The 3 best West African Franc Deposit Accounts revealed. We have explored and tested several prominent XAF Forex Deposit Accounts for forex trading in Ivory Coast to identify the 3 best.

This is a complete guide to the 3 best West African Franc Forex deposit accounts in Ivory Coast.

In this in-depth guide you’ll learn:

- The Best West African Franc Forex Deposit Accounts – a full Overview

- What is a West African Franc Forex Account

- How to choose a Forex broker that accepts XAF deposits

- How to trade the XAF successfully

- The benefits of making deposits in XAF when Forex trading

and much, MUCH more!

10 The Best Forex Brokers in Ivory Coast that offer XAF Deposit Accounts – a Comparison

| 🔍 Broker | 📌 XAF Deposit Account Offered | 🫰🏻 Best for |

| 🥇 Alpari | ✅Yes | MetaTrader 4 |

| 🥈 AvaTrader | ✅Yes | MetaTrader 5 |

| 🥉 eToro | ✅Yes | Beginners |

| 🏅 Oanda | ✅Yes | Low Minimum Deposits |

| 🏆 XM | ✅Yes | ECN |

| 🥇 Tickmill | ✅Yes | Islamic Account |

| 🥈 Exness | ✅Yes | Trading App |

| 🥉 FxPro | ✅Yes | Rebates |

| 🏅 Pepperstone | ✅Yes | Lowest Spreads |

| 🏆 IG | ✅Yes | Nasdaq 100 |

10 The Best Forex Brokers in Ivory Coast that offer XAF Deposit Accounts (2024)

- ☑️ Alpari – Overall, The Best Forex Broker that offers XAF Deposit Account in Ivory Coast

- ☑️ AvaTrade – The Best MetaTrader 5 Forex broker in Ivory Coast

- ☑️ eToro – The Best Forex Broker for Beginners

- ☑️ OANDA – Low Minimum Deposit Broker

- ☑️ XM – Best ECN Broker

- ☑️ Tickmill – Best Islamic / Swap-Free Forex Broker

- ☑️ Exness – Offers the Best Trading App for Traders

- ☑️ FxPro – Best Forex Rebates Broker

- ☑️ Pepperstone – Best Lowest Spread Forex Broker

- ☑️ IG – Leading Nasdaq 100 Forex Broker

What is a West African Franc deposit account in Forex?

Forex brokers that offer West African Franc Forex accounts are those that allow traders in the Ivory Coast to fund their accounts using XAF. This allows for faster deposits and withdrawals by traders in Ivory Coast, and several other convenient benefits.

The 3 Best Forex Brokers that offer West African Deposit Accounts

Here, we explore the 3 best Forex brokers that accept traders from Ivory Coast and which offer Forex trading accounts in which deposits can be made using XAF.

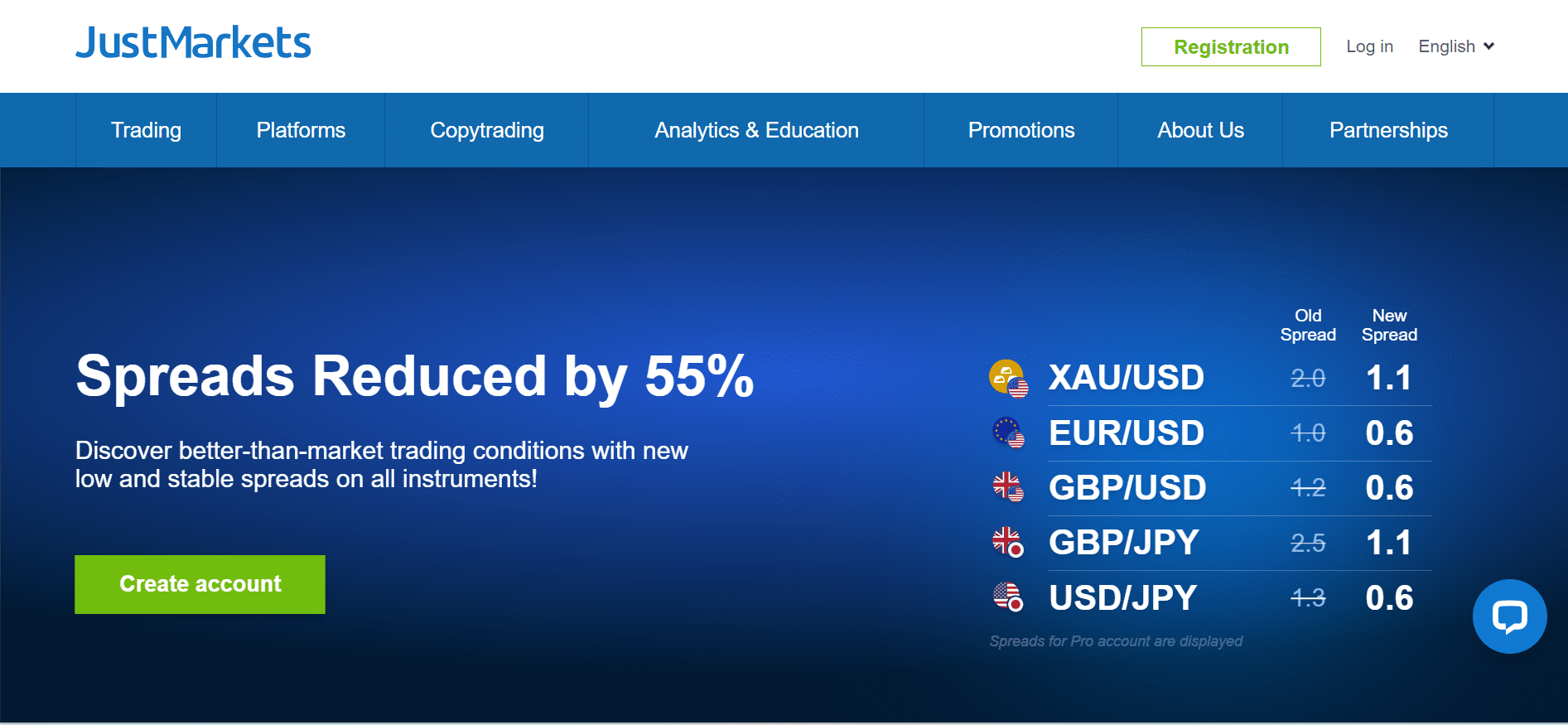

JustMarkets

Overview

JustMarkets is a reputable Forex broker offering Ivory Coast traders a comprehensive platform for successful currency trading. Renowned for its user-friendly interface, JustMarkets provides an array of trading features tailored to meet the needs of both novice and experienced traders.

With a diverse range of currency pairs, including those relevant to the West African region, traders in Ivory Coast can engage in well-informed decision-making.

JustMarkets ensures favourable trading conditions by offering competitive spreads, low transaction costs, and flexible leverage options. The platform also provides advanced charting tools, real-time market analysis, and educational resources, empowering traders to make informed decisions.

JustMarkets prioritizes security through robust encryption and adherence to regulatory standards, assuring traders in Ivory Coast of a safe trading environment.

Additionally, JustMarkets offers multilingual customer support to assist traders, ensuring a seamless experience. Whether you are new to Forex or an experienced investor, JustMarkets caters to the diverse needs of Ivory Coast traders, facilitating a dynamic and rewarding trading journey.

| 🔍 Feature | ℹ️ Information |

| ➡️Regulation | CySEC, FSCA, FSA, FSC |

| 📌BCEAO Regulation | None |

| 💻Social Media Platforms | Facebook YouTube |

| 🗂️Trading Accounts | MT4 Standard Cent Account MT4 Standard Account MT4 Pro Account MT4 Raw Spread Account MT5 Standard Account MT5 Pro Account MT5 Raw Spread Account |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 JustMarkets App |

| 💵Minimum Deposit (XAF) | XAF 5,989.44 or USD10 |

| 🛢️Trading Assets | Indices Energies Forex Metals Cryptocurrencies Shares Futures |

| 📝Minimum spread | From 0.0 pips |

| ✏️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| ✴️PAMM Accounts | ✅ Yes |

| 🎁Bonuses and Promotions for Ivorian traders | ✅ Yes |

| 💯Trust score for Ivory Coast | 90% |

Pros and Cons JustMarkets

| ✅ Pros | ❎ Cons |

| To attract new traders, JustMarkets is offering a $30 no-deposit incentive. | JustMarkets’ product portfolio is limited compared to other brokers |

| There are various account types to accommodate different trading philosophies and degrees of expertise. | JustMarkets does not have Tier-1 regulation at the moment |

| For every kind of account, competitive spreads are available. | The demo account available from JustMarkets expires after 30 days |

Trust Score

JustMarkets has a trust score of 90%

Can traders in Ivory Coast access multilingual customer support on the JustMarkets platform?

Yes, JustMarkets offers multilingual customer support to assist traders in Ivory Coast. This ensures that traders can seek assistance and resolve queries in their preferred language, promoting a more inclusive and accessible trading experience.

What are the trading conditions offered by JustMarkets?

JustMarkets provides favourable trading conditions, including competitive spreads, low transaction costs, and flexible leverage options. These conditions benefit traders in Ivory Coast by minimizing the overall costs of trading and offering the flexibility to tailor their trading approach.

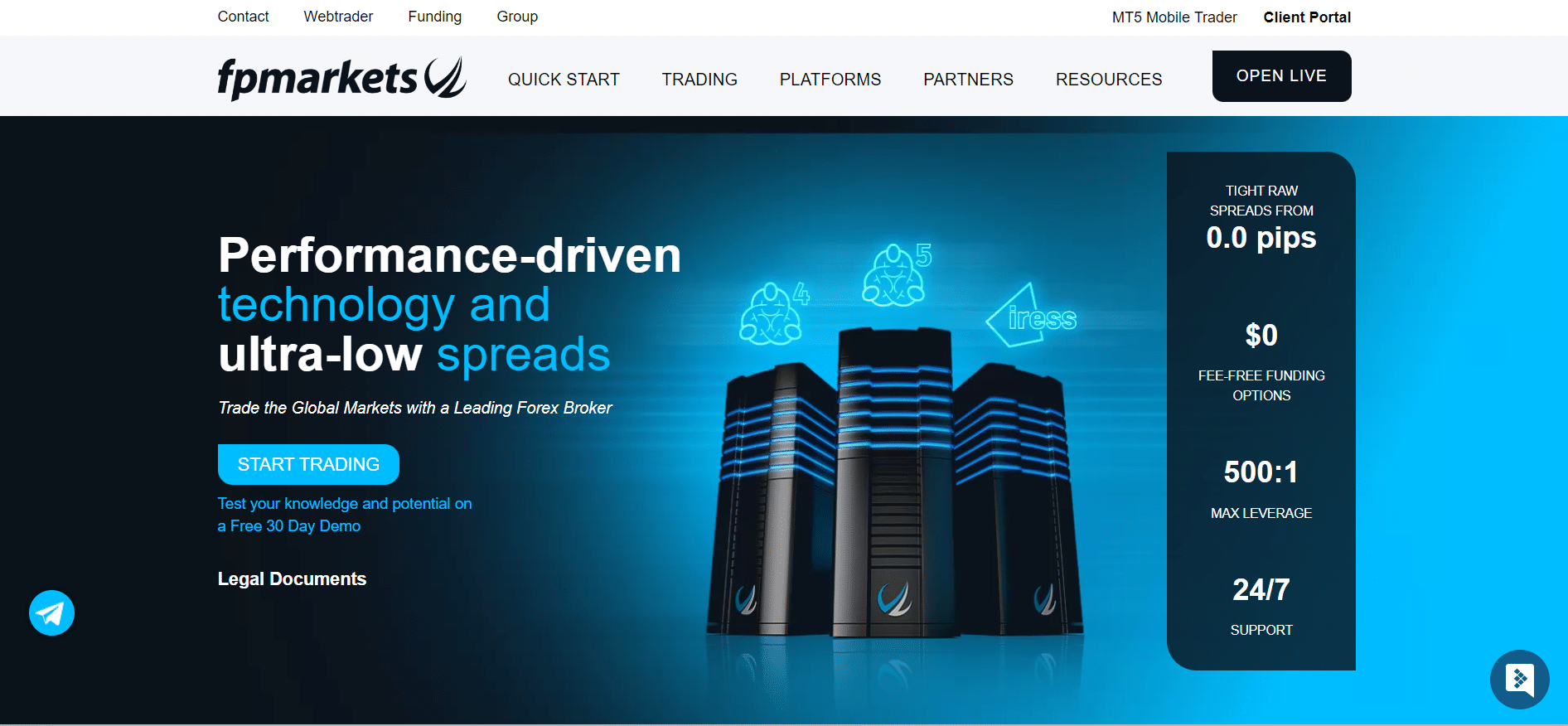

FP Markets

Overview

FP Markets, a leading Forex broker, extends its comprehensive trading platform to the Ivory Coast, empowering traders with optimal conditions for success. Renowned for competitive spreads and low commissions, FP Markets facilitates cost-effective trading.

Ivory Coast traders benefit from a diverse range of currency pairs, including those pertinent to West Africa. The platform boasts advanced charting tools, real-time market analysis, and a user-friendly interface, catering to both novice and experienced traders.

With a commitment to security through stringent regulatory compliance, FP Markets ensures a safe trading environment. Multilingual customer support further enhances the experience, making FP Markets an ideal choice for Ivory Coast traders seeking a dynamic and reliable Forex platform.

| 🔍Feature | ℹ️ Information |

| ➡️Regulation | CySEC, FSCA, ASIC, FSC, FSA |

| 📌BCEAO Regulation | None |

| 💻Social Media Platforms | Facebook YouTube |

| 🗂️Trading Accounts | MT4/5 Standard Account MT4/5 Raw Account MT4/5 Islamic Standard Account MT4/5 Islamic Raw Account |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 cTrader IRESS FP Markets App |

| 💵Minimum Deposit (XAF) | XAF 40406.00 or AUS100 |

| 🛢️Trading Assets | Forex Shares Metals Commodities Indices Cryptocurrencies Bonds ETFs |

| 📝Minimum spread | From 0.0 pips |

| ✏️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| ✴️PAMM Accounts | ✅ Yes |

| 🎁Bonuses and Promotions for Ivorian traders | None |

| 💯Trust score for Ivory Coast | 87% |

Pros and Cons FP Markets

| ✅ Pros | ❎ Cons |

| Ivorian traders profit from FP Markets' cutting-edge technological infrastructure. | Even though FP Markets' massive leverage could be advantageous, it also raises the risk of significant losses. |

| Ivorian traders receive complete customer service from a polite and competent staff. | It's possible that some payment methods unique to Ivory Coast won't be supported by FP Markets because of its global focus. |

| The broker is governed by a number of international regulatory agencies, such as FSCA, ASIC, CySEC, FSA, and FSC. | Although FP Markets offers a wide range of products, some local or specialty markets that could be of interest to certain Ivorian traders might not be covered. |

| Ivorian traders who wish to improve their level of expertise can make use of FP Markets' comprehensive training suite. | Withdrawal costs are assessed by FP Markets for a range of payment options. |

Trust Score

FP Markets has a trust score of 87%

What trading features does FP Markets offer to cater to the diverse needs of traders in Ivory Coast?

FP Markets provides a diverse range of currency pairs, including those relevant to West Africa, offering Ivory Coast traders the opportunity to make well-informed decisions. The platform also boasts advanced charting tools, real-time market analysis, and a user-friendly interface, catering to both novice and experienced traders in Ivory Coast.

How competitive are the trading conditions on FP Markets for traders in Ivory Coast?

FP Markets is known for its competitive trading conditions, offering low spreads and commissions. Ivory Coast traders can benefit from cost-effective trading, minimizing overall transaction costs and enhancing the profitability of their Forex activities.

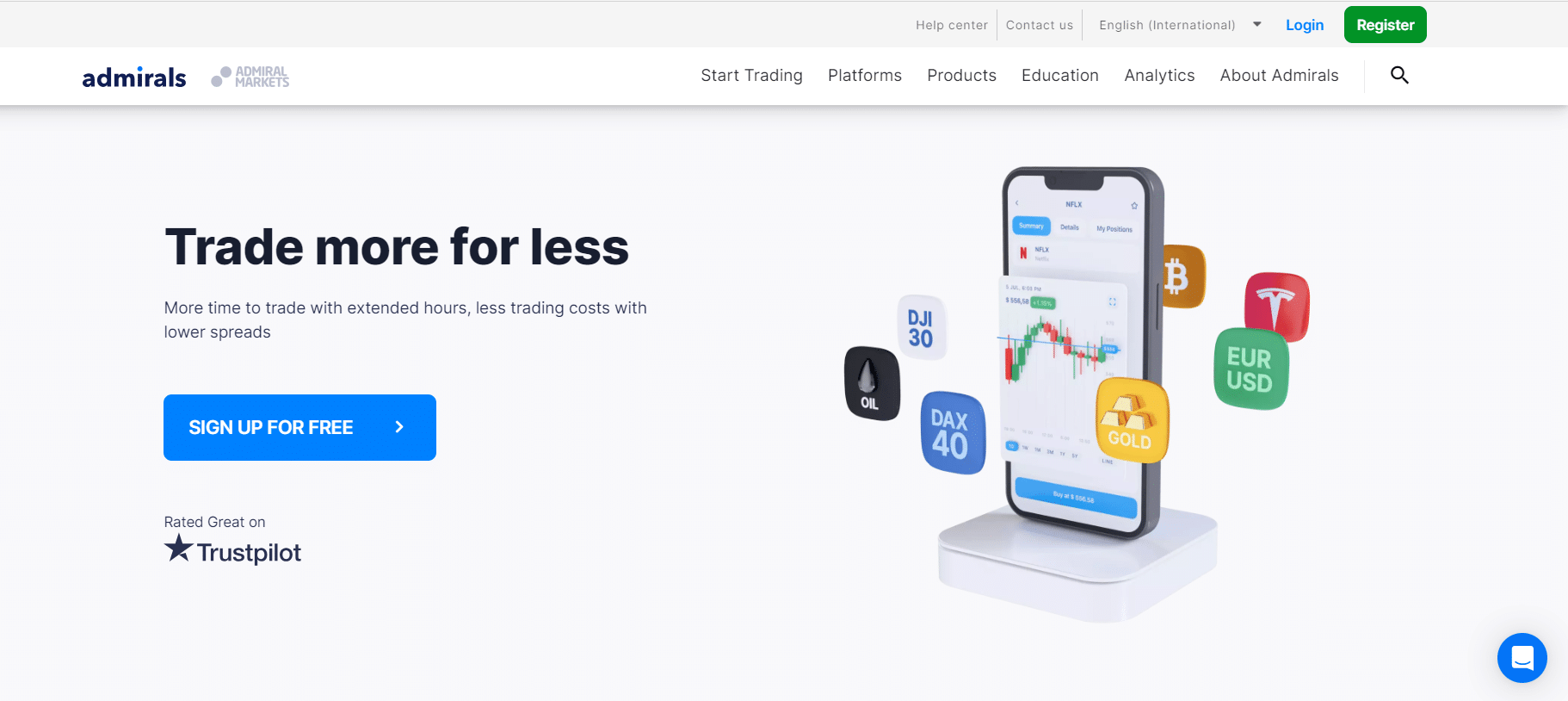

Admiral Markets

Overview

Admiral Markets, a premier Forex broker, extends its advanced trading platform to Ivory Coast, providing traders with a robust set of features.

Ivory Coast traders benefit from competitive trading conditions, including tight spreads and flexible leverage options, optimizing their trading experience. Admiral Markets offers a diverse range of currency pairs, including those relevant to West Africa, enabling well-informed trading decisions.

The platform’s user-friendly interface, advanced charting tools, and real-time market analysis cater to both novice and experienced traders. With a commitment to security and multilingual customer support, Admiral Markets ensures Ivory Coast traders a dynamic and secure environment for successful Forex trading.

| 🔍 Feature | ℹ️ Information |

| ➡️Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 💻Social Media Platforms | Facebook YouTube |

| 📌BCEAO Regulation? | None |

| 🗂️Trading Accounts | Trade MT5 Account, Invest MT5, Zero MT5, Bets MT5, Trade MT4, Zero MT4 |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 Admirals Mobile App |

| 💵Minimum Deposit in XAF | XAF 14,973.59 or USD25 |

| 🛢️Trading Assets | ESG Trading Instruments Forex Cryptocurrency CFDs Commodities Indices Stocks ETFs Bonds Spread Betting |

| ✴️XAF-based Account? | None |

| 💷XAF Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for Ivorian traders? | ✅ Yes |

| ⬇️Minimum spread | from 0.0 pips |

| ✏️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

Pros and Cons Admiral Markets

| ✅ Pros | ❎ Cons |

| Admirals is a reputable broker that provides traders worldwide with reliable trading solutions. | The Admirals demo account has a 30-day expiration date, which restricts the amount of time traders can use to test and refine their methods. |

| The platform offers sophisticated trading tools that make it easier for traders to do in-depth market analysis and support them in making wise selections. | Specific services might not be offered in specific locations due to jurisdictional restrictions, which would limit the options available to traders in those areas. |

| Admirals can provide a wide range of trading options for different investing strategies because of their large assortment of over 8,000 financial instruments. | Traders who are inactive for a prolonged length of time are subject to inactivity fees levied by Admirals. |

| The existence of a Swap-Free account, which complies with Islamic banking regulations, is advantageous to Muslim Forex traders. | When dealing with foreign currencies, traders need to be mindful of the 0.3% conversion cost, which could affect the total profitability of trades. |

| Businesses can maximise their profits through commission-free trade without having to pay extra fees. | Admirals provides excellent customer service; nevertheless, because to its limited business hours, urgent questions or issues may not be promptly attended to. |

Trust Score

Admirals has a trust score of 88%

Does Admiral Markets offer a diverse range of currency pairs, including those relevant to West Africa?

Yes, Ivory Coast traders on Admiral Markets can access a diverse range of currency pairs, including those relevant to West Africa. This ensures that traders can make well-informed decisions based on global and regional market dynamics.

What trading features does Admiral Markets offer to traders in Ivory Coast?

Admiral Markets provides Ivory Coast traders with a robust set of features, including a user-friendly interface, advanced charting tools, and real-time market analysis. These features cater to both novice and experienced traders, enhancing their overall trading experience.

How to choose the best Forex broker that accepts XAF deposits in Ivory Coast

Ivorian traders must evaluate the following components of a Forex broker that accepts XAF deposits to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Ivorian traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Ivorian traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Ivorian traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Ivorian traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Ivorian trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- ✅ eBooks

- ✅ Trading guides

- ✅ rading knowledge on leveraged products

- ✅ A risk warning on complex instruments

- ✅ Educational videos

Research can include some of the following:

- ✅ Trading tools

- ✅ Commentary

- ✅ Status of International Markets

- ✅ Price movements

- ✅ Market sentiments

- ✅ Whether there is a volatile market

- ✅ Exchange Rates

- ✅ Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Ivory Coast

In this article, we have listed the best brokers that offer XAF deposit accounts to Forex traders in Ivory Coast. We have further identified the brokers that offer additional services and solutions to traders in Ivory Coast

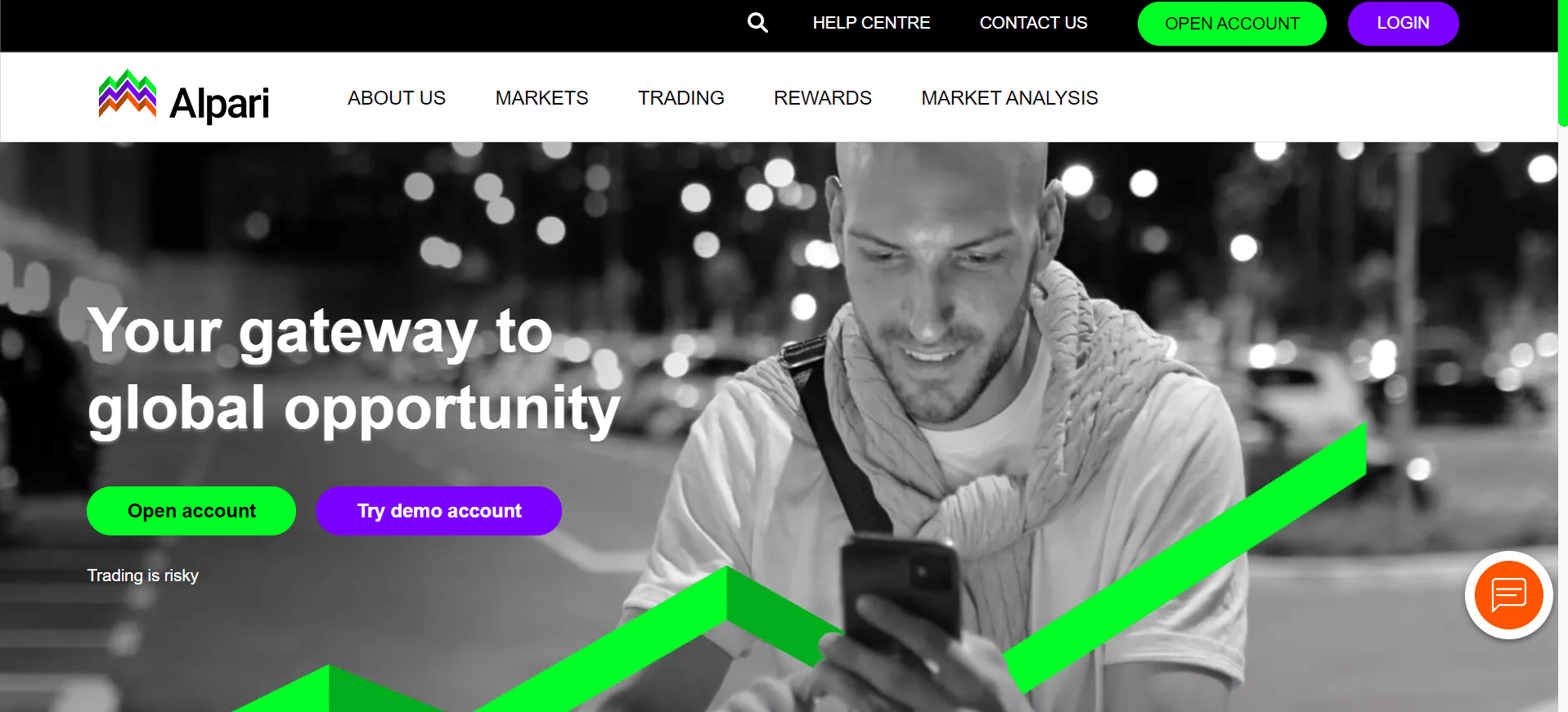

Best MetaTrader 4 / MT4 Forex Broker – Alpari

Overall, Alpari is the best MT4 Forex broker in Ivory Coast. Because of Alpari’s standing as a trustworthy market maker, investors are frequently encouraged to consider it as a safe alternative. Alpari guarantees that their trading elapsed times won’t go above one millisecond. There are currently over two million registered users on Alpari.

Best MetaTrader 5 / MT5 Forex Broker – AvaTrade

Overall, AvaTrade is the best MT5 Forex broker in Ivory Coast. It’s no secret that AvaTrade is a trustworthy broker for trading FX and CFDs. Strong reputation: AvaTrade has individual accounts for each of its clients at reputable institutions in all relevant jurisdictions.

Best Forex Broker for beginners – eToro

Overall, eToro is the best Forex broker for beginners in Ivory Coast. Users can gain from utilizing eToro in a number of ways, including the simulated trading accounts, eToro Academy, and the eToro Plus paid membership plan.

Best Low Minimum Deposit Forex Broker – OANADA

Overall, Oanda is the best low minimum deposit Forex broker for traders in Ivory Coast. All kinds of foreign currency dealers can benefit from Oanda’s state-of-the-art trading platform.

Best ECN Forex Broker – XM

Overall, XM is the best ECN forex broker in the Ivory Coast. XM prioritizes price, customer service, money, and safety while selecting an online trading platform.

Best Islamic / Swap-Free Forex Broker – Tickmill

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Ivory Coast. Because of its many account options, reasonable spreads, and affordable fees, this broker is a great alternative for a wide range of traders. Tickmill can currently be utilized in numerous contexts and accessed in a wide range of languages.

Best Forex Trading App – Exness

Overall, Exness offers the best trading app for traders in Ivory Coast. Because it offers so many helpful features and functionalities, traders in Ivory Coast can benefit greatly from the Exness Trader app. For inexperienced traders, candlestick charts, technical indicators, and quantitative tools are useful.

Best Forex Rebates Broker – FxPro

Overall, FxPro is the Best Forex Rebates Broker in the Ivory Coast. STP and ECN services are available to users of the FxPro platform. On the foreign currency market, retail traders can receive cashback returns of up to 30% per month.

Best Lowest Spread Forex Broker – Pepperstone

Overall, Pepperstone is the best lowest spread forex broker in the Ivory Coast. Pepperstone offers spreads for buying the US dollar vs the euro that start at 0.0 pip. Pepperstone Markets is one of the top brokerages in the industry with a long history of success.

Best Nasdaq 100 Forex Broker – IG

Overall, IG is the best Nasdaq 100 forex broker in the Ivory Coast. Owing to its extensive product offering, cutting-edge trading capabilities, and advantageous market circumstances, IG has risen to the top 20 platforms in the Ivory Coast. Being governed by strict rules and providing access to a diverse range of assets sets IG apart from the many trustworthy online brokers serving the Ivorian market.

Best Volatility 75 / VIX 75 Forex Broker – IC Markets

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in the Ivory Coast. The ability to trade on international financial markets has been extended to traders from Ivory Coast via IC Markets’ cutting-edge trading tools.

Best NDD Forex Broker – BDSwiss

Overall, BDSwiss is the best NDD forex broker in Ivory Coast. BDSwiss is a well-known global provider and broker of CFD and forex services. It oversees up to €20 billion in foreign exchange trading monthly and has more than 16,000 affiliate accounts.

Best STP Forex Broker – Octa

Overall, Octa is the best STP forex broker in Ivory Coast. More than twenty-eight industry awards have been given to Octa. Octa has reduced its trading costs by about a third by employing STP (Straight Through Processing) and ECN (Electronic Communication Network).

Best Sign-up Bonus Broker – HFM

Overall, HFM is the best sign up bonus broker in Ivory Coast. The trading platform offered by HFM is used by traders since it has good standards and reasonable prices. Because the HFM website offers a wide range of account settings and asset markets, individuals with different levels of experience trading foreign currencies can utilise it.

Trading the XAF successfully in Ivory Coast

Trading the XAF (Central African CFA franc) successfully in the Forex market requires a strategic approach, sound analysis, and an understanding of the unique economic factors influencing the currency.

Ivory Coast, being part of the West African Economic and Monetary Union (WAEMU), utilizes the XAF as its official currency. Here’s a comprehensive guide on how traders in Ivory Coast can navigate and trade the XAF successfully in the Forex market:

Understand Economic Indicators and Regional Factors

Successful trading begins with a solid understanding of economic indicators and regional factors affecting the XAF. Stay informed about Ivory Coast’s economic performance, regional stability within WAEMU, and key indicators such as GDP growth, inflation rates, and trade balances. Pay attention to regional economic developments as they can impact the XAF’s strength.

Follow Global Commodity Prices

Commodities play a crucial role in the economic landscape of Ivory Coast. As a major exporter of commodities like cocoa, coffee, and oil, the XAF is influenced by global commodity prices. Traders should closely monitor these prices, as any significant changes can impact the country’s trade balance and, consequently, the XAF’s value.

Utilize Technical Analysis

Employing technical analysis is essential for successful Forex trading. Utilize charts, indicators, and patterns to identify potential entry and exit points. Pay attention to support and resistance levels, trend lines, and key technical indicators like moving averages and relative strength index (RSI). Technical analysis can help traders make informed decisions based on historical price movements.

Stay Informed About Monetary Policy

Central banks play a pivotal role in shaping a currency’s value. Follow the monetary policy decisions of the West African Economic and Monetary Union (WAEMU) and the Central Bank of West African States (BCEAO). Changes in interest rates, reserve requirements, or other policy decisions can significantly impact the XAF.

Diversify Your Portfolio

Diversification is a key risk management strategy. While trading the XAF, consider diversifying your portfolio across different currency pairs. This helps spread risk and minimizes the impact of adverse movements in a single currency. Diversification can also enhance the overall stability of your trading portfolio.

Manage Risk Effectively

Successful traders prioritize risk management. Set realistic risk-reward ratios for each trade and use stop-loss orders to limit potential losses. Avoid over-leveraging, as excessive leverage can magnify both gains and losses. Implementing risk management strategies is crucial to long-term success in Forex trading.

Keep an Eye on Geopolitical Events

Geopolitical events can have a significant impact on currency markets. Stay informed about global geopolitical developments that may affect market sentiment and the XAF. Political stability, trade agreements, and international relations can all influence currency movements.

Use Fundamental Analysis

In addition to technical analysis, incorporate fundamental analysis into your trading strategy. Monitor economic indicators, government policies, and geopolitical events that could influence the XAF. Fundamental analysis provides a broader perspective on the underlying factors affecting a currency’s value.

Stay Updated on Market News

Being well-informed about current events and market news is essential. Subscribe to financial news sources and stay updated on economic reports, announcements, and events that could impact the XAF. Timely information allows traders to make informed decisions and react swiftly to market changes.

Choose a Reputable Forex Broker

Selecting the right Forex broker is crucial for successful trading. Choose a reputable broker with a reliable trading platform, competitive spreads, and excellent customer support. Ensure that the broker complies with regulatory standards to guarantee a secure trading environment.

Trading the XAF successfully in the Forex market requires a combination of research, analysis, and risk management. Traders in Ivory Coast can capitalize on the unique economic factors influencing the XAF by staying informed, using technical and fundamental analysis, and adopting effective risk management strategies.

As with any financial market, continuous learning and adaptation to market dynamics are key to long-term success in trading the XAF.

The benefits of making deposits in XAF when Forex trading

For traders in Ivory Coast, the ability to make deposits into Forex trading accounts using XAF (Central African CFA franc) offers several notable benefits:

- ✅ Firstly, it eliminates the need for currency conversion, reducing costs associated with exchange rates and conversion fees. This ensures that traders can fund their accounts without losing value during the conversion process.

- ✅ Secondly, making deposits in XAF provides a level of familiarity and convenience for Ivory Coast traders, as they transact in their local currency. This eliminates the need to constantly monitor and calculate exchange rates, streamlining the deposit process and making it more straightforward.

- ✅ Furthermore, using XAF for deposits can enhance transparency in financial transactions. Traders can easily track and reconcile their deposits and withdrawals in their local currency, facilitating better financial management. This transparency is particularly valuable for traders in Ivory Coast who want to maintain a clear overview of their trading activities without the complications of dealing with multiple currencies.

- ✅ Overall, the ability to make deposits in XAF not only simplifies the logistical aspects of funding a Forex trading account but also contributes to a more cost-effective and transparent trading experience for traders in Ivory Coast.

In Conclusion

Overall, choosing a Forex broker that accepts XAF accounts allows for a streamlined trading experience in Ivory Coast. But Ivorian traders should also be sure to sign up with a broker that is well-regulated and which offers competitive trading conditions.

You might also like: Forex Trading in the Ivory Coast – A Beginners guide

You might also like:

You might also like:

You might also like:

You might also like:

Frequently Asked Questions

How can I make XAF deposits into my Forex trading account in Ivory Coast?

To make XAF deposits, you can typically use bank transfers, electronic wallets, or other payment methods provided by your Forex broker. Ensure that your chosen broker supports XAF transactions and check for any associated fees or processing times.

Are there any restrictions on Forex trading in Ivory Coast?

While Forex trading is generally accessible in Ivory Coast, it’s important to be aware of any specific regulations.

Ensure that your chosen broker is regulated and complies with local laws. Consulting with financial authorities in Ivory Coast or seeking advice from legal professionals can help ensure compliance.

Can I trade Forex in Ivory Coast using mobile devices?

Yes, many Forex brokers offer mobile trading platforms or apps that support XAF trading. Check with your broker for mobile compatibility and download any necessary apps. Mobile trading allows you to manage your Forex positions conveniently from your smartphone or tablet.

What factors should I consider when choosing a Forex broker for trading with XAF in Ivory Coast?

Consider factors such as regulatory compliance, trading fees, available currency pairs, customer support, and the broker’s reputation. Ensure that the broker offers a user-friendly platform and the necessary tools for successful XAF trading. Read reviews and seek recommendations from other traders.

How can I manage currency risk when trading with XAF?

Managing currency risk involves diversification and staying informed about economic conditions in Ivory Coast and the WAEMU region. Keep an eye on economic indicators, monetary policy decisions, and regional stability. Diversifying your portfolio with other currency pairs can also help mitigate the impact of currency-specific risks.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Ivory Coast

Scam Forex Brokers in Ivory Coast