ivory Coast, traders can follow these steps:

- ✅ Log in to your Tickmill account.

- ✅ Ensure that all your positions are closed and no remaining funds are in your account. If any funds are remaining, you will need to withdraw them.

- ✅ Contact Tickmill’s customer service via email, live chat, or phone and inform them of your intention to close your account. They may request email confirmation for security purposes.

- ✅ After processing your request, you will receive confirmation that your account has been closed.

Tickmill Trading Platforms

Tickmill MAM / PAMM Features

Tickmill offers a Multi-Account Manager (MAM) feature through the MT4 Multiterminal platform. This feature caters specifically to money managers using the MetaTrader 4 platform and benefits professionals managing multiple accounts.

With the MAM feature, money managers can efficiently execute block orders with a single click from the master account, and the orders will be automatically distributed to sub-accounts in real-time.

MetaTrader 4

MetaTrader 4 (MT4) is a widely recognised and widely used trading platform that has gained a reputation as the industry’s premier platform. Known for its reliability and popularity among traders, MT4 offers a user-friendly environment and an intuitive interface.

The platform provides essential tools and resources for effective online trading, including fast execution speeds, a wide range of charting tools, algorithmic trading capabilities, and extensive customization options.

Tickmill offers the base version of MT4 with the option to upgrade to additional features for an additional fee.

While MT4 allows for extensive customization, some users may find the interface outdated, and certain functions may require more effort to discover. MT4 supports standard order types such as Market, Limit, Stop, and Trailing Stop.

MetaTrader 5

MetaTrader 5 (MT5) is the successor to MT4 and offers advanced features for experienced traders. Released in 2010, MT5 is a powerful platform known for its enhanced back-testing capabilities for automated trading algorithms.

It includes built-in features such as a news feed, a market depth indicator, an economic calendar, and the ability to trade directly from charts. Tickmill supports the regular version of MT5 without access to additional versions or functionality.

However, the addition of MT5 to Tickmill’s platform offerings allows the broker to expand its asset offerings and meet the demands of experienced traders who seek sophisticated trading tools and capabilities.

Tickmill App

The Tickmill App is a mobile application that allows traders to stay connected and control their trading activities while on the go. The app provides seamless account and fund administration, enabling easy access to various account features and functionality.

Traders can quickly log in using fingerprint or face recognition and perform essential tasks such as depositing and withdrawing funds, checking real-time account balances and equity, and monitoring their trading positions.

The app also allows users to handle their live trading accounts, including account management tasks, paperwork management, and accessing live chat support. Furthermore, its user-friendly design makes account and fund administration accessible and convenient from mobile devices.

Pros and Cons Tickmill Trading Platforms

| ✅ Pros | ❎ Cons |

| Traders can choose freely between MetaTrader 4 and 5 on all three account types | The Tickmill App is not innovative and has no trading functions |

Which Markets Can You Trade with Tickmill?

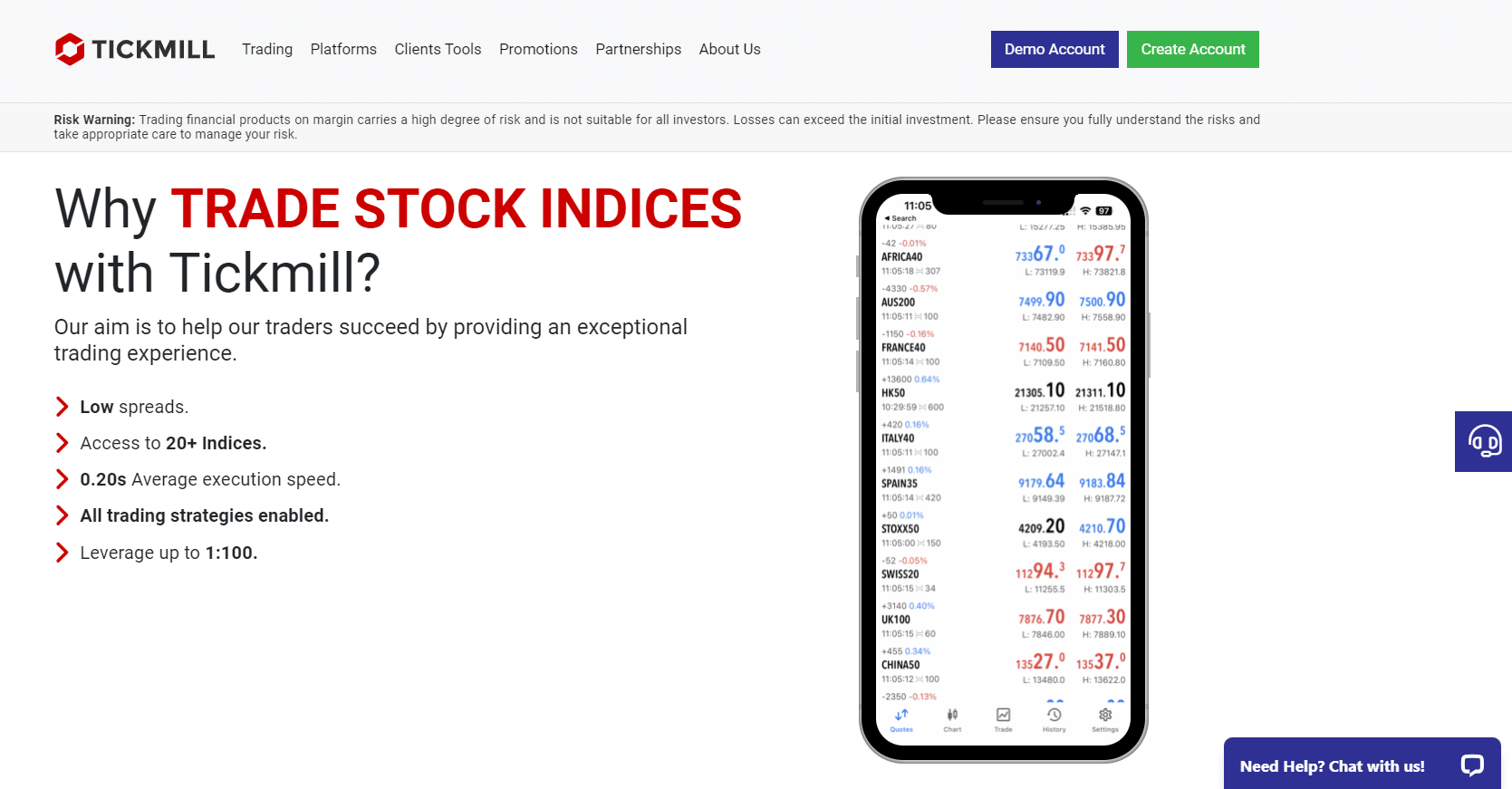

Ivory Coast traders can expect the following range of markets from Tickmill:

- ✅ Forex

- ✅ Stock Indices

- ✅ Energies

- ✅ Precious Metals

- ✅ Bonds

- ✅ Cryptocurrencies

Financial Instruments and Leverage offered by Tickmill

| 🔍 Instrument | 🔢 Number of Assets Offered | ⬆️ Max Leverage Offered |

| 🥇Forex | 62 | FCA, CySEC: 1:30 FSA, LFSA, FSCA: 1:500 |

| 💍Precious Metals | 4 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:500 |

| 🥈Indices | 23 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:100 |

| 📊Stocks | 98 | FCA, CySEC: 1:20 FSA, LFSA, FSCA: 1:20 |

| 💰Cryptocurrency | 8 | FCA, CySEC: 1:200 FSA, LFSA, FSCA: 1:200 |

| 🛢️Energies | 3 | FCA, CySEC: 1:10 FSA, LFSA, FSCA: 1:100 |

| 🥉Bonds | 4 | FCA, CySEC: 1:5 FSA, LFSA, FSCA: 1:100 |

Pros and Cons Tickmill Range of Markets

| ✅ Pros | ❎ Cons |

| Tickmill offers leverage of up to 1:500 depending on the region and financial instruments | The instrument portfolio is much smaller than that of competitors |

Tickmill Fees, Spreads, and Commissions

Tickmill Spreads

The spreads that traders encounter at Tickmill can vary depending on various factors such as their trading strategy, trading account type, trading circumstances, and prevailing market conditions on any given day. Here are the common spreads typically encountered at Tickmill:

- ✅ Pro Account – 0.0 pips

- ✅ Classic Account – 1.6 pips

- ✅ VIP Account – 0.0 pips

Tickmill Commissions

Tickmill offers commission-free trading for its Classic Account, where the broker’s costs are included in the marked-up spreads. However, commission fees apply to the following trading accounts:

- ✅ Pro Account: $2 per side, per 100,000 (standard lot) traded

- ✅ VIP Account: $1 per side, per 100,000 (standard lot) traded

For Islamic Accounts, while there are no overnight fees, commissions are still charged for positions held overnight. The following commissions apply to specific financial instruments:

| 🔍 Financial Instrument | 💵 Charge Per lot in USD |

| 📌BRENT, XTI/USD | 0.01 USD |

| 🚩LTC/USD | 0.1 USD |

| 📍ETH/USD | 1 USD |

| 🚨EUR/CZK, EUR/DKK, EUR/HKD, GBP/CZK, GBP/HKD, USD/CZK, USD/HKD, USD/SEK | 5 USD |

| 💡EUR/HKD, EUR/NOK, EUR/PLN, EUR/SEK, EUR/SGD, GBP/DKK, GBP/HUF, GBP/NOK, GBP/PLN, GBP/SEK, NZD/SGD, USD/CNH, USD/DKK, USD/HUF, USD/NOK, USD/PLN, USD/SGD | 10 USD |

| 🛎️EUR/MXN, EUR/ZAR, GBP/ZAR, USD/MXN, USD/ZAR | 20 USD |

| 🏷️BTC/USD | 25 USD |

| ✴️EUR/TRY, GBP/TRY, USD/TRY | 50 USD |

Tickmill Overnight Fees, Rollovers, or Swaps

In forex trading, traders may incur overnight interest, known as swaps, when holding positions overnight. Tickmill calculates swap rates based on the respective countries’ interest rates in the currency pair and the current market conditions.

Swap rates are executed at midnight EST according to the platform’s time, using a standard lot size of 100,000 base currency units. Tickmill applies fees for overnight swaps based on the following guidelines:

| 🔍 Instrument | ➡️ Long (Buy) Swap | 👉 Short (Sell) Swap |

| € EUR/USD | -6.62 pips | 3.52 pips |

| 📌USTEC | -0.52 pips | 0.26 pips |

| 🚩XAU/USD | -29.59 pips | 12.27 pips |

| 🛎️XAG/USD | -4.05 pips | 2.9 pips |

| 💡EURBOBL | -0.49 pips | -4.76 pips |

| 🏷️BTC/USD | 0 pips | 0 pips |

Tickmill Deposit and Withdrawal Fees

Tickmill does not impose any deposit or withdrawal fees, providing traders with the convenience of depositing and withdrawing funds without incurring additional charges.

Tickmill Inactivity Fees

Tickmill does not apply inactivity fees to dormant accounts, allowing traders the flexibility to maintain their accounts without being penalized for inactivity.

Tickmill Currency Conversion Fees

Ivory Coast traders should know that currency conversion fees may apply if they deposit or withdraw funds in XAF. Traders should consider these potential fees to ensure transparency in their trading expenses.

Pros and Cons Tickmill Trading and Non-Trading Fees

| ✅ Pros | ❎ Cons |

| There are no penalties on inactive trading accounts | Commissions apply to the Islamic Account on positions held for more than 3 days |

| Tickmill does not charge deposit or withdrawal fees | Currency conversion fees apply to XAF deposits and withdrawals |

| Traders can trade commission-free on the Classic Account | To get the best trading conditions, traders need a VIP account with a $50,000 minimum deposit |

Tickmill Deposits and Withdrawals

Tickmill offers Ivory Coast traders the following deposit and withdrawal methods:

- ✅ Bank Transfer

- ✅ Crypto Payments

- ✅ Debit Card

- ✅ Credit Card

- ✅ Skrill

- ✅ Neteller

- ✅ Dotpay

- ✅ PayPal

- ✅ Trustly

- ✅ Sticpay

- ✅ FasaPay

- ✅ UnionPay

- ✅ WebMoney

- ✅ Sofort

- ✅ Rapid (by Skrill)

Broker Comparison: Deposit and Withdrawals

| 🔍 Broker | 🥇 Tickmill | 🥈 InstaForex | 🥉 FXTM |

| ⏱️ Minimum Withdrawal Time | 1 Business Day | Instant | Instant up to 24 hours |

| ⏰ Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 6 working days | Up to 5 working days |

| ✔️Instant Deposits and Instant Withdrawals? | Instant Deposits | ✅ Yes | ✅ Yes, instant deposits |

Tickmill Deposit and Withdrawal Details – Payment Methods, currencies, processing time, etc.

| 📌 Payment Method | 💵 Deposit Currencies | ⌛ Deposit Processing | ✏️ Withdrawal Processing | 💷 Min Deposit | 💶 Min Withdrawal |

| 🏦Bank Transfer | USD, EUR, GBP | 1 working day | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| 💳Debit Card | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| 💳Credit Card | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| ✏️Skrill | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| ⌛Neteller | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| 🚀Dotpay | PLN | Instant | 1 working day | 100 PLN | 25 PLN |

| 🖋️PayPal | USD, EUR, GBP, PLN, CHF | Instant | 1 working day | 100 USD, EUR, GBP, PLN, CHF | 25 USD, EUR, GBP, PLN, CHF |

| ✴️Trustly | EUR, GBP, NOK, PLN, SEK, CZK, DKK | Instant | 1 working day | 100 EUR, GBP, NOK, PLN, SEK, CZK, DKK | 25 EUR, GBP, NOK, PLN, SEK, CZK, DKK |

| ⚠️Sticpay | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| 💡FasaPay | USD, IDR | Instant | 1 working day | 100 USD, 1,500,000 Rp | 25 USD |

| 🛎️UnionPay | CNY | Instant | 1 working day | 700 CNY, 100 EUR, USD, GBP | 25 USD, EUR, GBP |

| 🎉WebMoney | USD, EUR | Instant | 1 working day | 100 USD, EUR | 25 USD, EUR |

| 💎Sofort | EUR, GBP | Instant | 1 working day | 100 EUR, GBP | 25 EUR, USD |

| 🚩Rapid (by Skrill) | EUR, PLN, GBP, USD | Instant | 1 working day | 100 EUR, PLN, GBP, USD | 25 EUR, PLN, GBP, USD |

How to Deposit Funds with Tickmill

To deposit funds to an account with Tickmill, Ivory Coast traders can follow these steps:

- ✅ Sign into the Client Area on the Tickmill website using their login credentials.

- ✅ Access the funding and withdrawals section within the Client Area and select the “Deposit” option.

- ✅ Choose a deposit method from the available options provided by Tickmill.

- ✅ Specify the trading account to be funded.

- ✅ Select the desired deposit currency and proceed with any additional steps the chosen payment provider requires.

Tickmill Fund Withdrawal Process

To withdraw funds from an account with Tickmill, Ivory Coast traders can follow these steps:

- ✅ Log into the client area on the official Tickmill website using their login details.

- ✅ Complete the withdrawal request form provided within the client area.

- ✅ Submit the withdrawal request and await the release of funds into the designated bank account.

- ✅ Tickmill’s Finance Department processes all withdrawal requests within one working day. Requests received outside office hours, on weekends, or during holidays will be handled on the next working day.

- ✅ Traders should note that withdrawals can only be made using the same payment method to fund their trading accounts.

- ✅ Traders with open positions may need to transfer funds from their trading accounts to their wallet.

- ✅ When transferring funds from the trading account to the wallet, traders must ensure their free margin exceeds the requested amount. If there is insufficient free margin, the transfer will not be permitted until the correct account is selected.

Pros and Cons Tickmill Deposits and Withdrawals

| ✅ Pros | ❎ Cons |

| Traders do not pay any fees when they deposit or withdraw | Instant withdrawals are not supported |

| Tickmill’s minimum deposit starts from an industry-standard $100 / 60,000 XAF | Tickmill does not acknowledge XAF as a supported deposit or withdrawal currency |

| There is a low minimum withdrawal, which is beneficial to traders who do not wish to withdraw large quantities | Tickmill does not offer local deposit or withdrawal methods to Ivory Coast traders |

How long do Tickmill Deposits take?

Tickmill deposits are processed instantly, allowing traders to fund their accounts and start trading without delay.

How long do Tickmill Withdrawals take?

Tickmill withdrawals are typically processed within one working day. However, the actual time for funds to reflect in the trader’s bank account may vary depending on the withdrawal method.

Sometimes, the funds may take a few working days to be fully processed and appear in the trader’s bank account.

Tickmill Education and Research

Education

Tickmill offers the following Educational Materials to Ivory Coast traders:

- ✅ Webinars

- ✅ Seminars

- ✅ eBooks

- ✅ Video Tutorials

- ✅ Infographics

- ✅ Forex Glossary

- ✅ Fundamental Analysis

- ✅ Technical Analysis

- ✅ Educational Articles

- ✅ Market Insights

Tickmill Research and Trading Tool Comparison

| 🔍 Broker | 🥇 Tickmill | 🥈 InstaForex | 🥉 FXTM |

| 📆Economic Calendar | ✅ Yes | ✅ Yes | ✅ Yes |

| 💻VPS | ✅ Yes, not free | None | ✅ Yes |

| 📌AutoChartist | ✅ Yes | None | None |

| ☑️Trading View | None | None | None |

| 🏦Trading Central | None | None | None |

| 📊Market Analysis | ✅ Yes | ✅ Yes | ✅ Yes |

| 📰News Feed | ✅ Yes | ✅ Yes | ✅ Yes |

| 🖥️Blog | ✅ Yes | ✅ Yes | ✅ Yes |

Tickmill also offers Ivory Coast traders the following additional Research and Trading Tools:

- ✅ Access to AutoChartist

- ✅ Access to Myfxbook Copy Trading

- ✅ Economic Calendar

- ✅ Forex Calculators

- ✅ Tickmill VPS

- ✅ Pelican Trading

- ✅ Advanced Trading Toolkit

- ✅ Acuity Trading

Pros and Cons Tickmill Education and Research

| ✅ Pros | ❎ Cons |

| Beginners can access a wealth of educational materials on the Tickmill website for free | Tickmill does not offer free VPS |

Tickmill Customer Support

| 👥 Customer Support | 👩👧👧 Tickmill Customer Support |

| 🕰️Operating Hours | 24/5 |

| 🗣️Support Languages | English, Malay, Polish, Indonesian, Arabic, Thai, Chinese, Vietnamese, Portuguese |

| 📱Live Chat | ✅ Yes |

| 💻Email Address | ✅ Yes |

| ☎️Telephonic Support | ✅ Yes |

| 💯The overall quality of Tickmill Support | 3/5 |

Pros and Cons Tickmill Customer Support

| ✅ Pros | ❎ Cons |

| Tickmill offers multilingual support to traders | There is currently no support over weekends or on public holidays, which is problematic for cryptocurrency traders |

Tickmill VPS Review

Tickmill offers a robust Virtual Private Server (VPS) solution that operates 24/7 on the web. This VPS enables traders to effectively execute automated algorithmic strategies using Tickmill’s trading bots throughout the day.

By utilising Tickmill’s VPS, traders can enjoy several benefits, including a 20% discount on every package, expedited access to the customer service centre, a 100% uptime guarantee, and the ability to engage in accurate and uninterrupted Tickmill trading around the clock.

Tickmill Corporate Social Responsibility

Tickmill’s commitment to Corporate Social Responsibility (CSR) is evident in its dedication to positively impacting society.

The company actively participates in various CSR projects and initiatives, with a diverse portfolio that supports communities globally and promotes social welfare and sports development.

One of Tickmill’s key CSR initiatives is its partnership with the Gajusz Foundation for Terminally Ill Children. Tickmill is committed to supporting terminally ill children and their families through this collaboration.

By providing ongoing support and resources, Tickmill aims to improve the lives of these children and offer assistance during challenging times. In addition to their work with the Gajusz Foundation, Tickmill also donates to Germany’s Bärenherz Children’s Hospice.

This contribution reflects Tickmill’s recognition of the importance of providing care and support to children with life-limiting conditions. By supporting the hospice, Tickmill contributes to the essential services and compassionate care provided to these children and their families.

These CSR initiatives highlight Tickmill’s dedication to making a positive difference in the lives of vulnerable individuals and communities.

Through its active involvement in CSR projects, Tickmill is committed to social responsibility and strives to create a meaningful impact beyond its business operations.

Social Trading with Tickmill

Tickmill incorporates an innovative social copy trading feature called AutoTrade on its Myfxbook platform. It is important to note that this feature is currently unavailable at Tickmill’s UK headquarters. Additionally, Tickmill provides traders with the MQL5 Signals system, accessible through the MT4 platform.

This system is a valuable tool, delivering timely notifications to traders and enabling them to make well-timed moves in the asset markets.

Tickmill Trading Signals

Tickmill provides the Signal Centre Tool, a valuable resource for traders seeking market insights and trading ideas. As an FCA-regulated signal provider, Tickmill combines human and AI-driven analysis to unlock traders’ full trading potential.

By downloading the Signal Centre Tool onto their MT4/MT5 platform, traders can access daily trading ideas, entry levels, stop loss levels, and target levels across various assets, such as indices, stocks, currencies, commodities, and cryptocurrencies.

Tickmill Cashback Rebates Features and Conditions

Tickmill offers cashback rebates on all three trading accounts: Classic, ECN Pro, and VIP Accounts, with rebates of up to $7.74 per lot.

To qualify for Tickmill’s cashback rebates, clients must meet specific trading volume thresholds in forex trading each calendar month. The rebate tiers and corresponding amounts are as follows:

- ✅ Tier 1: 0 to 1,000 lots = $0.25 rebate per lot traded.

- ✅ Tier 2: 1,001 to 3,000 lots = $0.50 rebate per lot traded.

- ✅ Tier 3: 3,000 lots and more = $0.75 rebate per lot traded.

However, it is important to note that rebates are not available for customer accounts held with Tickmill entities representing Cyprus (CySEC), South Africa (FSCA), or Labuan (FSA).

Additionally, participation in the rebates program requires opening a new live MT4 trading account and making a minimum deposit of one hundred dollars.

Tickmill Web Traffic Report

| 🌐Global Rank | 83,891 |

| 🌎Country Rank | 13,283 |

| 🗂️Category Rank | 192 |

| 🔢Total Visits | 622.2K |

| 📌Bounce Rate | 46.05% |

| 📖Pages per Visit | 4.25 |

| 🕰️Average Duration of Visit | 00:02:43 |

| 💯Total Visits in the last three months | March – 653.8K April – 641.6K May – 622.2K |

Tickmill Geographic Reach and Limitations

Most of Tickmill’s market share is concentrated in these areas:

- ✅ Malaysia – 11.87%

- ✅ Vietnam – 10.87%

- ✅ India – 8.89%

- ✅ Egypt – 5.39%

- ✅ Poland – 4.96%

Tickmill’s Current Expansion Focus

Tickmill is currently expanding across Europe, Asia, and Africa.

Countries not accepted by Tickmill

Tickmill does not accept traders from the United States.

Popularity among Ivory Coast traders who choose Tickmill

Tickmill is one of the Top 20 Forex and CFD brokers for traders in the Ivory Coast.

Tickmill vs InstaForex vs FXTM – A Comparison

| 🔍 Broker | 🥇 Tickmill | 🥈 InstaForex | 🥉 FXTM |

| 📈Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA | FCA, BVI FSC, CySEC, FSA SVG | CySEC, FSCA, FCA, FSC Mauritius |

| 📉Trading Platform | MetaTrader 4 MetaTrader 5 Tickmill App | MetaTrader 4 MetaTrader 5 WebIFX InstaForex Multi-Terminal InstaForex WebTrader InstaTick Trader InstaForex MobileTrader | MetaTrader 4 MetaTrader 5 FXTM Trader |

| 💵Withdrawal Fee | None | ✅ Yes | ✅ Yes |

| 🗂️Demo Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 💶Min Deposit | 60,000 XAF | 610 XAF | 6,100 XAF |

| 📌Leverage | 1:500 | 1:1000 | 1:2000 |

| 📝Spread | Variable, from 0.0 pips | 0.0 pips | 0.0 pips, Variable |

| 💸Commissions | $1 per side per 100,000 traded | 0.03% to 0.07% | From $0.4 to $2 |

| 🛑Margin Call/Stop-Out | 100%/30% | 30%/10% | 40% to 50% (M) 60% to 80% (S/O) |

| 🧑⚖️Order Execution | Market | Instant | Market, Instant |

| ❌No-Deposit Bonus | ✅ Yes | ✅ Yes | None |

| 💰Cent Accounts | None | ✅ Yes | None |

| ℹ️ Account Types | Pro Account Classic Account VIP Account | Insta.Standard Trading Account Insta.Eurica Trading Account Cent.Standard Trading Account Cent.Eurica Trading Account | Micro Account Advantage Account Advantage Plus Account |

| 🏦Banking Commission of WAEMU Regulation | None | None | None |

| 💴XAF Deposits | None | None | ✅ Yes |

| ☑️XAF Account Offered? | None | None | None |

| 🕰️Customer Service Hours | 24/5 | 24/5 | 24/5 |

| ✏️Retail Investor Accounts | 3 | 4 | 3 |

| ☪️Islamic Account | ✅ Yes | ✅ Yes | ✅ Yes |

| ⬇️Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| ⬆️Maximum Trade Size | 100 lots | 100 lots | 100 lots |

| ⏱️Minimum Withdrawal Time | 1 Business Day | Instant | Instant up to 24 hours |

| ⏰Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 6 working days | Up to 5 working days |

| ✔️Instant Deposits and Instant Withdrawals? | Instant Deposits | ✅ Yes | ✅ Yes, instant deposits |

Broker Comparison for a Range of Markets

| 🔍 Broker | 🥇 Tickmill | 🥈InstaForex | 🥉 FXTM |

| 📌Forex | ✅ Yes | ✅ Yes | ✅ Yes |

| 💍Precious Metals | ✅ Yes | ✅ Yes | ✅ Yes |

| 💻ETFs | None | None | None |

| 🚩CFDs | ✅ Yes | ✅ Yes | ✅ Yes |

| 🛎️Indices | ✅ Yes | ✅ Yes | ✅ Yes |

| 📈Stocks | ✅ Yes | ✅ Yes | ✅ Yes |

| 💰Cryptocurrency | ✅ Yes | ✅ Yes | None |

| ✏️Options | None | None | None |

| 🛢️Energies | ✅ Yes | ✅ Yes | ✅ Yes |

| ➡️Bonds | ✅ Yes | None | None |

Tickmill Alternatives

- 🥇 XTB, founded in 2002 in Poland, is one of the country’s pioneering leveraged foreign exchange brokerage firms. With a long-standing presence in the industry, XTB offers favorable conditions for novice and experienced traders, boasting low costs and exceptional support encompassing comprehensive learning and research materials. The web platform and mobile app XTB provides are rich in tools, making them suitable for CCFD trading and day trading.

- 🥈 RoboForex stands out with its extensive range of trading accounts, catering to traders of all levels, from beginners to seasoned professionals. Their offering includes diverse assets such as indices, stocks, CFDs, commodities, metals, and ETFs. Education takes center stage at RoboForex, providing economic calendars, analytics centres, and a wealth of resources through the MetaTrader suite.

- 🥉 Although a relatively new entrant to the forex trading arena, having been established in 2018, FXPesa has rapidly gained momentum in recent years. FXPesa introduces innovative trading technology that specifically targets beginners in forex trading. One of its notable advantages is the ability to start trading with a minimum deposit of just $10, making it an accessible option for those looking to enter the market.

Tickmill Awards and Recognition

Tickmill has won several awards since its establishment, and here are the most recent ones:

- ✅ Best Partner Program Africa: Finance Magnates Africa Summit 2024

- ✅ Best Forex Spreads MEA: Ultimate Fintech Awards MEA 2024

- ✅ #1 Broker for Commissions and Fees: ForexBrokers.com Annual Forex Broker Review

- ✅ Best Forex Broker: QualeBroker Awards 2024

- ✅ Best Forex Spreads 2022: Ultimate Fintech Awards 2022

- ✅ Best Forex Customer Service: Global Forex Awards 2022

- ✅ Best Forex Trading Experience: Global Forex Awards 2022

and many, MANY more!

Recommendations according to our in-depth review of Tickmill

Support for XAF as a deposit or withdrawal currency

Tickmill does not accept XAF as a supported deposit or withdrawal currency. This can lead to additional currency conversion fees for Ivory Coast traders who deposit or withdraw funds in XAF.

By supporting XAF, Tickmill could reduce these potential fees and make transactions more transparent for local traders.

Instant withdrawals

At present, Tickmill does not support instant withdrawals. This means traders may have to wait a certain period before accessing their funds.

By offering instant withdrawals, Tickmill could provide traders quicker access to their funds, which could be particularly beneficial in fast-moving markets.

Local deposit or withdrawal methods

Tickmill does not offer Ivory Coast traders local deposit or withdrawal methods. This could make transactions less efficient for local traders who prefer to use local payment methods.

By incorporating local deposit or withdrawal methods, Tickmill could make transactions easier and more efficient for local traders.

Dedicated account manager for Ivory Coast traders

Currently, Tickmill does not provide a dedicated account manager for Ivory Coast traders. A dedicated account manager could offer personalized service and support, helping traders to navigate the platform and make the most of their trading experience.

This could be particularly beneficial for new traders unfamiliar with the platform.

Tickmill Customer Reviews

🥇 Exceptional Service!

“I’ve experienced exceptional customer service with Tickmill. Their support staff is top-notch.” – Aminata Yobo (October 2022)

🥈 Happy Customer!

“I’m thrilled with Tickmill! They have an excellent team providing outstanding services.” – Nafissatou Bamba (May 2024)

🥉 Highly Recommended!

“Tickmill is one of the top CFD, Forex brokers with a solid reputation. Despite being relatively new to Futures and Options, their offerings on TradingView are competitive. They have proactively facilitated my trading experience and addressed all my requests and desires without issue. I would endorse them, particularly for volume traders.” – William Kato (December 2022)

Pros and Cons of Trading with Tickmill

| ✅ Pros | ❎ Cons |

| Strong regulation and regional registrations provide a secure trading environment. | Tickmill offers a narrower selection of tradeable assets compared to some other top forex brokers, which may limit trading opportunities for certain traders. |

| Tickmill offers a narrower selection of tradeable assets compared to some other top forex brokers, which may limit trading opportunities for certain traders. | Pricing for Tickmill’s Classic account is not as competitive as the Pro and VIP accounts, potentially discouraging traders who prefer the Classic account type. |

In Conclusion

According to our research, Tickmill offers Ivory Coast traders a commendable range of services. Its diverse trading platforms, including MetaTrader 4 and 5, and a wide array of tradable assets, provide traders with ample opportunities.

The broker’s quick withdrawal processing and various deposit methods are also advantageous. However, Tickmill falls short in certain areas. The lack of support for the local currency, XAF, and the absence of instant withdrawals are notable drawbacks.

Additionally, the absence of a dedicated account manager for Ivory Coast traders and local deposit or withdrawal methods could be improved. However, in our experience, despite these shortcomings, Tickmill’s offerings, such as various trading tools and promotions, make it a viable choice.

Therefore, we can conclude that Tickmill presents a balanced blend of strengths and areas for improvement, making it a considerable option for Ivory Coast traders

Tickmill Risk Warning and Disclaimer for Traders: Trading with Tickmill risks financial loss and may not be suitable for all traders. The volatile nature of financial markets can result in significant profits or losses.

Before engaging in any trading activity, traders should carefully assess their financial status and risk tolerance.

It is important to note that the information and services provided by Tickmill are for educational and informational purposes only and do not guarantee their accuracy or reliability. Traders are advised to seek independent financial advice if necessary.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyse, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Now it is your turn to participate:

- ✅ Do you have any prior experience with Tickmill?

- ✅ What was the determining factor in your decision to engage with Tickmill?

- ✅ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

- ✅ Have you experienced issues with Tickmill, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk.

In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Frequently Asked Questions

How long does it take to withdraw from Tickmill?

The withdrawal time at Tickmill varies depending on the chosen payment method. In most cases, withdrawals are processed within one business day. However, bank wire transfers may take up to seven days for the funds to reach the recipient’s account.

Does Tickmill have VIX 75?

No, Tickmill does not currently offer trading on the VIX 75 index.

Is Tickmill Safe or a Scam?

Yes, Tickmill is considered a safe and trustworthy broker. It has built a strong reputation in the forex and CFD industry and maintains high trust scores and ratings.

Tickmill’s regulatory status, coupled with its commitment to client fund security and transparent trading practices, ensures that traders can have confidence in the safety of their funds and the integrity of their trading experience.

Does Tickmill have Nasdaq 100?

Yes, Tickmill offers trading on the Nasdaq stock exchange, allowing traders to access and trade a wide range of securities listed on the Nasdaq.

Is Tickmill regulated?

Yes, Tickmill is a regulated broker. It holds licenses from reputable regulatory authorities in multiple jurisdictions, including CySEC in Cyprus, FCA in the United Kingdom, DFSA in Dubai, FSCA in South Africa, FSA in Seychelles, and LFSA in Malaysia.

These regulatory bodies ensure that Tickmill complies with industry standards and provides a safe and secure trading environment.

Why should I work through the SA Shares Cashback?

You can expect some of the highest commissions if you work through SA Shares to earn up to 30% Cashback Rebates from Forex Brokers such as Tickmill.

This is because SA Shares aims to negotiate the most competitive commission rates with brokers such as Tickmill to ensure you get the most back from your trading activities.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Ivory Coast

Scam Forex Brokers in Ivory Coast