With a staggering population of over 26 million potential traders, Ivory Coast is not just the largest economy in the West African Economic and Monetary Union but also a promising market for Forex trading.

As the world’s largest exporter of cocoa beans and the fourth-largest exporter of goods in sub-Saharan Africa, the country boasts a strong economic foundation for Forex trading.

In this article you will learn:

- The Best Forex Brokers in the Ivory Coast

- The Best Forex Brokers for Beginners in the Ivory Coast

- The Foreign Exchange Market in the Ivory Coast – Overview

- Is Forex Trading Legal in the Ivory Coast

and much, MUCH more!

The 10 Best Forex Brokers in the Ivory Coast – a Comparison

| 🔎 Forex Broker | 🤝 Accepts Ivory Coast traders | 💴 Min Deposit (XAF) | 💵 Min Deposit (ZAR) |

| 🥇 Exness | ✅Yes | 6,000 XAF | 188,55 |

| 🥈 XM | ✅Yes | 3,000 XAF | 94,28 |

| 🥉 Pepperstone | ✅Yes | 81,000 XAF | 2545,46 |

| 🏅 FP Markets | ✅Yes | 40,000 XAF | 1257,02 |

| 🎖️ AvaTrade | ✅Yes | 60,000 XAF | 1885,52 |

| 🥇 FXTM | ✅Yes | 6,000 XAF | 188,55 |

| 🥈 OANDA | ✅Yes | 0 XAF | R0 ZAR |

| 🥉 FBS | ✅Yes | 600 XAF | 18,86 |

| 🏅 JustMarkets | ✅Yes | 600 XAF | 18,86 |

| 🎖️ HF Markets | ✅Yes | 0 XAF | R0 ZAR |

The 10 Best Forex Brokers in the Ivory Coast (2024)

- ☑️ Exness – Overall, the Best Forex Broker in the Ivory Coast

- ☑️ XM – Free VPS Hosting

- ☑️ Pepperstone – Best Low Spread Broker in the Ivory Coast

- ☑️ FP Markets – Award-Winning Forex Broker

- ☑️ AvaTrade – Best Volatility 75 / VIX 75 Forex Broker

- ☑️ FXTM – Best Broker with Fast Execution

- ☑️ Oanda – The Best Islamic, Swap-Free Account for Ivorian Traders

- ☑️ FBS – 200+ Deposit Options and Withdrawal methods

- ☑️ JustMarkets – Best High Leverage Broker

- ☑️ HF Markets – Offers access to a top rebate program

This comprehensive guide will teach you all you need to know about being a great trader and which forex brokers in The Ivory Coast best suit your trading style. Ivory Coast traders can easily start earning profits from the competitive, exciting environment of forex trading.

- ✅ Finding trustworthy Forex brokers who accept Ivory Coast traders and allow these traders to invest in their currency, the West African Franc (XAF), can be a complex process.

- ✅ Despite Forex trading not being as widespread as expected in The Ivory Coast, multiple globally regulated Forex Brokers accept traders from the country.

- ✅ Ivory Coast offers numerous investment opportunities, a strong economy, and an ever-improving infrastructure. The government is also committed to doubling foreign investment over the next few years, making it a promising environment for Forex trading.

- ✅ The country has a prominent level of monetary stability due to its membership in the West African Economic and Monetary Union and the XAF franc zone, providing a stable environment for Forex trading.

- ✅ The Ivory Coast’s economy is robust and primarily based on agriculture, with the country being the world’s largest exporter of cocoa. Stable exports and robust domestic demand are expected to drive the country’s economic recovery, potentially impacting Forex trading prospects.

Unveiling unique insights into forex trading, we address the queries commonly encountered by aspiring traders in The Ivory Coast. Delve into our platform to discover comprehensive answers to the following questions and more:

- ✅ What are the pros and cons of forex trading in the Ivory Coast?

- ✅ How can traders in the Ivory Coast start trading Forex?

- ✅ Which currency pairs are the best for beginner and professional traders in the Ivory Coast?

- ✅ How to choose the right broker to trade Forex in the Ivory Coast?

- ✅ What are the Basics of Forex Trading in the Ivory Coast?

- ✅ What are the important Forex terms that I must know?

- ✅ What are the best trading strategies for Ivory Coast traders?

Embracing a legal framework, foreign exchange trading in The Ivory Coast falls under the Banking Commission of the West African Economic Monetary Union (WAEMU) purview. Although the Bank of Ivory Coast does not directly regulate forex brokers involved in financial activities, Ivory Coast traders are offered protection by regulatory bodies such as the FSCA, FCA, CySEC, and others.

Our platform showcases a curated selection of reputable brokers who comply with verified regulations and operate locally in The Ivory Coast. Rest assured that these brokers have earned high trust scores and ratings, ensuring a secure trading experience for Ivory Coast traders.

Step-by-Step on How to Start Trading Forex in The Ivory Coast

Step 1: Learn about Forex Trading

Knowing what forex trading is, is crucial before you begin. Foreign exchange, or Forex, trades various currencies against one another. With a daily trading volume of over $6 trillion, the Forex market is the world’s largest and most liquid financial market.

To profit from their trades, traders attempt to forecast changes in currency exchange rates. Online courses, e-books, and articles are just a few learning resources about forex trading.

Step 2: Learn the Basic Forex Trading Terminology

You should be familiar with certain terms used in forex trading. To name a few:

- ✅ Base Currency: This is the first quoted currency in a currency pair.

- ✅ This is the second currency in a currency pair that is quoted.

- ✅ Exchange rate: This is how much one currency is worth about another.

- ✅ Long Position: A trader will “go long” or purchase the base currency if they anticipate an increase in value.

- ✅ Short Position: A trader will “go short” or sell the base currency if they anticipate a decline in its value.

Step 3: Register a Demo Account with A Broker of Your Choice

You can practice trading with a demo account without risking any real money. It’s an excellent way to learn how to trade and become familiar with the trading platform. Ensure the broker you choose is regulated, has a user-friendly platform, and provides excellent customer service.

Step 4: Learn about the Risks of Forex Trading

Trading foreign exchange carries sizable risks. The greatest risk is financial loss, which can result from market volatility, the use of leverage, or a lack of trading expertise. Understanding and managing these risks, such as placing stop-loss orders to reduce potential losses, are essential.

Step 5: Learn about different Trading Strategies

In forex trading, a variety of trading strategies are employed, such as:

- ✅ Day trading is a strategy in which several trades are made daily. Although it takes time and work, it might result in sizable profits.

- ✅ Swing Trading: This tactic keeps trades open for several days to take advantage of price movements.

- ✅ Position trading is a long-term tactic in which trades may be held for a few days, months, or even years.

The best strategy for you will depend on your trading objectives and risk tolerance. Each strategy has advantages and disadvantages.

Step 6: Use Your Demo Account to Practice Trading

Use the demo account to practice your newly acquired trading strategies. This will give you practical experience and aid in your understanding of how various strategies function in actual market circumstances.

Step 7: Register a Real Account When You Are Ready

You can open a real trading account when you are confident in your trading methods and are aware of the risks. Remember to start small and increase your investment gradually as you gain more expertise.

Step 8: Choose a Trading Platform

The best trading platform depends on your individual needs among the many available. MetaTrader 4 and MetaTrader 5 are two popular platforms.

These platforms provide cutting-edge charting features, market indicators, and automated trading capabilities. Consider a platform’s usability, features, and compatibility before choosing it.

Step 9: Deposit Funds into the Account and Start Trading

After setting up your account, you can fund it and begin trading. Most brokers provide various deposit options, such as bank transfers, credit cards, and electronic wallets. Always monitor your trades and only trade with money you can afford to lose.

4 Best Currency Pairs for Beginner Ivory Coast Traders to Trade

As a newcomer to Forex trading in The Ivory Coast, it is essential to start with currency pairs that are more predictable and less volatile. Here are four currency pairs often recommended for beginners due to their lower risk and greater liquidity.

- EUR/USD: This currency pair symbolizes the fusion of two formidable economic powerhouses: the European Union and the United States. It stands as the most actively traded pair with narrow spreads, thus making it an ideal option for novice traders. Its inherent stability and extensive availability of analytical data further enhance its attractiveness.

- USD/XAF: Involving the US dollar and the West African XAF franc, which serves as the currency of the Ivory Coast, this pair serves as a crucial gateway for novice traders in The Ivory Coast to comprehend the behavior of their local currency. Valuable insights can be gained by observing and analyzing this pair.

- GBP/USD: Commonly called the “cable,” this currency pair exhibits high liquidity and low spreads. Compared to the EUR/USD, it possesses a moderate level of volatility, offering increased opportunities for both profit and potential loss.

Finally, The USD/JPY – A representation of the US and Japanese economies, this currency pair is renowned for its liquidity and typically narrow spreads. Notably, it tends to be less influenced by economic news from the Eurozone, thus granting a degree of diversification to traders.

4 Best Currency Pairs for Professional Ivory Coast Traders to Trade

For seasoned Forex traders in The Ivory Coast, the focus often shifts towards maximizing profit potential. This typically involves trading in currency pairs that offer higher volatility and greater opportunities.

Here are four such currency pairs that experienced traders in The Ivory Coast often consider.

- ✅ EUR/XAF: This currency pair combines the Euro and the West African XAF franc. Since the XAF franc is pegged to the Euro, professional traders in The Ivory Coast may leverage this pair to capitalize on minor fluctuations and execute advanced trading strategies.

- ✅ GBP/XAF: Although less prevalent, this currency pair can present intriguing prospects for experienced traders possessing in-depth knowledge of the UK and West African economies.

- ✅ USD/ZAR: Involving the US dollar and the South African Rand, this currency pair holds significance due to the economic ties and geographic proximity between South Africa and Ivory Coast. Savvy traders with expertise in regional economic trends might be able to anticipate movements in this pair, thus capitalizing on potential opportunities.

Given Ivory Coast’s prominent role as a major exporter of commodities such as cocoa beans, seasoned traders may opt to engage in pairs like CAD/XAF or AUD/XAF, where the currencies belong to countries heavily engaged in commodity markets. Commodity fluctuation can impact these pairs, presenting profitable openings for astute traders.

5 Most Successful Forex Traders in The Ivory Coast

While we could not pinpoint the most successful forex traders specifically in The Ivory Coast, here are the 5 most successful Forex Traders in Africa overall:

- ✅ Jabulani Ngcobo

- ✅ Louis Tshakoane Junior

- ✅ Sandile Shezi

- ✅ Ref Wayne

- ✅ George van der Riet

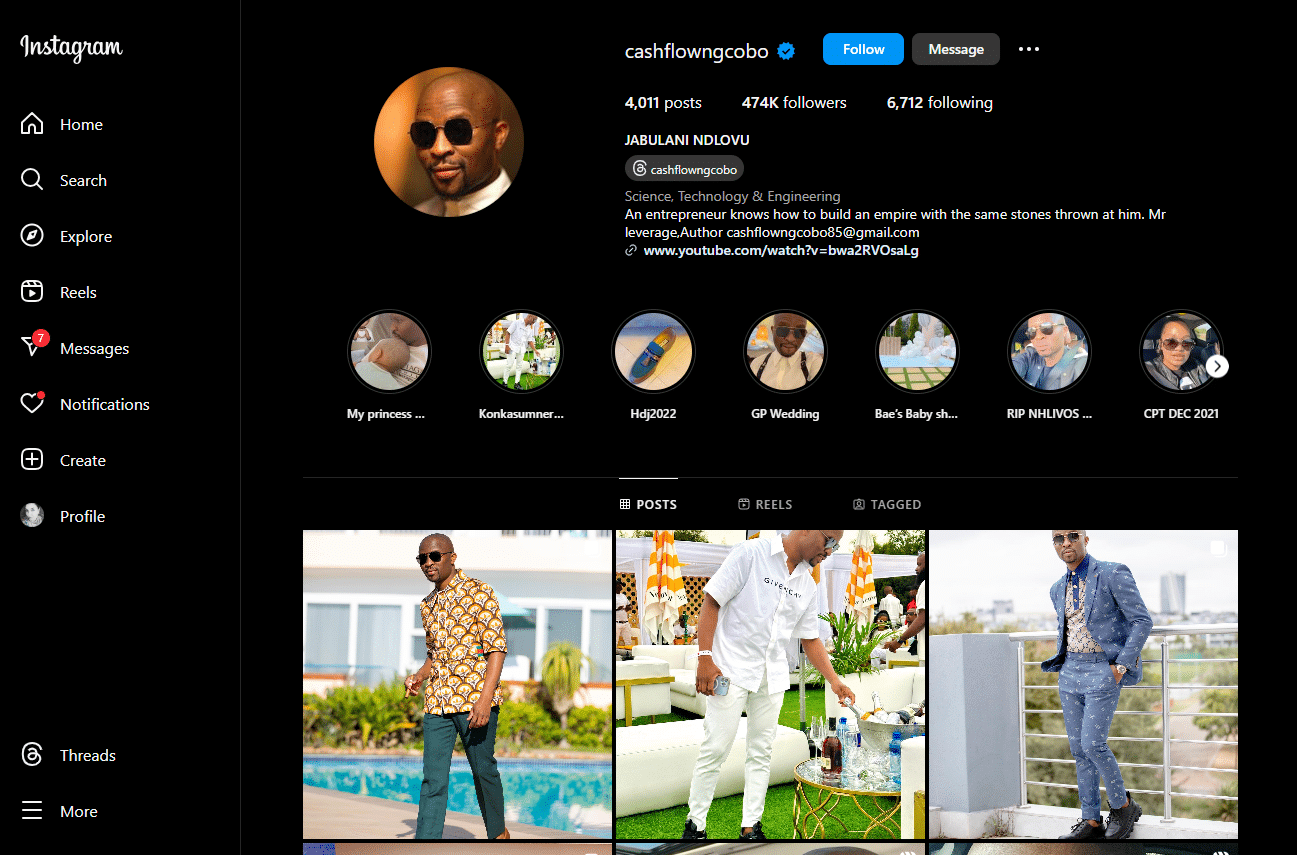

Jabulani Ngcobo

Jabulani Ngcobo, a South African individual, has achieved a net worth of approximately US$2.5 billion, primarily through his endeavors in Forex Trading. His wealth accumulation has positioned him as a prominent figure in the financial sphere.

In addition to his financial achievements, Jabulani has taken an active role in various ventures, including delivering lectures dedicated to stock exchange trading and engaging in motivational speaking engagements throughout South Africa.

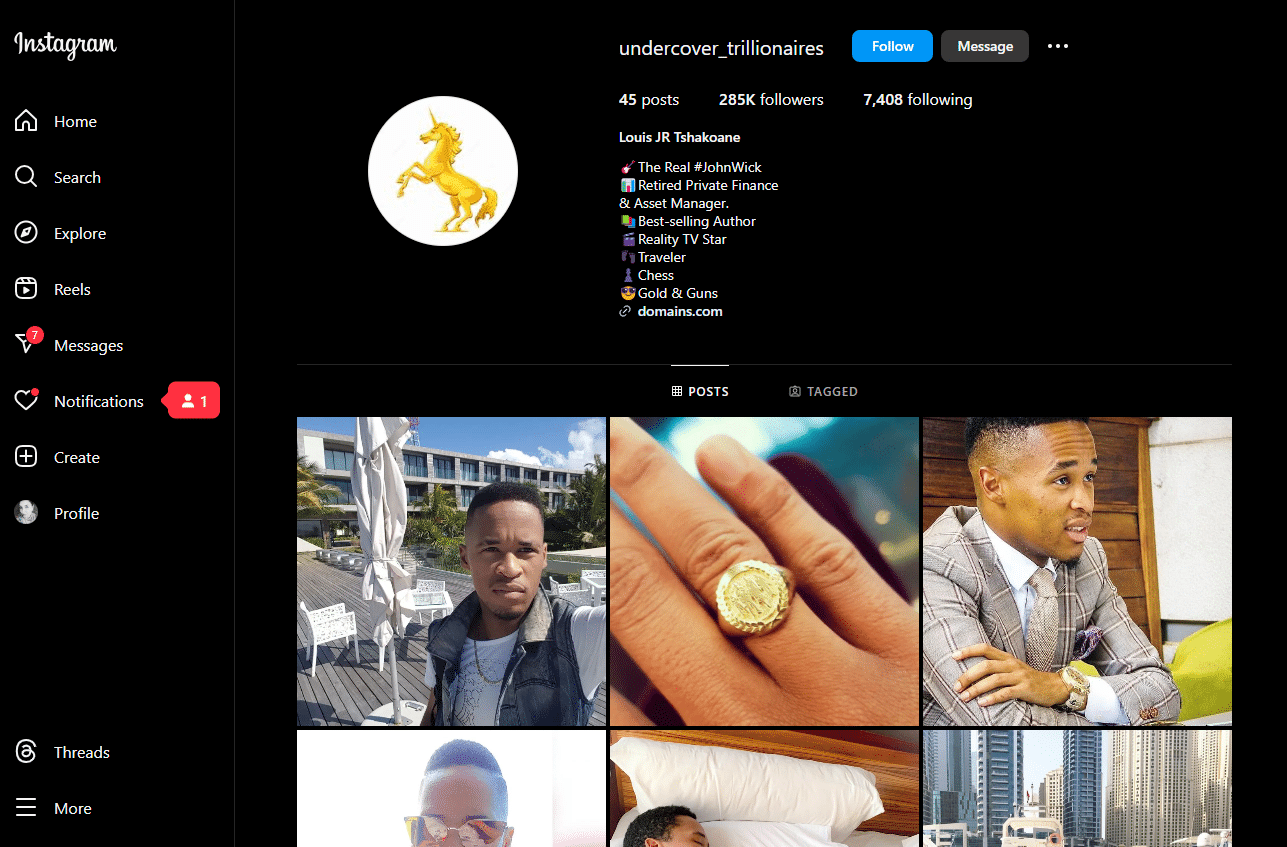

Louis Tshakoane Junior

Louis Tshakoane Junior is one of the most accomplished people in Africa, and his extraordinary success story began when he was still a teenager. Louis founded Botho Gym, his first business, during his adolescence with the help of Sir Richard Branson.

The gym was created to give back to the Tembisa neighborhood and mentor young people, steering them clear of criminal activity, drug abuse, and excessive alcohol consumption. Louis Tshakoane has developed an impressive professional profile through his dedication and drive.

He gained experience at UBS and Lamborghini, which has greatly helped him in his subsequent endeavors. He later founded Undercover Millionaires, a network of entrepreneurs who work together to enhance people’s lives and support underserved areas.

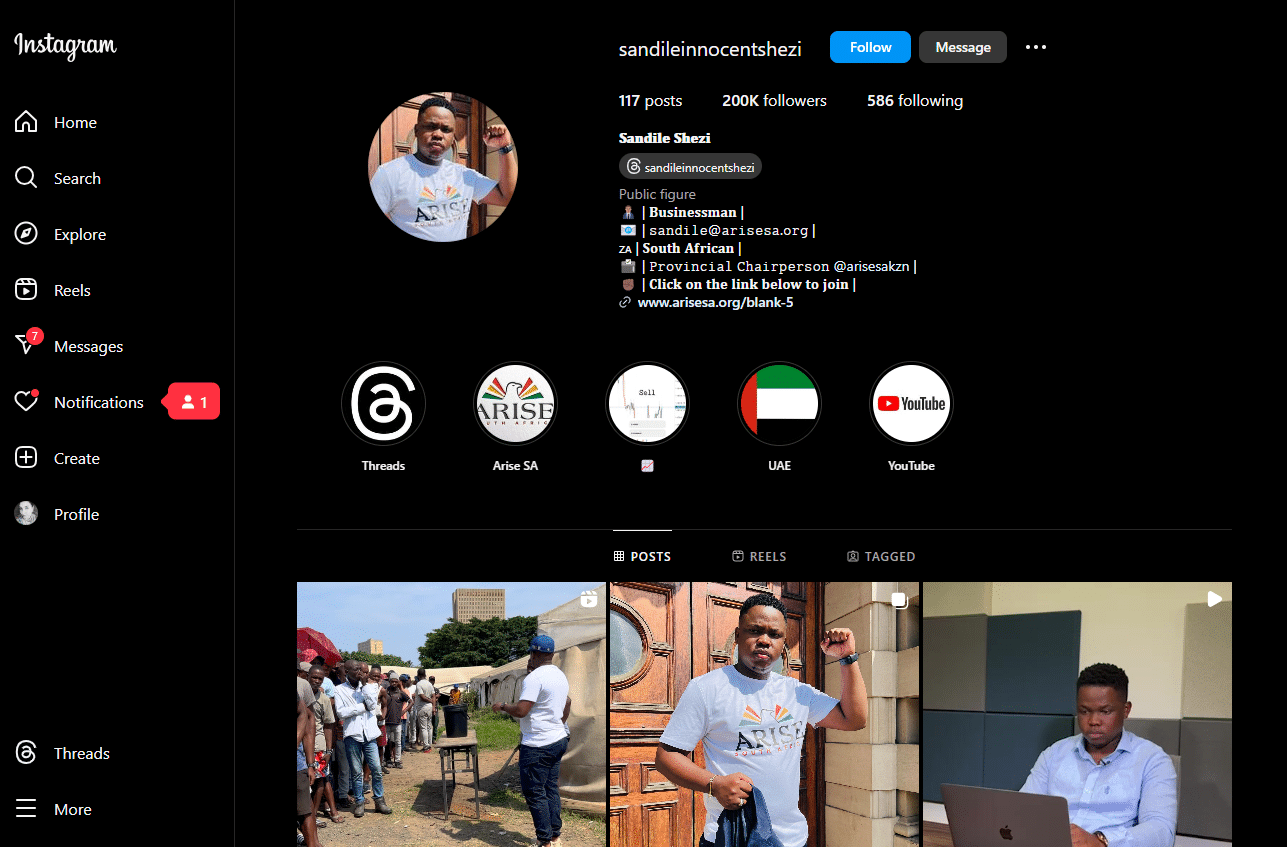

Sandile Shezi

Sandile Shezi is well-known as a trader in Africa and has attained significant success. He is admired for his success in Forex trading and his propensity to take calculated risks. Sandile currently holds the distinction of being one of South Africa’s youngest millionaires.

Aspiring traders setting their career paths can find inspiration and motivation from their journey and successes.

Sandile founded the Global Forex Institute, a company devoted to educating people from various backgrounds about forex trading to share his knowledge and give others opportunities.

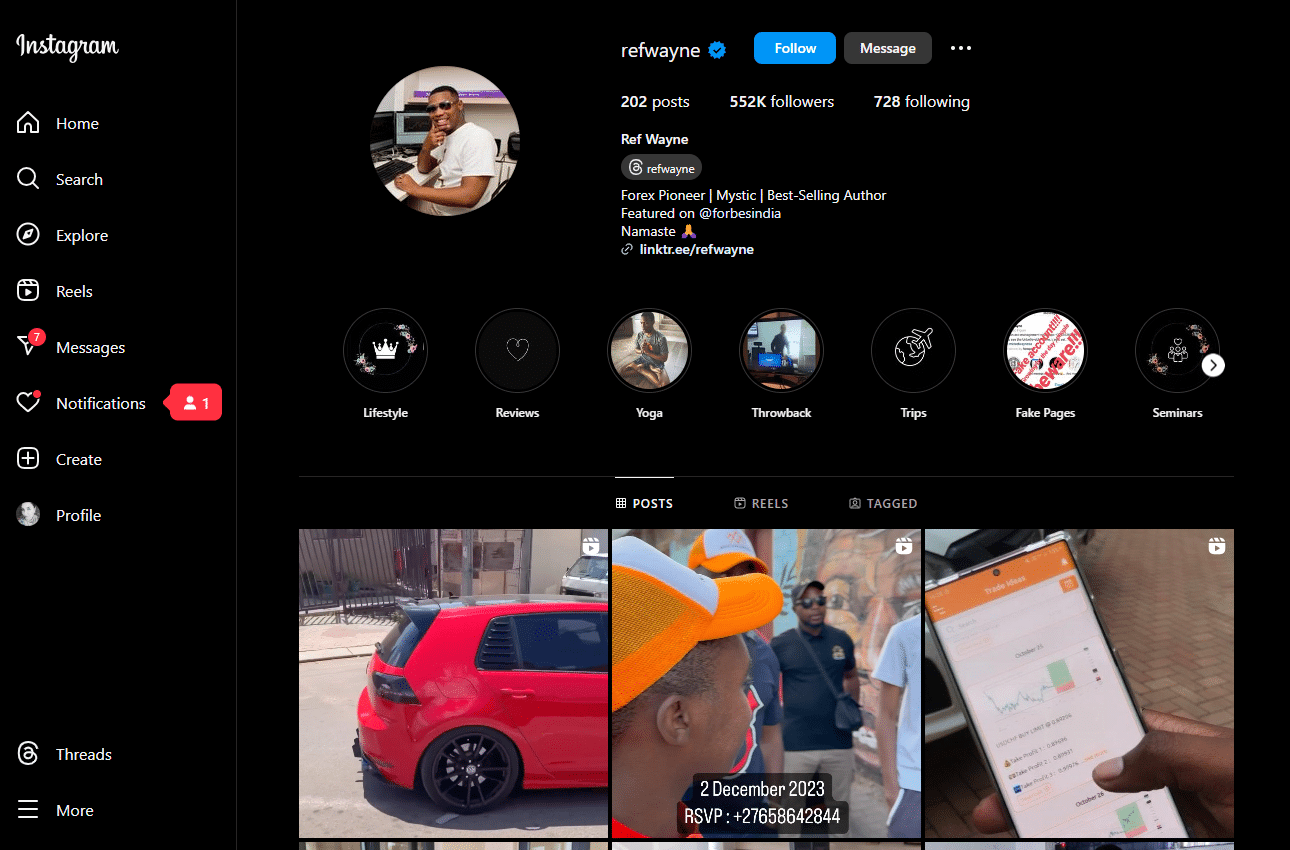

Ref Wayne

Ref Wayne is a well-known trader in Africa renowned for leading a lavish lifestyle and motivating many people to start trading Forex. His success in the foreign exchange market is a living example of this industry’s potential for financial gain.

Ref Wayne is notable for knowing various subjects, including business, philosophy, and psychology, strengthening his influence as a teacher.

He frequently leads educational seminars and beginner workshops on both Forex and cryptocurrency trading, passing along his expertise to eager students.

George van der Riet

George van der Riet, a well-known African figure, is praised for his accomplishments in the forex market. His dedication to lifelong learning and in-depth familiarity with forex trading were distinguishing characteristics of his journey to financial success.

Because of his time working for financial institutions in the UK, George gained the skills and knowledge required to succeed in Forex trading.

He works with Sandile Shezi to empower young people by helping them understand forex trading so they can successfully navigate this lucrative industry.

How to Choose a Forex Broker in The Ivory Coast

Choosing a Forex broker is a critical step in your trading journey, especially in a place like Ivory Coast, where Forex trading is still growing. Here are some steps to guide you:

- ✅ First, check whether a credible financial authority regulates the broker. Regulation ensures that the broker operates under the guidelines of the financial body and provides a level of security for your investment.

- ✅ You should look for a broker that offers a wide range of currency pairs, especially those you are interested in trading. This includes major pairs like EUR/USD, minor pairs, and exotic pairs, which might include the West African Franc (XAF).

- ✅ The broker should be user-friendly and stable, with various trading tools. Consider brokers who offer platforms like MetaTrader 4 or MetaTrader 5, which are popular among Forex traders.

- ✅ Brokers make money through spreads (the difference between the buy and sell price) and commissions. Look for a broker offering competitive spreads and low commission rates.

- ✅ Good customer service is essential, especially for new traders. Check if the broker has a responsive customer support team, preferably one that provides service in your local language and operates 24/7.

- ✅ Check if the broker supports deposit and withdrawal methods that are accessible and cost-effective for you. This could be bank transfers, credit cards, or online payment systems.

- ✅ Especially for beginners, brokers that provide educational resources (like webinars, eBooks, and articles) and trading tools (like economic calendars, analytics, etc.) can be beneficial.

- ✅ A broker that offers a demo account is also a viable choice, as it allows you to practice trading without risking real money.

Lastly, look at reviews and testimonials from other traders in The Ivory Coast to understand the broker’s reputation.

Before You Start Trading, Read these Few Basics to Forex Trading

Understanding What Forex Trading Is

Forex trading is the buying and selling of currencies. Traders speculate on the fluctuations in the values of different currency pairs to profit from these changes.

The Forex market is decentralized and operates 24 hours a day, five days a week, making it accessible to traders worldwide at any given time.

Knowing The Major Currency Pairs

There are many currency pairs that you can trade, but some of the most traded pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

These major pairs represent some of the world’s largest economies. Understanding these pairs and their dynamics is essential for any Forex trader.

Learning The Basics of Technical and Fundamental Analysis

To make informed trading decisions, traders use two main types of analysis: technical and fundamental. To anticipate price changes, technical analysts analyze past trends by looking at price charts

On the other hand, fundamental analysis involves evaluating the economic, social, and political forces that may affect the supply and demand of an asset. Both types of analysis are crucial to developing a solid trading strategy.

Understanding Leverage and Margin

With the help of leverage, investors can manage a larger portfolio with the same amount of capital. It is always expressed as a ratio. For example, 100:1 or 1:100, meaning you can control $100,000 with just $1,000.

However, Ivory Coast traders must remember that leverage can amplify profits and losses, making it a tool to use with caution.

Margin, on the other hand, is the amount of money you need to open a position. Furthermore, it is a “good faith” deposit required to maintain open positions. Understanding how leverage and margin work is essential before you start trading.

Risk Management in Forex Trading

Forex trading can be highly profitable but comes with significant risks. Learning how to manage your risk is one of the most important aspects of Forex trading.

This can involve setting stop-loss orders to limit potential losses, diversifying your trading portfolio, and only risking a small percentage of your trading capital on any single trade.

Importance of a Trading Plan

A trading plan outlines your financial goals, risk tolerance, methodology, and evaluation criteria. It serves as a roadmap for trading activities and helps keep emotions like fear and greed in check. Having a well-thought-out trading plan is crucial for long-term success in Forex trading.

Top 20 Need-to-Know Forex Terms

Here are 20 essential forex terms and their definitions to help you navigate the world of forex trading:

- ✅ Forex – Foreign exchange, or Forex, is the abbreviation for the global market for exchanging different national currencies.

- ✅ Currency pair – A pair of currencies that are exchanged side by side. For example, the currency pair is EUR/USD.

- ✅ Base Currency – A currency pair’s leading listed currency. It illustrates the ratio of the quote currency to the base currency needed to buy one unit.

- ✅ Quote Currency – The second currency in a pair of currencies. It displays the amount that must be exchanged for one unit of the base currency.

- ✅ Pip stands for “Percentage in Point,” an acronym. It is the smallest price change a particular exchange rate is capable of.

- ✅ Lot – The predetermined amount of a currency pair that traders may purchase or dispense.

- ✅ Leverage – A tool made available by brokers that enables traders to manage bigger sums of money with comparatively little capital.

- ✅ Margin is the sum a trader must deposit to open a new position. It serves as a kind of collateral.

- ✅ Spread – The discrepancy between a currency pair’s ask and bid prices.

- ✅ Bid Price – The price the market is willing to purchase a particular currency pair.

- ✅ Ask Price – The price at which a particular currency pair is willing to be sold in the market.

- ✅ Long Position – The phrase “long position” is used when a trader purchases a currency pair hoping its value will rise.

- ✅ A short position is when a trader sells a currency pair in anticipation of a decline in value.

- ✅ Slippage – When a trade’s execution price, because of market volatility, is lower than the price at which it was ordered.

- ✅ Stop-Loss Order – An order to sell a security when its price reaches a specific level. It is intended to restrict the loss an investor can sustain from a trading position.

- ✅ Take-Profit Order – An instruction to close a position when the market moves a certain amount in the position’s favor.

- ✅ Technical analysis is a technique for assessing securities that involves looking at data produced by market activity, such as previous prices and volume.

- ✅ The fundamental analysis assesses security by determining its intrinsic value and looking at relevant qualitative and quantitative economic, financial, and other factors.

- ✅ Swap – If you hold your trade overnight, you will be charged a rollover fee at the end of each trading day.

- ✅ Liquidity – An asset can be converted into cash quickly and without a price reduction. Forex typically has to do with the number of traders and the volume of money exchanged.

Understanding Forex Charting

Every forex trader needs to be proficient in using forex charts. Charts are an essential tool for technical analysis because they visually represent price changes over a given time frame.

Line Charts

The line chart is the most basic type of chart used in forex trading. They are created by drawing a line by joining several data points together. In addition to the open, high, low, or median prices, this is frequently the closing price.

Bar Charts

A bar chart offers more data than a line chart does. Each bar represents a specific time, such as one hour, day, or week.

The horizontal lines on either side of the bar represent the opening and closing prices, with the top representing the highest price realized during the period and the bottom representing the lowest price.

Candlestick Charts

The same data is presented in a candlestick chart, which is more aesthetically pleasing than a bar chart. The open, high, low, and close prices for each “candlestick” are each represented for a particular time frame.

The candlestick’s main portion is referred to as the “body,” and the lines that extend above and below the body are referred to as the “wicks” or “shadows.”

Effective Risk Management for Ivory Coast Forex Traders

Risk management is key to profitable forex trading, particularly for traders in The Ivory Coast, where large currency fluctuations occur. It is important to comprehend the general idea of risk management strategies before getting into the details.

Risk management refers to traders’ actions to safeguard their investments from unfavorable market movements in forex trading.

Understanding Risk/Reward Ratio

A key idea in risk management is the risk/reward ratio. It deals with how much risk you will accept in exchange for a specific reward level. For instance, a risk/reward ratio of 1:2 means that you risk $1 in hopes of earning $2.

For traders, aiming for a potential reward higher than the risk they are willing to accept is advisable.

Setting Stop-Loss and Take-Profit Points

Tools that aid traders in risk management include stop-loss and take-profit points. A stop-loss order limits the trader’s loss by automatically terminating a trade when the price reaches a particular level.

A take-profit order, on the other hand, closes a trade once the price reaches a predetermined level, locking in a trader’s profit.

Position Sizing

Choosing how much of your capital you’re willing to risk on each trade is known as position sizing. According to conventional wisdom, never risk more than 1% to 2% of your trading account on a single trade. This will protect your trading capital and keep losses under control.

Best Forex Strategies for Ivory Coast Traders Revealed

Your ideal forex trading strategy will depend on your unique situation, objectives, and risk appetite. Before using a strategy in live trading, it is critical to comprehend it, practice it in a demo account, and assess how well it fits your trading style.

The most popular strategies for Ivory Coast traders are listed below.

Trend Following

Trading strategies like trend following help investors profit from rising or falling in value markets.

By employing this strategy, traders can recognize the trend’s direction and place trades accordingly. For instance, traders might look to buy when the price drops and sell when it rises if the EUR/USD is trending upward.

Range Trading

When a market is trending sideways, range trading is a good strategy. Aiming to buy at the lower range (support) and sell at the upper range (resistance), traders will identify support and resistance levels.

Scalping

Scalping is a strategy that involves entering into many trades quickly to profit from minute price changes. This approach needs time, focus, and in-depth comprehension of short-term price changes.

Swing Trading

Swing trading is a tactic that aims to profit from market increases for a few days to several weeks. Swing traders use technical analysis to identify trading opportunities and may also use fundamental analysis to inform their choices.

Spot, Forwards, and Futures in Forex Trading

Distinguishing themselves as distinct trading instruments within the foreign exchange market, spot, forwards, and futures each possess unique characteristics and serve different purposes.

For Ivory Coast traders seeking comprehensive knowledge, here is an exclusive elucidation of these financial instruments.

Spot Market

The spot market constitutes the foundation of forex trading, representing the most utilized form. In this type of trading, currencies are exchanged promptly at the prevailing market price, known as the spot price.

Typically, settlement occurs within two business days, with transactions settled “on the spot.” The spot market is the primary avenue for immediate currency buying and selling.

Key Attributes of the Spot Market:

- ✅ Immediate exchange of currencies at the current market rate.

- ✅ Settlement takes place within two business days.

- ✅ Traders can capitalize on short-term price and currency fluctuations.

- ✅ Due to its extensive participant base, this market boasts high liquidity and tight spreads.

Benefits of the Spot Market for Ivory Coast Traders:

The spot market provides Ivory Coast traders with swift access to the foreign exchange market, facilitating the exploitation of short-term trading opportunities and efficient currency conversions.

Forwards Market

Forwards encompass agreements between two parties to exchange currencies at a predetermined price (forward rate) on a future date.

These contracts are traded on the over-the-counter (OTC) market, tailored to the specific requirements of buyers and sellers. Unlike spot trading, forwards enable traders to lock in exchange rates for future transactions.

Key Attributes of the Forwards Market:

- ✅ Future exchange of currencies at a predetermined price on a specified date.

- ✅ Contracts are customizable to meet specific needs.

- ✅ Settlement date predetermined in advance.

- ✅ Transactions occur in the decentralized OTC market.

Benefits of the Futures Market for Ivory Coast Traders:

Forwards can prove advantageous for Ivory Coast traders seeking to hedge against future currency fluctuations or fulfill specific foreign exchange requirements related to business operations or international transactions.

Futures Market:

Futures contracts entail standardized agreements to buy or sell currencies at a predetermined price (future price) on a future date.

These contracts are traded on regulated exchanges such as the Chicago Mercantile Exchange (CME) and possess predetermined contract sizes and expiration dates. Institutional traders and speculators primarily engage in futures contracts.

Key Attributes of the Futures Market:

- ✅ Standardized contracts with fixed durations and contract sizes.

- ✅ Trading conducted on regulated markets.

- ✅ Obligation to buy or sell the specified currency at a predetermined price and date in the future.

- ✅ Daily mark-to-market and settlement of gains or losses.

Benefits of the Futures Market for Ivory Coast Traders:

While individual retail traders in The Ivory Coast may have limited access to trading forex futures, comprehending futures contracts offers insight into the broader forex market and the roles played by institutional participants.

Such understanding can enhance their overall understanding of the market dynamics.

An Introduction to Forex Brokers

In the exciting world of Forex trading, brokers play a crucial role as intermediaries between the trader and the market.

They provide platforms for trading, give access to market data, and often offer additional services like educational resources and customer support. This section will guide Ivory Coast traders through the essentials of understanding Forex brokers.

What is a Forex Broker?

A Forex broker is a facilitator, allowing traders to buy and sell foreign currencies through a dedicated trading platform. These transactions occur within the largest and most liquid currency market globally.

By partnering with a Forex broker, traders gain access to a dynamic marketplace where they can capitalize on the fluctuations of various currency pairs, enabling them to participate in the exciting world of Forex trading.

Types of Forex Brokers

There are two main types of Forex brokers – dealing desk brokers and non-dealing desk brokers.

- ✅ Dealing Desk Brokers (Market Makers): These brokers create a market for their clients, providing buy and sell quotations for various currency pairs. They usually take the opposite side of their clients’ trades and make money through the spreads.

- ✅ Non-Dealing Desk Brokers (STP/ECN): These brokers do not take the opposite side of their clients’ trades. Instead, they route orders directly to the interbank market or liquidity providers. They make money by charging a commission on each trade or adding a markup to the spread provided by the liquidity providers.

How do Forex Brokers Make Money?

The currency market depends heavily on forex brokers because they give traders a place to buy and sell currencies. But how precisely do they make a living? Understanding how Forex brokers profit makes informed decisions and selecting the best broker easier.

Spreads

Spreads, the difference between the ask and bid prices of currency pairs, are the primary source of revenue for Forex brokers.

The asking price represents the lowest price a seller is willing to sell a particular currency, while the bid price represents the highest price a buyer is willing to pay. Forex brokers facilitate transactions and generate revenue on the foreign exchange market by utilizing these price differences.

The broker applies the spread when you open a trade, which puts you “down” by the spread’s size at the outset of the transaction. The market must move in your favor by the spread amount to break even.

The broker, the currency pair, and market volatility can all affect the spread. Since they lower the cost of trading, brokers with lower spreads are typically more appealing to traders.

Commissions

Some brokers impose a commission on each trade in place of or in addition to the spread, particularly those that provide direct access to the interbank market.

Typically, commissions are either a fixed sum per trade or a percentage of the total trades. For instance, a broker might charge $2 for every $100,000 traded.

Overnight Interest Rates (Swaps)

When trading currencies, one currency is bought, and another is sold. The respective nation’s central bank determines each currency’s associated interest rate.

You profit from a positive swap if the interest rate on the currency you buy is higher than the interest rate on the currency you sell. If the interest rate of the currency you purchase is lower, on the other hand, you pay the difference in interest rates (a negative swap).

When traders keep positions open throughout the night, brokers can profit from the swap. Depending on the interest rate differential and the broker’s swap rates, the swap may be advantageous to the broker.

Some brokers offer swap-free accounts for traders who cannot earn or pay the interest due to their religious beliefs. Islamic accounts are a common name for these accounts.

Additional Services

The extra services that forex brokers provide to traders may also bring in money. These might include access to trading webinars and seminars, premium research and analysis, cutting-edge trading tools, and educational resources.

Some brokers may charge for these services to entice and keep clients, while others may provide them without charge.

Forex Brokers in The Ivory Coast

Forex trading is gaining popularity in The Ivory Coast, and many globally regulated Forex brokers accept traders from the country.

When choosing a broker, Ivory Coast traders should also consider factors like the availability of customer service in French or English, the ability to deposit and withdraw funds in West African Francs (XAF), and compatibility with local payment methods.

Ask and Bid Price in Forex Trading

It is impossible to overstate the importance of bid and ask prices in forex trades. To assess trade costs and their potential impact on profitability, traders in the Ivory Coast must understand the significance of bid and ask prices.

Furthermore, the bid-ask spread should be considered when choosing a broker because tighter spreads can result in lower trading costs.

Ask Price

A trader can buy a currency pair from a market maker or broker at the ask price, also known as the offer price.

The market’s willingness to exchange the base currency for the quote currency is indicated by this term. The upper part of the bid-ask spread comprises the ask price, which is always higher than the bid price.

Bid Price

Contrarily, the bid price determines a trader’s ability to sell a currency pair to a market maker or broker.

It displays the price at which the market is prepared to exchange the base currency for the quoted currency. The lower part of the bid-ask spread is represented by the bid price, which is consistently lower than the ask price.

Bid-Ask Spread

The difference between the ask and bid prices is called the “bid-ask spread.” It takes into consideration the expense of starting or stopping a trade.

The spread varies between currency pairs and brokers, typically expressed in pip increments. A narrower spread denotes greater liquidity, while a wider spread may indicate decreased liquidity or increased market volatility.

Spread and Pips in Forex Trading

Spread and pips are key terms in forex trading that determine transaction costs and provide information on the liquidity and volatility of currency pairs.

Spread and pip concepts are crucial for traders in the Ivory Coast to understand because they directly impact their trading costs and potential profits. To maximize trading results, evaluating the spreads offered by brokers and choosing those with competitive spreads is essential.

Spread

The spread in the world of foreign exchange refers to the discrepancy between the ask and bid prices. It is frequently expressed in basis points, also called pips, and represents the cost of trading.

Market liquidity, volatility, and the broker’s chosen pricing model impact the spread. Fixed or variable spreads are available from brokers; the latter typically contracts during increased liquidity.

Pips

The smallest unit by which the price of a currency pair can fluctuate is referred to as a “pip,” which is derived from “percentage in point.”

Except for currency pairs involving the Japanese yen, which corresponds to the second decimal place, it represents the fourth decimal place for many currency pairs. Pips allow traders to monitor price changes, compute gains or losses, and assess how the spread affects their trades.

An Introduction to Day Trading

As the name implies, day trading entails opening and closing trades during a single trading day. Due to its potential for quick returns and capacity to leverage small price movements, this type of trading is well-liked among many Forex traders, including those in The Ivory Coast.

What is Day Trading?

Buying and selling a financial instrument on the same day or several times throughout the day is known as day trading. The goal is to profit from minute price changes in extremely liquid markets, such as the forex market.

Benefits and Risks of Day Trading

Benefits

Day trading offers quick profits and does not require holders of positions to hold them overnight, preventing potential negative price movements after the market closes.

Risks

Due to the market’s rapid pace and the use of leverage, it also carries a high level of risk. Being consistently profitable takes a lot of time, perseverance, and experience.

Skills Required for Day Trading

Technical analysis, trading platforms, and a thorough understanding of the Forex market are necessary for successful day trading. Traders must feel at ease making prompt decisions, controlling risk, and dealing with the stress of a volatile trading environment.

An Introduction to Swing Trading

Another well-liked trading method among Forex traders, including those in The Ivory Coast, is swing trading. It entails holding trades for a few days to a few weeks to capitalize on short- to medium-term price fluctuations.

What is Swing Trading?

With swing trading, gains in a financial instrument are sought after over a few days to several weeks. Swing traders frequently set short- to medium-term goals and use stop losses to reduce risk while using technical analysis to identify trading opportunities.

Benefits and Risks of Swing Trading

Benefits

Compared to day trading, swing trading has the potential for higher profits because trades have more time to reach their profit targets. Additionally, it requires less screen time than day trading.

Risks

Swing trading exposes investors to market risk over the weekend and overnight. The trader’s aptitude for spotting market trends and patterns is crucial to swing trading success.

Skills Required for Swing Trading

Swing trading calls for patience, risk management, and a solid grasp of technical analysis for trades to develop to their full potential. Understanding fundamental analysis can also be helpful because macroeconomic developments can affect the market’s direction over the medium term.

An Introduction to Scalping in Forex Trading

The goal of the quick trading strategy known as “scalping” is to capitalize on minute changes in price. Due to its rapid pace and potential for quick profits, it is well-liked by many Forex traders, including those in The Ivory Coast.

What is Scalping Trading?

The goal of the trading strategy known as “scalping” is to take advantage of small price changes in a currency pair by placing numerous trades throughout the day. High trade volumes characterize it and necessitate a strict exit plan to reduce losses.

Benefits and Risks of Scalping Trading

Benefits

Due to its emphasis on small price changes, scalping can offer various trading opportunities. Because trades are typically opened and closed quickly, it reduces exposure to market volatility.

Risks

Scalping is difficult and takes a lot of time and focus. If trades are not managed properly, it also has the potential for rapid losses.

Skills Required for Scalping Trading

Scalping requires making split-second decisions, strict self-control, and quick chart and price movement analysis. Executing trades quickly and successfully requires a solid understanding of trading platforms and tools.

Base and Quote Currencies in Forex Trading

Understanding the ideas of base and quote currencies is essential in forex trading. In a forex transaction, the two currencies are referred to by these terms. Understanding these concepts can significantly impact traders’ success in the Ivory Coast and other countries.

What are Base and Quote Currencies?

The base currency is listed first in a forex pair, followed by the quote (or counter) currency. For instance, the base currency in the EUR/USD pair is EUR, and the quote currency is USD.

Using the exchange rate, you can determine how much of the quoted currency is required to purchase one unit of the base currency.

How Base and Quote Currencies Impact Trading

Making trading decisions requires having a solid understanding of the base and quote currencies. When you purchase a currency pair, you sell the quote currency and buy the base currency.

In contrast, when you sell a currency pair, you do so while purchasing the quote currency. As a result, you should consider any potential economic influences on each currency in the pair when developing your trading strategy.

The Importance of Market Sentiment in Forex Trading

Market Sentiment is important in forex trading because it describes investors’ general perspective toward a specific market or financial instrument.

Understanding market sentiment can give traders in the Ivory Coast useful information about potential market movements.

Understanding Market Sentiment

Market sentiment is frequently divided into bullish (positive) and bearish (negative) categories. Many bullish traders believe prices will rise, while those who are bearish on the market believe prices will decline.

Several variables can affect market sentiment, including economic indicators, geopolitical developments, and market news.

Using Market Sentiment in Trading

Traders can use market sentiment as a contrarian indicator. If most traders are bullish, it might be a sign of a market top, and if most are bearish, it might be a sign of a market bottom.

Extreme sentiment, however, can cause significant price movements in the desired direction. As a result, a thorough trading strategy should include considering market sentiment and using other analytical tools.

The Effects of Leverage on Forex Trading

Leverage is a potent tool that enables traders to manage larger positions than their account balance would typically allow. Leverage can increase profits and losses, making it crucial for traders in the Ivory Coast and elsewhere to comprehend.

Understanding Leverage in Forex Trading

When leverage is expressed as a ratio, such as 100:1, a trader can control $100 of the market with just $1 in their account. As a result, a trader may open a position significantly larger than their account size would normally permit.

Leverage’s Effect on Trading

Leverage can boost potential earnings but also magnifies the risk of loss. The full position value, not just the amount the trader’s account balance contributed, will be used to calculate losses if a leveraged trade goes against the trader.

As a result, it is essential to use leverage wisely and in concert with efficient risk management techniques.

5 Best Forex Brokers in The Ivory Coast with Free VPS Hosting

A Virtual Private Server (VPS) is significant in forex trading, providing traders with numerous advantages. Firstly, a VPS ensures uninterrupted trading even with an unstable internet connection, allowing traders to remain active in the market without disruption.

Secondly, a VPS optimizes the performance of trading applications, such as Expert Advisors (EAs), by providing a stable and reliable environment, minimizing potential disruptions and trade execution delays.

Moreover, a VPS offers faster trade execution times than trading on a physical computer, reducing the risk of slippage.

Additionally, VPS services prioritize security, protecting traders’ data and assets through robust measures. By utilizing a VPS, Ivory Coast traders can experience enhanced trading efficiency.

Below we have provided information on the 5 Best Forex Brokers that offer VPS and a breakdown of their VPS services.

Exness

Exness offers Virtual Private Server (VPS) hosting services designed to cater to the needs of Ivory Coast traders. Their strategically located servers near the MT servers ensure fast and secure trading for users worldwide.

With Exness’ VPS, Ivory Coast traders can trade seamlessly even with an unstable internet connection. One of the key advantages of using Exness’ VPS is the optimization of Expert Advisor (EA) performance.

Regardless of internet stability, the VPS ensures the smooth operation of EAs, facilitating efficient trade execution and minimizing disruptions. Traders interested in accessing Exness’ VPS hosting can contact their support team through email or live chat to initiate the process.

It is important to note that certain requirements, such as maintaining a free margin greater than $100 and a total deposit of at least $500, need to be met to qualify for VPS hosting.

By utilizing Exness’ VPS hosting, Ivory Coast traders can enjoy reliable and fast trade execution, regardless of location or internet connection stability, allowing them to focus on their trading strategies.

AvaTrade

AvaTrade offers a Virtual Private Server (VPS) service to select clients, subject to specific terms and conditions. This service provides Ivory Coast traders with a reliable and stable platform for uninterrupted trading.

By utilizing AvaTrade’s VPS hosted on a robust and secure server, traders can expect a dependable environment for the seamless execution of their trading applications.

Furthermore, AvaTrade’s VPS offers faster trade execution times than a physical computer, reducing potential delays and slippage.

HFM

HFM strives to enhance the trading experience for Ivory Coast traders by offering innovative solutions and exceptional customer service. As part of their commitment, HFM has partnered with Beeks Financial Cloud, a leading provider, to provide traders with free and high-quality VPS hosting tailored to their specific trading requirements.

With Beeks Financial Cloud’s extensive network presence across nine international data centers, Ivory Coast traders can expect lightning-fast response times, enabling seamless transactions with minimal latency.

HFM’s primary objective is to deliver low-latency and reliable VPS hosting solutions that meet clients’ platform needs, ultimately improving the trading performance of Ivory Coast traders.

Eligible traders who fulfill certain deposit and trading requirements may qualify for HFM’s complimentary VPS plans, while additional features and capabilities are available through paid subscriptions priced at $30 per month.

FBS

The FBS VPS server allows Ivory Coast traders to take their trading to a new level. By setting up a VPS server, traders can experience unparalleled convenience, speed, and reliability in trading activities.

One of the key advantages of the FBS VPS server is its 24/7 operation, ensuring uninterrupted trading even in offline mode. Traders can rely on the VPS server’s protection from power outages and connection interruptions, providing a secure and stable environment for their trading activities.

The fast and stable connection to the trading platform ensures efficient trade execution and timely access to market opportunities.

Furthermore, the FBS VPS server allows traders to install expert advisors, empowering them to automate trading strategies and maximize their profit potential.

With the FBS VPS server, Ivory Coast traders can enjoy enhanced trading capabilities and seize opportunities around the clock, regardless of their physical presence or internet connectivity.

XM

The XM VPS service allows Ivory Coast traders to enhance their trading capabilities and optimize their strategies.

By utilizing the XM VPS, traders can experience uninterrupted trading and leverage expert advisors to automate their trading activities. The Key Features of XM VPS are as follows:

- ✅ Enhanced Trade Execution: The XM VPS provides Ivory Coast traders with improved trade execution speed, ensuring timely order placement and reducing potential slippage.

- ✅ Accessibility and Availability: With the XM VPS service, traders can access their trading accounts 24/7, even offline, to stay connected to the markets.

- ✅ Ideal for Expert Advisors (EAs): The XM VPS is well-suited for the use of expert advisors, enabling traders to automate their trading strategies and take advantage of market opportunities.

- ✅ Reliable Connectivity: Traders can benefit from state-of-the-art optical fiber connectivity, ensuring a fast and stable connection to the XM trading platform.

During the promotional period, XM offers the VPS service to existing and new clients, subject to specific conditions.

MetaTrader 4 VS MetaTrader 5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are among the most popular trading platforms in the world of forex trading, including in The Ivory Coast. Both platforms were developed by MetaQuotes Software and share similarities, but they also have distinct features that cater to diverse types of traders.

Overview of MetaTrader 4 (MT4)

MT4 is one of the most widely used forex trading platforms globally and is favored by both beginners and experienced traders. It is renowned for its user-friendly interface, robust charting capabilities, and support for automated trading using Expert Advisors (EAs).

Features of MetaTrader 4

MT4 supports various technical analysis tools, including 30 built-in indicators and 24 graphical objects. It also allows traders to create custom indicators using the MQL4 programming language.

Another prominent feature of MT4 is its ability to support automated trading through EAs, which can execute trades based on predetermined strategies even when the trader is not present.

Overview of MetaTrader 5 (MT5)

MT5 is the successor to MT4 and offers more advanced features for more experienced traders and those dealing with more than just Forex. It includes additional order types, enhanced charting tools, and robust automated trading and testing support.

Features of MetaTrader 5

MT5 offers 38 built-in indicators, 44 graphical objects, and 21 timeframes, providing traders with more comprehensive technical analysis tools. It supports more order types, including “Buy Stop Limit” and “Sell Stop Limit”.

MT5 also introduces a built-in economic calendar, displaying news events and their potential impact on the markets. The platform also improves on automated trading, with a more powerful programming language (MQL5) and a built-in strategy tester that allows more sophisticated testing of EAs.

MT4 vs MT5: Which One to Choose?

Choosing between MT4 and MT5 depends on the trader’s needs and preferences. MT4’s simplicity and extensive support from the trading community make it an excellent choice for beginner traders or those focused solely on forex trading.

On the other hand, MT5’s advanced features and broader asset coverage make it more suitable for experienced traders and those interested in trading a wider range of financial instruments.

Best Forex Brokers in The Ivory Coast

Best MetaTrader 4 / MT4 Forex Broker in the Ivory Coast

Overall, IG is the best MT4 Forex Broker in the Ivory Coast. Through its MetaTrader 4 platform, IG provides AutoChartist and a few other helpful features.

Additionally, traders can anticipate superior market research, educational resources, and challenging trading environments.

Best MetaTrader 5 / MT5 Forex Broker in the Ivory Coast

Overall, BDSwiss is the best MetaTrader 5 Forex Broker in the Ivory Coast. When trading CFDs on BDSwiss’ MT5 platform, there are no restrictions on the trading methods that can be used.

BDSwiss’ top-notch research, educational, and trading tool resources are available to traders at all levels in the Ivory Coast.

Best Forex Broker for beginners in the Ivory Coast

Overall, Exness is the best Forex Broker for beginners in the Ivory Coast. Exness provides three user-friendly trading platforms: MT4, MT5, and the Exness terminal. Exness provides new users a Cent Account, Demo Account, and an instructional section.

Best Low Minimum Deposit Forex Broker in the Ivory Coast

Overall, XTB is the best Low Minimum Deposit Forex Broker in the Ivory Coast. No set minimum deposit amount is needed by XTB when traders sign up for trading accounts.

Additionally, XTB gives traders access to various financial instruments, competitive spreads, and cutting-edge trading technology.

Best ECN Forex Broker in the Ivory Coast

Overall, OctaFX is the best ECN Forex Broker in the Ivory Coast. OctaFX is an NDD broker that uses STP and ECN execution with pricing gathered from the best liquidity providers.

This means that spreads on important instruments, like the EUR/USD, can be expected to start at 0.0 pips across all platforms.

Best Islamic / Swap-Free Forex Broker in the Ivory Coast

Overall, OANDA is the best Islamic / Swap-Free Forex Broker in the Ivory Coast. It is simple for Muslims from the Ivory Coast to open an Islamic Account with OANDA and benefit from halal trading options and favorable trading conditions.

Additionally, traders will have access to various products that can be traded on powerful trading platforms like OANDA and MetaTrader.

Best Rebates Broker in the Ivory Coast

Overall, HFM is the Best Forex Rebates Broker in the Ivory Coast. With up to $4 per lot offered for Micro and Premium Accounts, HFM is the leading rebate supplier in the Ivory Coast. Additionally, traders can anticipate receiving monthly direct deposits into their trading accounts.

Best Forex Trading App in the Ivory Coast

Overall, FOREX.com is the best Forex trading app in the Ivory Coast. FOREX.com has developed a trading app that is both accessible and simple to use. The app allows traders to place multiple orders, access charts, and conduct research. It also has a helpful search function.

Best Lowest Spread Forex Broker in the Ivory Coast

Overall, Pepperstone is the best lowest spread Forex Broker in the Ivory Coast. Traders can choose from various instruments at Pepperstone, a well-known CFD broker with spreads starting at 0 pip on the most popular instruments.

With the help of Pepperstone’s extensive trading tools and specialized teaching website, traders can perform technical and fundamental analyses.

Best Nasdaq 100 Forex Broker in the Ivory Coast

Overall, Libertex is the best Nasdaq 100 CFD Broker in the Ivory Coast. Libertex provides spreads starting at 0.0 pip access to indices, including the Nasdaq 100. Additionally, traders can trade Nasdaq using cutting-edge platforms like Libertex, MetaTrader 4, and MetaTrader 5.

Best Volatility 75 / VIX 75 Forex Broker in the Ivory Coast

Overall, AvaTrade is the best Volatility 75 / VIX 75 Forex Broker in the Ivory Coast. AvaTrade is a reputable and well-respected forex broker that offers prices close to the market average for the VIX 75 index as a CFD instrument.

Additionally, AvaTrade offers retail traders from the Ivory Coast leverage of up to 1:20 when trading CFD products.

Best NDD Forex Broker in the Ivory Coast

Overall, Tickmill is the best NDD Forex Broker in the Ivory Coast. Tickmill is a well-respected company that provides traders with competitive STP pricing starting at 1.6 pip with no commissions on the Classic Account.

Traders have dependable access to the best pricing compiled from top liquidity providers thanks to Tickmill’s NDD model.

Best STP Forex Broker in the Ivory Coast

Overall, RoboForex is the best STP Forex Broker in the Ivory Coast. With RoboForex, traders can access flexible STP trading accounts across MT4, MT5, cTrader, and RoboForex’s platform.

Best Sign-up Bonus Broker in the Ivory Coast

Overall, Admirals is the best sign-up bonus broker in the Ivory Coast. Traders who sign up for an Admiral’s trading account and verify their information are given a free $100 bonus.

Traders can use this bonus to explore Admirals’ offers, practice trading, or start trading risk-free in live markets, with the benefit of withdrawing profits from this bonus.

Best Award-Winning Forex Broker in the Ivory Coast

FP Markets has won multiple awards, including awards for Best Customer Service, Best Trade Execution, and Best Educational Materials.

The Best Broker with Fast Execution in the Ivory Coast

FXTM is the Top Broker Choice for Traders who are looking for Fast Execution, Exceptional Value, and First-Class Education.

Best Broker for Deposit and Withdrawal Options in the Ivory Coast

FBS offers traders access to 200+ Deposit Options and Withdrawal methods. For Deposits, traders can select from options such as Skrill, Bitcoin, and Neteller.

Best High Leverage Broker in the Ivory Coast

JustMarkets offers traders an opportunity to choose convenient leverage from 1:1 to 1:3000.

In Conclusion

Understanding the Forex Trading Process and Finding a Trustworthy Regulated Forex Broker in the Ivory Coast are the first steps in any Forex Trading Journey.

Frequently Asked Questions

What is Forex trading in Ivory Coast?

Forex trading in Ivory Coast involves exchanging the West African XAF Franc (the local currency) with other global currencies, aiming to profit from the changes in exchange rates.

How can I start Forex trading in Ivory Coast?

To start Forex trading in Ivory Coast, you must educate yourself about Forex, understand basic trading terminology, select a trustworthy broker, practice with a demo account, learn about trading risks and strategies, and start trading with real money.

Who are the best Forex brokers in Ivory Coast?

The best Forex brokers in the Ivory Coast are globally regulated, offer competitive spreads and commissions, and more, including Exness, AvaTrade, HFM, Pepperstone, FBS, and others.

What are some Forex trading strategies for Ivory Coast traders?

Some popular Forex trading strategies include day trading, swing trading, scalping, and position trading, each with its risk and reward profile.

How can I manage risk in Forex trading in Ivory Coast?

You can manage risk in Forex trading by using stop-loss orders, limiting your leverage, diversifying your portfolio, and following a well-tested trading plan.

Is day trading popular in Ivory Coast Forex trading?

Day trading can be a popular strategy among Ivory Coast Forex traders due to its potential for quick profits, but it requires considerable time and expertise.

What is scalping in Ivory Coast Forex trading?

Scalping is a Forex trading strategy that entails making multiple daily trades to profit from small price fluctuations.

Can I participate in swing trading in Ivory Coast Forex?

Yes, swing trading, which involves holding positions for several days to capture price swings, can be done in Ivory Coast Forex trading.

What is the importance of a base and quote currency in Forex trading?

The base and quote currencies represent the two currencies being traded, with the base currency being the one you are buying or selling and the quote currency indicating the amount needed to buy one unit of the base currency.

How does market sentiment impact Forex trading in Ivory Coast?

Market sentiment, representing the overall attitude of traders, can significantly impact currency prices, influencing whether traders buy or sell currency pairs.

How does leverage affect Forex trading in Ivory Coast?

Leverage in Forex trading allows Ivory Coast traders to control larger positions than their account balance would allow, increasing potential profits but also amplifying potential losses.

What are the legalities of Forex trading in Ivory Coast?

Forex trading is legal in Ivory Coast, but traders are advised to use regulated brokers and comply with local tax obligations.

CFA Franc Forex Trading Accounts

CFA Franc Forex Trading Accounts

Scam Forex Brokers in Ivory Coast

Scam Forex Brokers in Ivory Coast